Tesla Stock Backs Down After Soft US Retail Sales, Meta Doesn’t Stop

The Tesla stock opened with a gap higher today, but has reversed and is down now, while the Meta stock continues to make gains.

Live TSLA/USD Chart

The Tesla stock opened with a gap higher today, but has reversed and is down now, while the Meta stock continues to make gains and remain on a winning streak.

Tesla, which had been in a downward trajectory since mid-December, has staged an impressive comeback, surging 15% over the past two days. The stock opened with an upward gap and extended its rally, bouncing strongly from the $322 level and gaining over $50 in value. Despite this recent rebound, Tesla shares have struggled in recent months, shedding more than 30% since their December peak of $388. The recent uptick follows the introduction of new legislation proposed by Republican senators. However, after an early rally today, Tesla has given back some of its gains and now trades about $15 below its intraday high.

Meta Shares Continue the Relentless Rally

Meanwhile, Meta is on course for its 20th consecutive day of gains, with shares rising 1.33% to $738.37. According to Bloomberg, the company is planning significant investments in AI-powered humanoid robots, positioning itself as a competitor to Elon Musk in the field. Additionally, Meta is bringing in RealReal’s CEO to help drive sales of AI-integrated wearable devices.

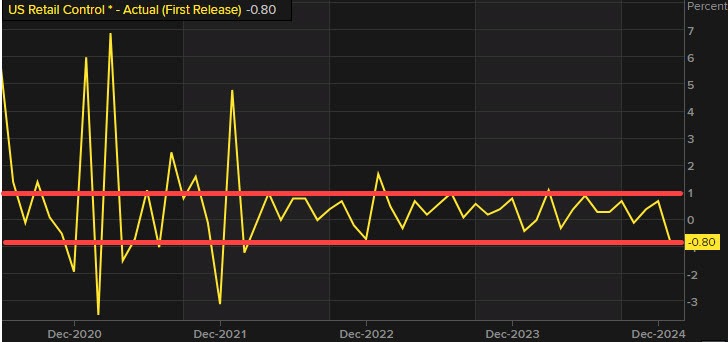

US Retail Sales – January 2025![retail sales]()

Headline Figures:

- Retail Sales MoM: -0.9% (vs -0.1% expected), prior revised up to +0.7% (from +0.4%)

- Ex Autos MoM: -0.4% (vs 0.3% expected), prior revised up to +0.7% (from +0.4%)

- Ex Gas/Auto MoM: -0.5% (vs 0.5% prior, revised from +0.3%)

- Control Group: -0.8% (vs 0.3% expected), prior revised up to +0.7% (from +0.3%)

- Retail Sales YoY: 4.2% (vs 3.92% prior)

Breakdown by Category:

Significant Declines:

- Motor vehicle & parts dealers: -2.8%

- Auto & other motor vehicle dealers: -3.0%

- Sporting goods, hobby, musical instruments & books: -4.6%

- Furniture & home furnishings: -1.7%

- Nonstore retailers: -1.9%

Modest Declines:

- Electronics & appliances: -0.7%

- Building materials & garden supplies: -1.3%

- Clothing & accessories: -1.2%

- Health & personal care: -0.3%

Increases:

- Gasoline stations: +0.9%

- Department stores: +0.8%

- General merchandise stores: +0.5%

- Grocery stores: +0.2%

January’s retail sales data showed a significant pullback, with broad-based declines across major categories, particularly in autos, home furnishings, and discretionary goods. The control group, which feeds into GDP calculations, also saw a sharp drop, raising concerns about slowing consumer demand. However, gasoline stations and department stores showed some resilience. While the year-over-year figure remains positive at 4.2%, the sharp monthly contraction suggests potential headwinds for consumer spending in early 2025, which could influence monetary policy expectations.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account