Rigetti Computing’s Quantum Leap: Will the Bullish Run Continue?

Rigetti Computing Inc. (NASDAQ: RGTI) has positioned itself at the forefront of the quantum computing revolution, thanks to its cutting-edge quantum processors and full-stack quantum computing systems. Fueled by increasing market interest in quantum technology, RGTI has seen an astonishing price appreciation of 3,145% over the past five months.

RGTI Stock Surged By 171.43 % In Recent Days

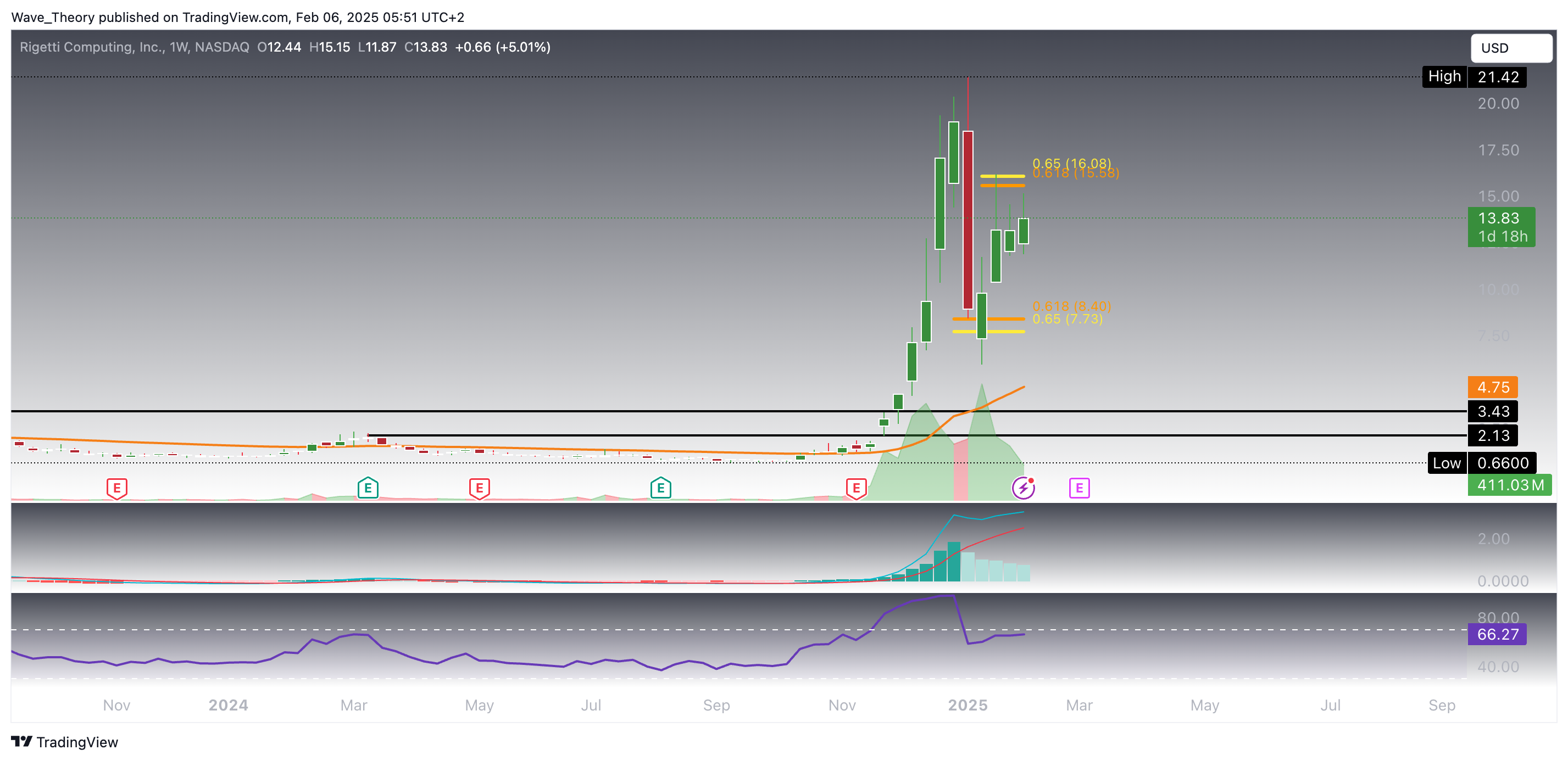

In our previous analysis, we identified $7.73 as a key entry point for RGTI bulls. After briefly dropping 23 % below this golden ratio support level, RGTI initiated a sharp rebound, rallying over 171 %. From the $7.73 entry, the stock has surged by 110 %, approaching the critical golden ratio resistance at $16.

Breaking through this resistance is crucial to invalidating the ongoing correction phase. However, RGTI has so far been unable to breach the $16 level with bullish conviction. A successful breakout above this level could see the stock surge towards its all-time high (ATH) of $21.4, representing an additional 32% upside potential.

Technically, the outlook remains bullish. The MACD histogram has been steadily increasing, indicating positive momentum, with the MACD lines on the verge of a bullish crossover. Additionally, the RSI remains in neutral territory, providing room for further upside. The EMAs continue to exhibit a golden crossover, reinforcing the bullish trend in the short to medium term.

RGTI Holds Above The 50-4H-EMA

So far, RGTI stock has maintained support above the 50-4H-EMA at $12.3, despite facing a bearish rejection at the golden ratio resistance level of $16. This sustained support suggests that RGTI may soon attempt another bullish breakout at this key resistance.

Technical indicators on the 4-hour chart reinforce this short-term bullish outlook. The MACD lines have crossed into bullish territory, and the EMAs are also crossed bullishly, further confirming upward momentum. The histogram continues to tick higher, signaling strengthening buying pressure, while the RSI remains neutral, leaving room for further upside movement.

Rigetti Computing Stock Moves Between Golden Ratio Levels

Rigetti Computing (RGTI) continues to trade within key golden ratio levels, and the next directional move will depend on breaking one of these levels decisively. If RGTI breaks the golden ratio support at $7.73, a drop to the 50-week EMA at $4.75 could be in play. Significant support lies further below, between $2.13 and $3.43, providing a potential safety net in a bearish scenario.

Conversely, should RGTI break the golden ratio resistance at $16, it opens the path to retest its all-time high (ATH) at $21.42, with the potential to surpass it. Currently, the weekly chart indicates mixed signals. While the RSI is nearing overbought territory, suggesting a potential cooldown, the MACD lines remain bullishly crossed, signaling sustained momentum. However, the histogram has been ticking bearishly lower for the past four weeks, indicating some weakening in buying pressure despite the continued uptrend. For now, RGTI has been trending higher for the past four weeks, suggesting that bulls remain in control until a key level is broken.

Massive Uptrend For Rigetti Computing Inc.

Rigetti Computing Inc. (RGTI) has been in a remarkable uptrend over the past five months, skyrocketing by an incredible 3,145%. Despite experiencing a significant correction last month, where the stock dropped by 72.2%, the overall trend remains bullish. The stock is poised to continue its upward momentum if it can break through the key golden ratio resistance level at $16.

Technically, the indicators remain largely favorable. The MACD histogram has been ticking bullishly higher for the past five months, while the MACD lines are still bullishly crossed, reinforcing the continuation of the upward trend. The RSI, though in overbought territory, has not flashed any bearish divergence, indicating that the bullish run still has room to extend. Breaking the $16 resistance could set the stage for further gains.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account