Nikkei Bounces 1.3% As Markets Digest Reciprocal Tariffs Comments from Trump

Nikkei opened lower at resistance last night, but it bounced right back by more than 1%, as markets anticipate mild tariffs, or a solution u

Nikkei opened lower at resistance last night, but it bounced right back by more than 1%, as markets anticipate mild tariffs, or a solution until the next trouble.

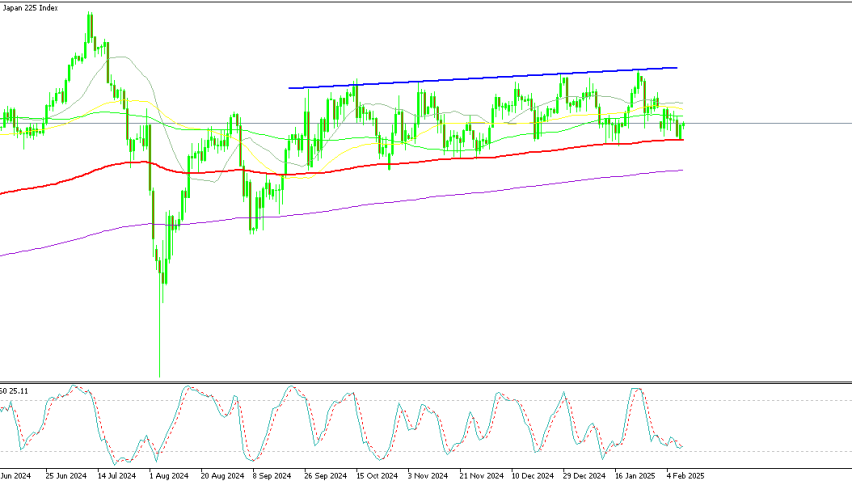

Nikkei opened with a small bearish gap at around 48,200 points at the Tokyo open, but jumped up right away and climbed around 500 points higher in one hour, which means a 1.3% gain and shows strong buying momentum. Although, buyers leaned against the 100 SMA (red) on the daily chart, which has been holding as solid support since September last year.

Promising Market Reaction to Trump’s Tariff Threats

Financial markets opened lower as risk currencies and stock futures declined following US President Donald Trump’s weekend announcement of new tariffs. He pledged to impose a 25% tariff on all steel and aluminum imports, stating that he had the authority to do so. Additionally, he threatened reciprocal tariffs on countries that impose duties on US goods, with implementation set to begin “almost immediately.” However, the legality of such measures—particularly against nations with trade agreements with the US—remains uncertain. German Chancellor Scholz quickly pushed back, stating that retaliation could come “within an hour.” Despite the initial market reaction, skepticism over whether these tariffs will be fully enforced led to a tempered response. The US dollar strengthened by 30 to 50 pips across multiple currency pairs, with commodity-linked currencies experiencing the most pressure.

Stock Market Volatility and Investor Sentiment

S&P 500 futures opened the week down 30 points amid trade concerns but quickly reversed, gaining 20 points within an hour. This rapid recovery suggests that investors are increasingly skeptical about the likelihood of an actual trade war. While Trump’s rhetoric on tariffs remains firm—reiterating that steel and aluminum duties will apply to all countries—markets appear to be pricing in a more measured approach. Additionally, Trump indicated that Japanese firm Nippon Steel would not be allowed to acquire a majority stake in US Steel, signaling a stricter stance on foreign ownership in key industries. The market’s quick “buy-the-dip” reaction highlights the belief that, despite aggressive rhetoric, full-scale protectionist policies may not materialize as expected.

Japan Economic Data – Current Account

- December Current Account:

- Reported at ¥1,077 billion, falling short of the expected ¥1,362 billion.

- Indicates a weaker-than-expected surplus, potentially due to higher import costs or slowing exports.

- A sharp decline from November’s surplus of ¥3,352.5 billion, highlighting seasonal or structural shifts.

- January Bank Lending:

- Increased 3.0% year-over-year (YoY), slightly below the previous 3.1% growth in December.

- Suggests a steady but modest expansion in credit activity, reflecting cautious borrowing trends.

- Lending growth remains resilient despite economic uncertainties, with businesses and households maintaining access to credit.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account