Forex Signals Brief Feb 13: More Inflation Data and Tariff Talk

Today we have more inflation reports from several countries and the usual trade tariff talk, which will drive markets around, on top of the UK GDP data.

The U.S. Consumer Price Index (CPI) for January came in hotter than expected for the fourth consecutive year, making it harder for the Federal Reserve to reach its 2% inflation target. Headline CPI rose 3.0% year-over-year, with a monthly increase of 0.5%, both above forecasts. Core CPI, excluding food and energy, climbed 3.3% annually, with a 0.4% monthly gain. As a result, expectations for rate cuts in 2025 have been lowered, with markets now pricing in just 31 basis points of easing, down from 40 basis points before the data release.

Fed Chair Jerome Powell testified before Congress, acknowledging progress in lowering inflation but emphasizing that “we are close but not there yet.” He reaffirmed the Fed’s commitment to keeping policy restrictive despite the hotter CPI report. The U.S. dollar ended mixed, gaining against the yen, Australian dollar, and New Zealand dollar while slipping against the euro.

U.S. stocks initially dropped on inflation concerns but recovered throughout the day. The Dow closed at 44,368, down 225 points or 0.50%, while the S&P 500 lost 17 points or 0.3% to end at 6,052. The Nasdaq edged up 6 points or 0.1% to 19,650.

Crude oil fell $2, or 3%, to $71 as diplomatic hopes for Ukraine and shifts in Russian oil supply weighed on prices. Gold dipped $4 to $2,890, while silver rose 1.5% to $32.25. Bitcoin closed with a $2,000 gain at $97,500.

With inflation concerns still in focus, market sentiment is increasingly influenced by geopolitical risks, central bank policy, and evolving expectations for economic growth and interest rates.

Today’s Market Expectations

Swiss CPI Inflation for January

Switzerland’s CPI is projected to slow further, with year-over-year inflation expected at 0.4%, down from 0.6%, while the monthly figure is forecasted at -0.1%. The market is pricing in a 92% probability of a 25 basis point rate cut in March and a total of 40 bps by year-end, effectively bringing the policy rate back to 0%. A strong Swiss Franc has contributed to disinflation, prompting the Swiss National Bank to consider interventions. SNB Chairman Schlegel has reiterated that while they are reluctant to return to negative rates, they will do so if necessary.

US PPI Inflation Comes After Yesterday’s Hot CPI

In the U.S., PPI data is expected to show a mixed picture. Headline producer prices are forecasted to rise 3.2% year-over-year, slightly below the previous 3.3%, while the monthly figure is expected to increase to 0.3% from 0.2%. Core PPI is projected at 3.3% annually, easing from 3.5%, with a monthly gain of 0.3% from 0.0% previously. Given recent inflation surprises, markets will likely react based on trends established in the previous day’s CPI report.

US Unemployment Claims

The U.S. jobless claims report remains a key labor market indicator. Initial claims have fluctuated between 200K-260K since 2022, while continuing claims remain elevated. This week’s initial claims are expected at 216K, slightly lower than the prior 219K. However, there is no consensus on continuing claims, which previously rose to 1.886 million from 1.850 million. The labor market remains resilient but shows signs of softening, reinforcing expectations for the Federal Reserve’s next policy moves.

Traders are keeping a close eye on key technical levels and macroeconomic developments in order to predict the next move in the financial markets. Yesterday, gold resumed its upward momentum after falling nearly $80, but it remained below $2,900. The movements of forex pairs and stock markets highlight the mixed sentiment in financial markets. Gold continues to rise as investors seek a safe haven amid uncertainty, while US stock markets struggled with resistance and volatility.

The Turn for the 50 SMA to Support Gold

Gold saw a new high of $2,942 during the Asian session but retreated below $2,900 in the US session, driven by improved risk sentiment and some profit-taking. However, it found support at the 20-day SMA, triggering a buy signal. This marks the sixth consecutive weekly gain, supported by ongoing trade tensions, inflation concerns, and broader macroeconomic uncertainty. However, on Tuesday we saw a strong pullback, nonetheless, the 50 SMA (yellow) held as support on the H4 chart and the price bounced above the 20 SMA (gray) yesterday, but it didn’t close above $2,900.

XAU/USD – H4 Chart

EUR/USD Fail to Hold Above the 50 Daily SMA Again

EUR/USD has been on a steady decline since October, losing 10 cents despite occasional rebounds, such as January’s push above 1.05 and last week’s surge above 1.04. Buying momentum remains weak, and lower highs suggest a continued bearish trend. The European Central Bank’s dovish policy stance continues to pressure the euro, while the US dollar is bolstered by economic resilience and the Federal Reserve’s cautious approach. If this trend persists, EUR/USD may continue to drift lower.

EUR/USD – Daily Chart

Cryptocurrency Update

Bitcoin Continues to Remain Between MAs

Bitcoin has struggled to hold its ground, mirroring broader risk asset weakness. After a brief dip below $90,000 following Trump’s tariff announcement in early February, BTC/USD rebounded above $100K but failed to maintain momentum, sliding back below $95K. The 100-day SMA has provided some support, but Bitcoin will need to reclaim the 50-day SMA and hold above $100K to challenge January’s all-time high near $110K. Meanwhile, 16 US states, including Texas and Florida, are exploring the possibility of adopting Bitcoin through proposed legislation that could allow them to invest up to 10% of their excess reserves in digital assets. If this momentum grows, it could push Bitcoin further into the global financial system, solidifying its role as a potential reserve asset.

BTC/USD – Daily chart

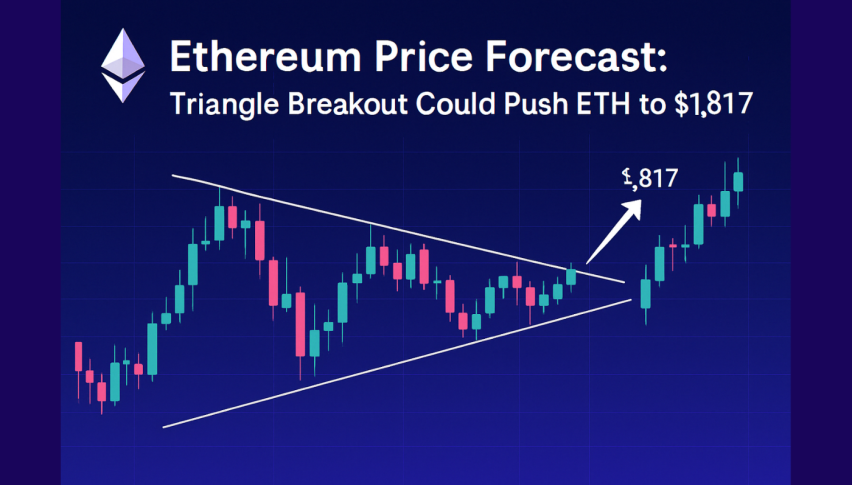

Ethereum Starts to Reverse Higher

Elsewhere, Ethereum has faced steep selling pressure, failing to sustain gains after nearing $4,000 in late 2024. A flash crash on Monday wiped out 50% of its value, briefly sending ETH down to $2,000 before a modest recovery. Despite persistent bearish pressure, Ethereum could still rebound if technical support holds near $2,000 and broader market sentiment improves.

ETH/USD – Daily Chart