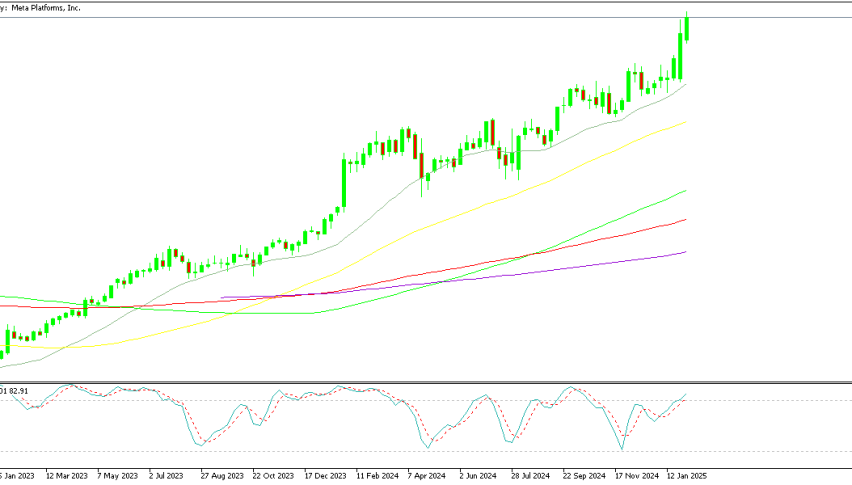

(Facebook) Meta Stock Ends Week 9% Higher, While Nasdaq, S&P 500 and DAX Fall

This week Facebook seems to be the only winner, as the Meta stock finished with decent gains, while major indices ended lower.

Live META Chart

[[META-graph]]This week Facebook seems to be the only winner, as the Meta stock finished with decent gains, while major indices ended lower.

Meta shares were trading at $600 early last week, but the sentiment improved massively after the settlement with Donald Trump, as shown by the massive bullish candlestick on Monday. This week we saw another surge on Monday as trade tariffs were postponed and markets got relived. So, the Meta stock kept gaining even as most major companies were losing value, climbing above $700, closing the week at $715, which means a 9% increase since last Monday’s open and around 17% increase in the last two weeks.

Meta and Trump’s Legal Settlement

Meta’s stock rally may be linked to news of a $25 million legal settlement between Facebook’s parent company and former President Donald Trump. Trump sued Meta and CEO Mark Zuckerberg in 2021 after his accounts were suspended following the January 6 Capitol riots. The resolution of this case appears to have lifted investor sentiment, contributing to the stock’s rise.

The rest of the stock market closed with significant losses across major indices, capping off a second consecutive week of declines. Today’s losses pushed all major indices into negative territory for the week. Investors faced renewed pressure amid concerns over economic data, earnings reports, and potential shifts in Federal Reserve policy. The persistent declines suggest growing caution as markets assess future growth prospects and inflation trends. Dow Jones and S&P closed down around 1% lower while NASDAQ index finished 1.36% lower.

Changes for Main US Indices

Today’s Performance

- Dow Jones Industrial Average dropped 444 points (-0.9%), closing at 44,303.

- S&P 500 fell 57 points (-1%), ending at 6,026.

- NASDAQ Composite saw the steepest drop, losing 268 points (-1.4%) to 19,523.

- Russell 2000 declined 27 points (-1.2%) to 2,280.

Weekly Performance

- Dow Jones fell 0.5%.

- S&P 500 slipped 0.25%.

- NASDAQ Composite declined 0.5%.

- Russell 2000 edged down 0.35%.

The NASDAQ Composite led the downturn, falling 1.4%, while the Dow Jones, S&P 500, and Russell 2000 also posted significant losses. For the week, all major indices closed in negative territory, reflecting investor caution amid economic uncertainties. Despite a relatively modest weekly decline, the continued downward trend suggests persistent market concerns over inflation, interest rates, and broader economic conditions.

S&P 500 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account