XRP Buying Opportunity During Ripple Price Decline, As RLUSD Adoption Increases

Ripple (XRP) has experienced its worst weekly decline, shedding over 50% from its recent peak. However, this sharp drop could present...

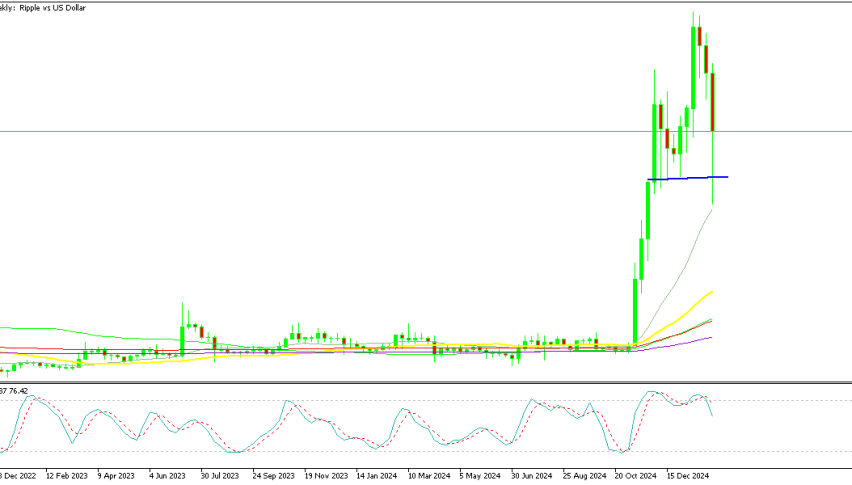

Live XRP/USD Chart

Ripple (XRP) has experienced its worst weekly decline, shedding over 50% from its recent peak. However, this sharp drop could present an opportunity for investors who missed out on the last major rally or those looking to expand their positions.

At the end of last year, Ripple saw a massive surge, climbing from $0.50 to $2.90, followed by another rally in January that pushed the price to an all-time high of $3.39. The bullish momentum was driven by positive legal developments in Ripple’s case against the SEC and Donald Trump’s election victory, which fueled optimism across the crypto market.

However, XRP has been in a steep decline over the past three weeks, a downtrend that accelerated after Monday’s flash crash triggered by new US tariffs on Canada and Mexico. The selloff sent XRP/USD down to $1.76, where it found temporary support just above the 20-week SMA. Ripple eventually rebounded, forming a hammer candlestick and climbing back above the 50-day SMA, as investors adjusted to news that the tariffs would be postponed. While risk sentiment improved, lifting equities and traditional markets, cryptos have struggled to keep up, with Bitcoin slipping below $100K again.

XRP Daily Chart – The 50 SMA Has Been Broken

So, we are looking to get long on ripple and buy some XRP coins before the bullish reversal. The first mild support zone comes around $2.25, which is followed by the next support area around $2, which has held as support several times since the major suge in November. Below that, is the Monday low at around $1.75, so we will be following the price action around these levels for clues of a bullish reversal, as well as following the sentiment in the crypto market.

Market Concerns and Ripple Institutional Adoption

The decline in XRP was exacerbated by a one-hour outage of the XRP Ledger, which sparked concerns over network stability. While Ripple Labs later confirmed that the issue had been resolved, the technical damage was evident on the price chart. Additionally, open interest in XRP futures fell by 12.2% to $3.65 billion, reflecting growing investor caution.

Despite the pullback, Ripple’s institutional adoption remains strong. SBI Shinsei Bank Japan and SBI Remit, a key user of the XRP Ledger, announced a new client referral partnership to enhance cross-border payment solutions. Meanwhile, the Ripple USD (RLUSD) stablecoin has expanded its reach, securing new listings on Zero Hash and Revolut, which is expected to boost adoption significantly.

While XRP’s sharp decline raises concerns, the long-term adoption of Ripple’s technology remains promising. Institutional interest and expanding use cases continue to support the broader bullish case, making current price levels a potential accumulation zone for investors betting on a recovery.

Ripple Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account