Oil Prices Rise as Supply Risks Loom – Will WTI Break $73?

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

WTI crude oil prices climbed 0.18% to $72.03 as supply concerns in Russia and the U.S. bolstered market sentiment.

A Ukrainian drone attack on a major Russian oil pumping station caused a 30%-40% disruption in flows through the Caspian Pipeline Consortium (CPC), translating to a potential 380,000 barrels per day supply cut. Meanwhile, the North Dakota Pipeline Authority reported that severe winter conditions could reduce production by 150,000 barrels per day in the U.S.

Adding to uncertainty, OPEC+ may reconsider its planned production increase in April as oil markets remain volatile. This speculation has supported WTI prices, keeping them above the crucial $70 level.

Russia’s oil supply through CPC dropped up to 40% after a drone strike.

Cold weather in the U.S. may reduce production by 150,000 barrels per day.

OPEC+ is weighing a potential delay in its scheduled April output hike.

U.S. Tariffs and Economic Policies Impact Demand

Despite rising oil prices, demand-side risks persist. U.S. President Donald Trump’s administration confirmed ongoing talks with Russia over Ukraine, which, if successful, could ease sanctions on Russian oil exports. However, Goldman Sachs analysts believe sanctions have primarily affected the destination of Russia’s oil exports rather than total production, suggesting that any agreement may have limited impact on supply levels.

Meanwhile, Trump signaled his intent to impose a 25% tariff on auto imports and additional duties on semiconductors and pharmaceuticals. These tariffs could fuel inflation, slow economic growth, and ultimately curb fuel demand in the U.S.

Trump’s administration is in talks with Russia, potentially affecting sanctions.

Goldman Sachs suggests Russia’s oil output is already constrained by OPEC+.

New tariffs on autos and tech could weaken the U.S. economy and oil demand.

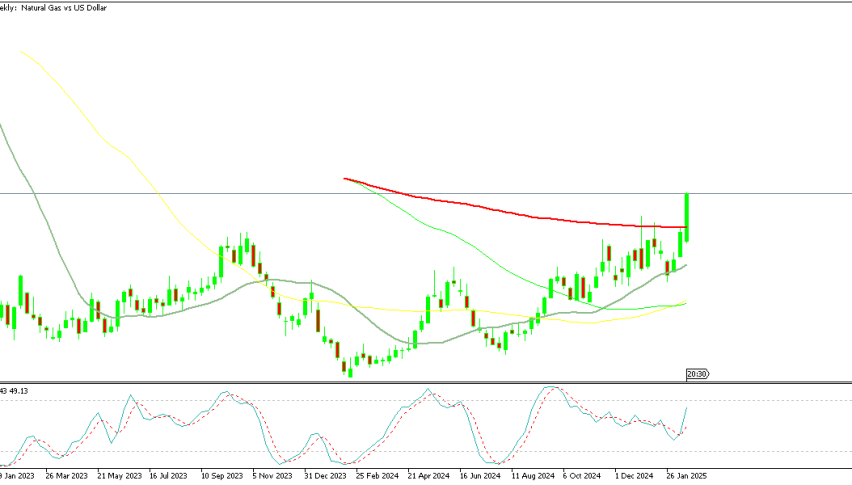

Technical Analysis: Can WTI Break Out?

From a technical standpoint, WTI crude is testing the upper boundary of a descending channel, indicating a potential breakout. The 50-day EMA at $71.39 has provided a strong support base, allowing buyers to push prices higher. If WTI surpasses resistance at $72.81, momentum could accelerate toward $73.63 and $74.73.

However, if resistance holds, prices may retrace toward $70.95, with further downside at $70.09 and $69.34. A confirmed breakout above $73.63 would mark a shift in sentiment, suggesting an end to the recent bearish trend.

Key Takeaways:

WTI crude eyes a breakout above $72.81, with upside targets at $73.63.

50-day EMA at $71.39 serves as crucial support, keeping buyers engaged.

Failure to break resistance could trigger a pullback toward $70.09.

As oil markets navigate geopolitical risks, supply concerns, and economic policies, traders should watch resistance at $72.81 for confirmation of a trend reversal.