Nikkei Jumps After Impressive Japan GDP, USD to Yen Rate Slips Below 152

USD/JPY continued lower early this morning, after the impressive Japan GDP report, which showed a 2.8% expansion in the Japanese economy in 2024.

USD/JPY rebounded early last week after suffering a sharp four-cent decline the previous week, driven by the Bank of Japan’s (BOJ) hawkish rate hike, which strengthened the yen. Rising inflation and increased household spending have also contributed to the yen’s momentum. However, buyers couldn’t keep the gains and gave back most of them, closing near 152.

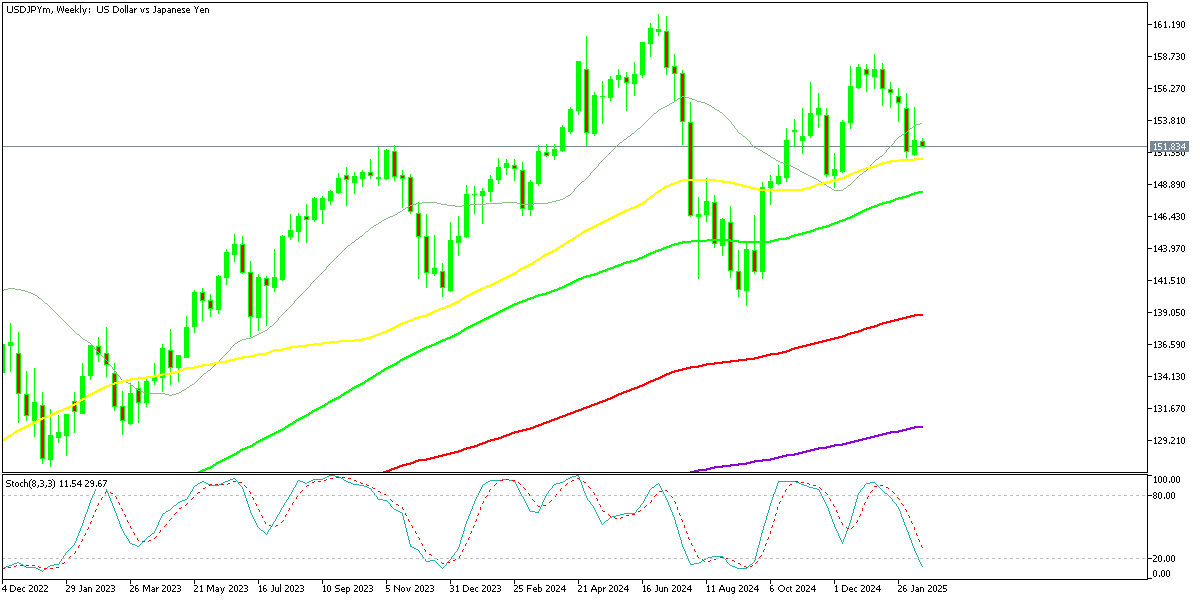

USD/JPY Chart Weekly – The 50 SMA Still Holding As Support

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Since turning bullish in September, following a 20-cent drop during the summer that pushed the pair below 140, USD/JPY has maintained an upward trajectory. A retracement in late November tested the 50-week SMA (yellow) as support, which held firm, allowing the pair to resume its bullish trend. Currently, another pullback is underway, but once again, the 50-week SMA is acting as support. If this level continues to hold, another rebound may be on the horizon. However, positive economic developments for Japan could intensify selling pressure, potentially driving USD/JPY below the key 150 level. A confirmed break below the 50-week SMA would signal a shift in trend.

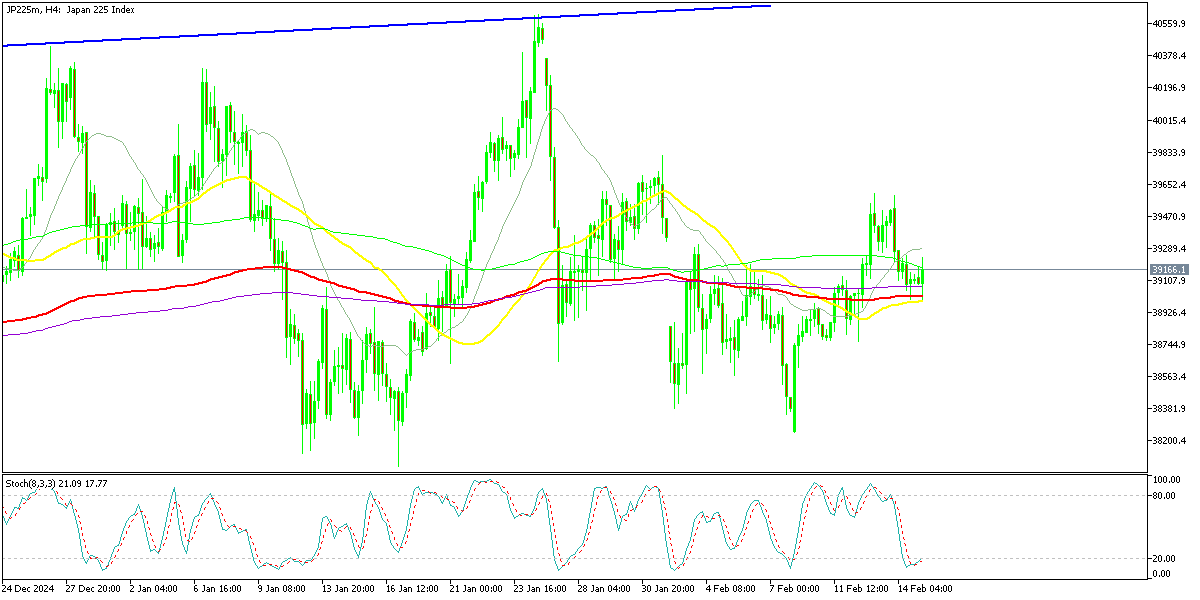

Nikkei 225 Chart H4 – Jumping 200 Points Off MAs

Japan’s stronger-than-expected GDP figures fueled a rally in the yen, as investors reacted to signs of economic resilience. While external demand and exports played a significant role in the expansion, weak domestic demand and underwhelming capital expenditure remain concerns. The Bank of Japan may face increasing pressure to adjust its monetary policy, particularly if inflation remains elevated and economic growth continues its upward trend.

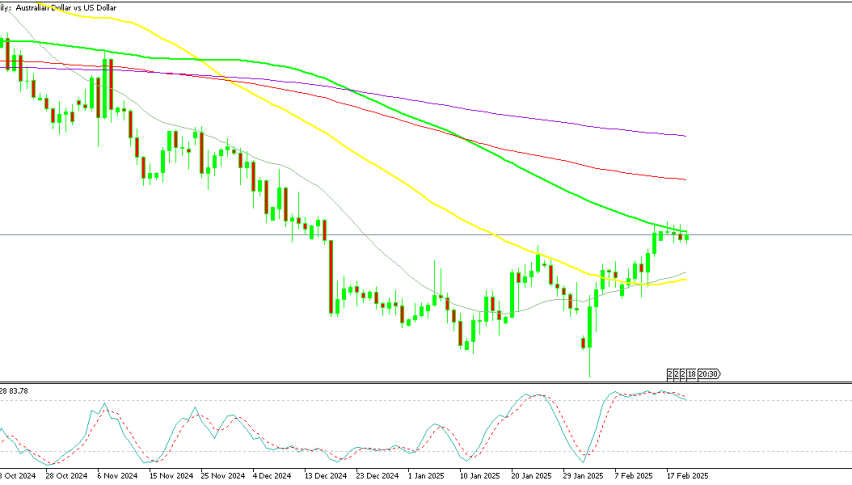

Japan’s Q4 GDP Boosts the Yen

- Stronger-than-expected economic growth: Japan’s economy expanded at an annualized rate of 2.8%, far exceeding the 1.0% projected in polls, signaling a robust recovery.

- Positive private consumption: Despite concerns over weak consumer spending, private consumption rose by 0.1% quarter-on-quarter, defying expectations of a 0.3% contraction.

- External demand drives growth: Net exports contributed 0.7 percentage points to GDP growth, surpassing the forecast of 0.4 percentage points, highlighting the strength of Japan’s trade sector.

- Mixed capital expenditure figures: Business investment increased 0.5% quarter-on-quarter, though it fell short of the expected 1.0%, indicating cautious corporate spending.

- Real GDP beats estimates: Japan’s real GDP expanded by 0.7% quarter-on-quarter, more than doubling the 0.3% growth predicted in the Reuters poll.

- Exports on the rise: Japan’s exports grew 1.1% quarter-on-quarter, reinforcing the economy’s reliance on international trade amid global demand fluctuations.

- Weak domestic demand: Domestic demand subtracted 0.1 percentage points from GDP growth, reflecting ongoing struggles in domestic consumption and investment.

- Inflationary pressures persist: The GDP deflator, a key measure of price changes in the economy, increased 2.8% year-on-year, suggesting persistent inflationary trends.

Japan’s Household Spending Surges

Japan’s household spending surged in December, marking a strong recovery in consumer activity. Year-on-year, spending increased by 2.7%, well above the 0.2% forecast and rebounding from November’s 0.4% decline. On a monthly basis, spending rose by 2.3%, defying expectations of a 0.5% drop and accelerating from November’s modest 0.4% gain. The sharp increase suggests improving consumer confidence and may play a role in shaping the Bank of Japan’s monetary policy as inflationary pressures persist.

BOJ’s Hawkish Shift

BOJ board member Tamura Naoki reinforced expectations of tighter monetary policy with his recent comments. Speaking at a gathering of local leaders in Nagano, Tamura emphasized the need for gradual short-term interest rate hikes, potentially reaching 1% by the latter half of fiscal 2025. A known hawk, he warned that inflation risks are increasing and that the BOJ must act to bring interest rates closer to neutral levels, ensuring economic stability.

With rising inflation, strong household spending, and growing hawkish sentiment within the BOJ, the yen could see further support, which may challenge USD/JPY’s bullish outlook in the coming months.