Ethereum Price Struggles to Break Above $2,900 as Pectra Upgrade Nears

Ether ( ETH) is leaving derivatives exchanges at a rate not seen since August 2023, indicating a notable trend in the bitcoin market. Analysts say this trend indicates a positive indication for Ethereum’s price.

It becomes more difficult for the ETH/USD price to drop when traders remove their Ether from derivatives markets, therefore limiting the immediate quantity accessible for sale. Moreover, these outflows usually show that traders are closing leveraged positions and maybe shifting their Ether to cold storage, hence reducing selling pressure.

The latest remarks of Eric Trump, who advised that it is “a great time to buy ETH,” confirm this optimistic attitude. This optimistic view corresponds with other good signals for Ethereum, such as the possible opening of a staked Ether exchange-traded fund and ongoing ETH accumulation by well-known investors.

Pectra Upgrade on Track for April Launch

Based on successful tests on the Holesky and Sepolia testnet, Ethereum’s forthcoming Pectra upgrade looks set for an early April release. Among the various benefits this major update will bring to the Ethereum network are improved staking freedom for validators and more wallet usability. Improving the Ethereum network’s scalability and user experience is likely to depend much on the Pectra update.

Ethereum ETFs Experience Record Inflows of $500M

With around $500 million joining the market in only five trading sessions, spot Ethereum ETFs have seen a notable increase in inflows recently. Since the debut of spot Ethereum ETFs, this amounts to a sizable share of all-time net inflows.

This flood of institutional money into Ethereum ETFs shows increasing faith in the long run possibilities of the cryptocurrency. These inflows imply that Ethereum might be positioned for more expansion in the next months, even if the short-term price action is yet unknown.

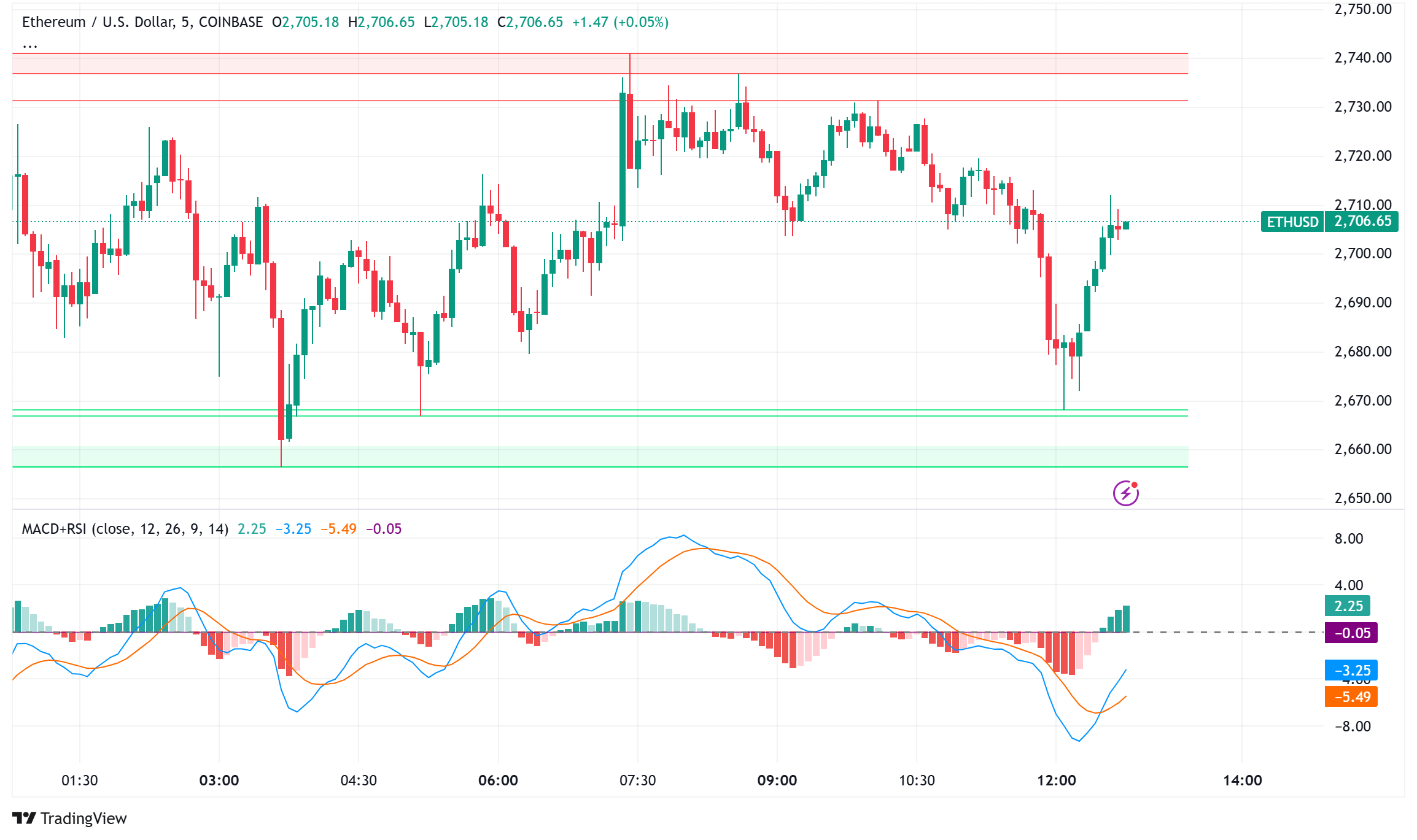

Ethereum Price Consolidates Under $2,900

Ethereum’s price is currently consolidating even if futures exchanges are seeing recent outflow. Following a brief comeback over the $2,650 level, the price is currently finding it difficult to surpass the $2,880 and $2,920 resistance levels.

Technical analysis suggests that a break below the $2,800 mark would start a new fall. But a clear move above the $2,920 resistance might drive the price into the $3,000 mark and maybe higher.