On the daily chart, the EMAs have also formed a golden crossover, reinforcing a bullish trend in the short to medium term. However, the MACD lines are bearishly crossed, with the histogram ticking lower since yesterday, signaling weakening bullish momentum. The RSI remains neutral, not providing a clear directional bias. QUBT is currently holding significant support at the 200-day EMA at $5.23, where a potential bounce could occur, targeting the golden ratio resistance level at $10.

Quantum Computing Inc. (QUBT) Stock Undergoes Steep Correction After Quant Hype Has Cooled Off

Konstantin Kaiser•Wednesday, February 12, 2025•2 min read

The quantum computing hype has tempered, leading Quantum Computing Inc. (QUBT) to undergo a sharp correction. Despite this, QUBT remains positioned for a potential recovery if key support levels hold and broader market sentiment shifts.

Quantum Computing Inc. (QUBT) Breaks Below Important Fibonacci Support Level

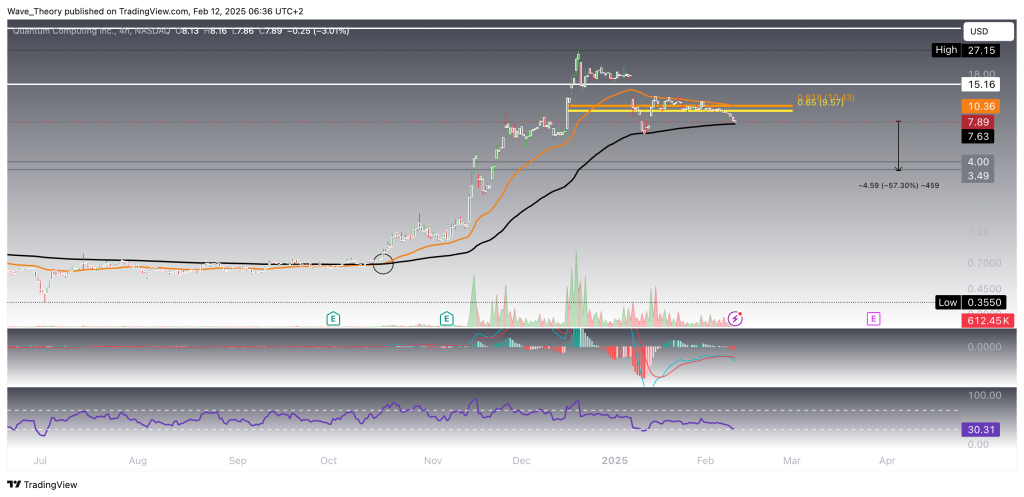

Quantum Computing Inc. (QUBT) experienced a remarkable 7,550% surge over the past eight months, but the stock has since entered a significant correction phase at the start of the new year. After facing rejection within the resistance zone between $15.16 and $39.60, QUBT broke below the critical golden ratio support at $10, signaling potential downside to the 50-month EMA at $3.71, erasing a large portion of its previous gains.

Although the MACD histogram has started to tick bearishly lower this month, the MACD lines remain bullishly crossed, and the RSI is hovering in neutral territory, offering mixed signals for the near-term outlook.

Weekly Chart: A Golden Crossover Has Appeared

On the weekly chart, Quantum Computing Inc. (QUBT) presents mixed signals. The EMAs have formed a golden crossover, confirming a bullish trend in the mid-term. However, the MACD lines have recently crossed bearishly, and the MACD histogram is reflecting a bearish trend. The RSI remains neutral, not giving strong directional bias. QUBT’s next significant support levels are the 50-week EMA at $4.91 and the 200-week EMA at $3.52, which could act as key points if the downward correction continues.

QUBT Stock: Daily Chart Presents Bearish Signals

4H-Chart Hints At Downside of 57.3 %

On the 4-hour (4H) chart, the EMAs have established a golden crossover, confirming a bullish trend in the short term. However, the RSI is nearing oversold territory, and the MACD histogram has been ticking lower recently, with the MACD lines bearishly crossed. QUBT currently holds significant support at the 200-4H EMA at $7.63. If this support level breaks, QUBT could potentially drop to the support zone between $3.5 and $4, indicating a potential downside of 57.3%.

In summary, QUBT experienced an impressive rally but failed to maintain its position above the key golden ratio support, effectively invalidating its uptrend. The stock could potentially retrace up to 57% before entering another upward cycle.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Konstantin Kaiser

Financial Writer and Market Analyst

Konstantin Kaiser comes from a data science background and has significant experience in quantitative trading. His interest in technology took a notable turn in 2013 when he discovered Bitcoin and was instantly intrigued by the potential of this disruptive technology.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments