Bitcoin Price Prediction: Will BTC Break $97K or Drop to $91K Next?

Bitcoin is back in the spotlight as meme coin hype fades, with institutional investors and traders pivoting toward BTC and Layer...

Bitcoin is back in the spotlight as meme coin hype fades, with institutional investors and traders pivoting toward BTC and Layer-1 protocols like Ethereum, Solana, and Cardano.

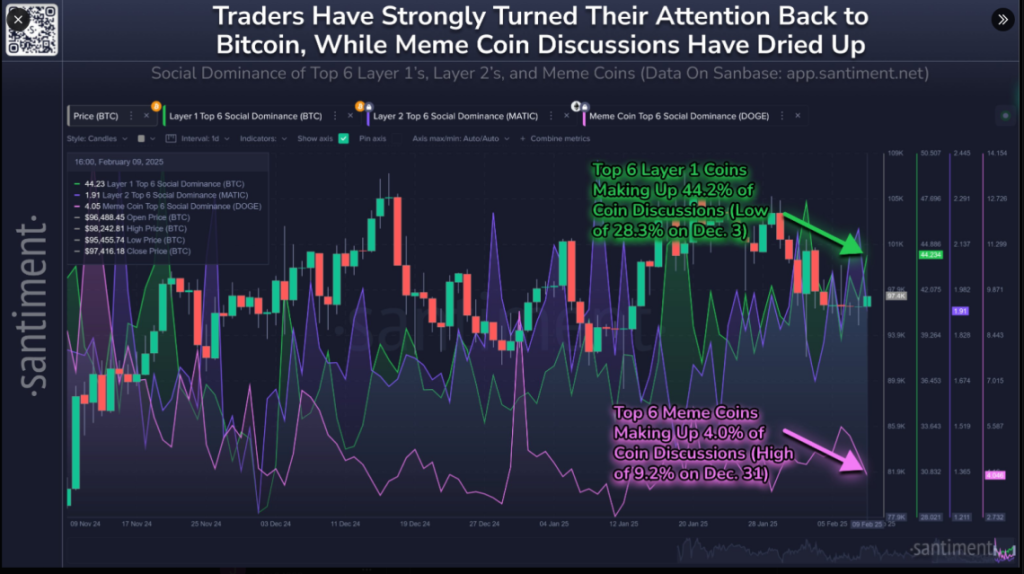

Recent data from Santiment highlights a 44% increase in discussions surrounding major blockchain networks, signaling a shift in market sentiment toward long-term sustainability.

Bitcoin Takes Center Stage as Meme Coin Craze Fizzles

According to Santiment, social media discussions on Bitcoin and Layer-1 networks are rising, while interest in speculative meme coins like Dogecoin and Shiba Inu is dwindling. Analysts attribute this shift to increased volatility in altcoins and declining short-term trading enthusiasm.

Market Sentiment: Bitcoin and Ethereum now dominate 44% of discussions, while meme coin chatter has declined.

Fundamental Focus: Investors are prioritizing security, innovation, and real-world adoption, moving away from speculative gambling.

Institutional Confidence: Large-scale investors continue to accumulate BTC, reinforcing long-term bullish sentiment.

This shift mirrors historical trends where excessive speculation leads to market corrections, pushing traders back to assets with proven utility.

😀 The crypto community has largely shifted their attention to Bitcoin and other Layer 1 assets like Ethereum, Solana, Toncoin, and Cardano. Collectively, the top Layer 1 assets are getting 44.2% of discussions among specific coins. Meanwhile, top meme coins like Dogecoin, Shiba… pic.twitter.com/PpBjD9vSi4

— Santiment (@santimentfeed) February 10, 2025

A More Sustainable Market Is Emerging

Santiment suggests that this pivot toward Bitcoin and Layer-1 blockchains indicates a mature and balanced market environment. Meme coins, often fueled by hype and viral trends, tend to experience rapid price surges followed by sharp crashes. In contrast, Bitcoin’s dominance reflects growing institutional participation and mainstream adoption.

Layer-1 protocols are the backbone of the crypto ecosystem, supporting DeFi, smart contracts, and large-scale applications.

Investors are shifting from high-risk speculative plays to assets with long-term growth potential.

BTC’s dominance is rising, reinforcing its role as a store of value amid macroeconomic uncertainties.

With Bitcoin’s market cap nearing $2 trillion, analysts believe this trend signals a more stable and structured investment landscape.

Bitcoin’s Price Outlook: Key Resistance & Support Levels

Bitcoin remains under pressure, consolidating within a symmetrical triangle pattern on the 4-hour chart. The recent drop to $95,080 aligns with key trendline support, keeping BTC on the edge of a breakout. A decisive move below $95,000 could open the door for further declines towards $93,251 and $91,522, reinforcing the bearish outlook.

On the upside, BTC faces immediate resistance at $97,033, with the 50-EMA at $97,539 capping short-term gains. A breakout above this level would shift momentum, targeting $98,536 and potentially extending to the 200-EMA at $99,180. A successful reclaim of these levels could push BTC towards $100,090, marking a strong bullish reversal.

Market Outlook:

Bullish Breakout: BTC must break $97,033 to trigger a rally toward $100,000.

Bearish Breakdown: Failure to hold $95,000 could lead to a decline toward $91,522.

Watch Volume Trends: Increased buying activity will confirm a directional move.

Conclusion

Bitcoin is regaining dominance as traders move away from short-lived meme coin frenzies toward fundamentally strong assets. The market’s focus on security, innovation, and real-world adoption points to a healthier investment cycle—reducing volatility while attracting institutional capital.

For now, Bitcoin’s price action hinges on key resistance at $97,033. A breakout could fuel a rally, while a drop below $95,000 may trigger further declines. Traders should monitor volume and macroeconomic factors for confirmation of Bitcoin’s next major move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account