Record Close for Dax 40 and FTSE 100 on Dovish ECB Policy

The German Dax index and the UK FTSE 100 gained around 1% today, closing at a record high, as European stock markets continue to remain...

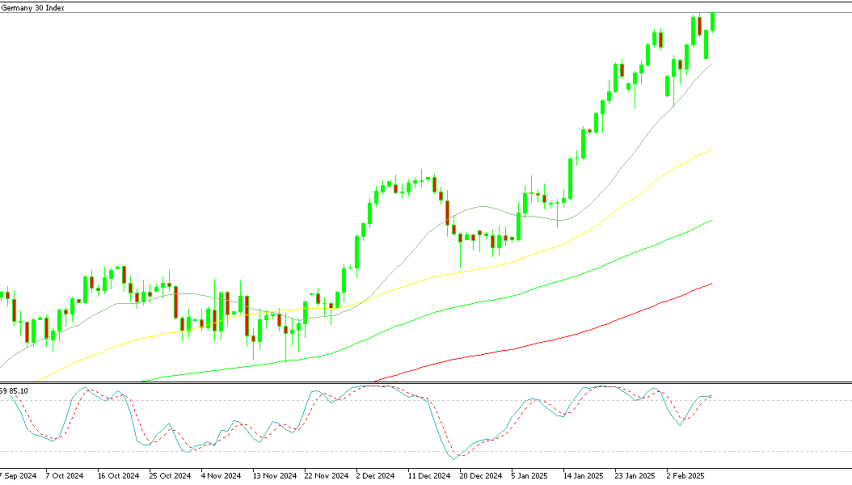

Live DAX/USD Chart

[[DAX/USD-graph]]The German Dax index and the UK FTSE 100 gained around 1% today, closing at a record high, as European stock markets continue to remain bullish, while the ECB hints toward being more accommodative.

During the US trading session, EUR/USD remained confined to a narrow 30-pip range, fluctuating between a session high of 1.0330 in the first hour of trading and a low of 1.0300. Despite this limited movement in currency markets, equities continued their upward momentum. European stock markets kicked off the week on a positive note, with broad-based gains across major indices. The UK’s FTSE 100 emerged as the top performer, rising 0.90%, while Spain’s Ibex posted a more modest increase of 0.15%, trailing behind its European counterparts.

European Stock Market Close – UK FTSE Daily Chart

- Germany’s DAX: +0.87%

- Led by strong gains in industrial and technology stocks.

- Investor sentiment remained positive amid stable economic data and corporate earnings.

- France’s CAC 40: +0.42%

- Energy and financial sectors provided support.

- Cautious optimism as investors await key inflation data.

- UK’s FTSE 100: +0.90%

- Gains driven by mining and consumer goods stocks.

- A weaker pound provided additional support to export-heavy companies.

- Spain’s IBEX 35: +0.15%

- Marginal gains, with banking stocks capping further upside.

- Investors remained watchful of economic and political developments.

- Italy’s FTSE MIB: +0.50%

- Strong performance from utilities and manufacturing sectors.

- Moderate optimism despite ongoing macroeconomic uncertainties.

European equity markets closed on a positive note, with major indices posting gains amid improving risk sentiment and resilient corporate performance. While Germany’s DAX and the UK’s FTSE 100 led the advance, other indices saw more measured gains as investors remained cautious ahead of key economic data releases. The FTSE 100 benefited from a weaker pound, boosting multinational stocks, while France’s CAC and Italy’s FTSE MIB saw support from financial and industrial sectors. Despite lingering uncertainties, the market’s upward momentum suggests underlying confidence in economic stability and earnings resilience heading into the next trading sessions.

ECB President Christine Lagarde’s remarks highlight a measured but cautious approach to economic recovery and monetary policy. While inflation is expected to decline toward the 2% target, ongoing risks demand policy flexibility. The ECB remains committed to data-driven decision-making, avoiding rigid rate commitments amid a highly uncertain global landscape. With economic shocks likely to persist, the central bank signals a watchful stance, ready to adapt to evolving financial and geopolitical challenges in the months ahead.

Key Takeaways from ECB President Lagarde’s Comments

- Recovery Outlook:

- Lagarde reaffirmed that conditions for economic recovery remain intact, despite recent challenges.

- Growth momentum is expected to gradually improve, supported by easing inflation and stabilizing financial conditions.

- Inflation Trajectory:

- Inflation is on track to return to the ECB’s 2% target over the medium term.

- However, risks remain balanced, with potential for both upside and downside surprises depending on energy prices, wage growth, and supply chain developments.

- Monetary Policy Flexibility:

- The ECB is not locked into a fixed rate path, emphasizing a data-dependent approach to future rate decisions.

- Policymakers will continue to assess incoming economic indicators before adjusting policy further.

- Global Uncertainty and Future Shocks:

- Lagarde warned that the frequency of economic shocks is likely to remain elevated, requiring agility in policymaking.

- Persistent geopolitical tensions, supply chain disruptions, and climate-related factors could lead to increased volatility.

German Index Dax 40 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account