Meta Stock 900% Rally As Trump Drops Lawsuit, Points to $1,000 Soon

Meta shares have surged 900% since October 2022, gaining $100 in two weeks as Trump dropped the lawsuit, which suggests that the $1,000 will be reached soon.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Meta’s stock has been on an impressive winning streak, defying expectations as it extends its upward trajectory for the seventh consecutive week. Market trends can often push further than traders anticipate, and in Meta’s case, a breakout above the key resistance of $700, suggests the rally still has room to run toward $1,000. While prolonged gains often lead to overbought conditions, the current price action indicates that bullish momentum remains intact after a 20% surge in the last two weeks, and 900% gains in more than two years.

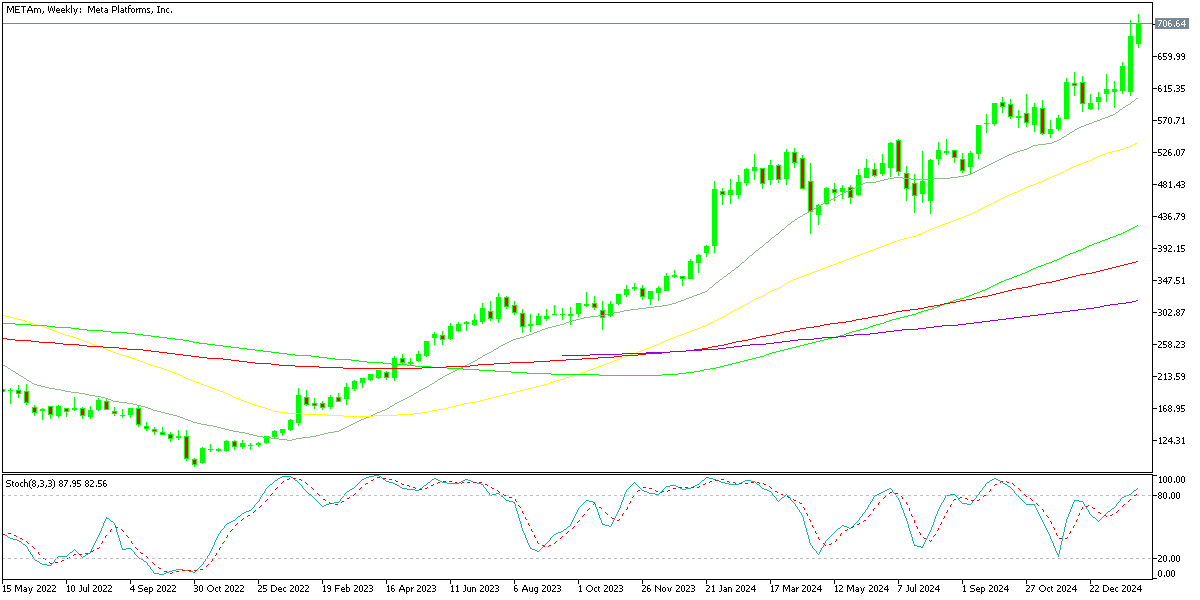

Meta Stock Chart Weekly – Supported by MAs

Meta shares are currently hovering near $714, having touched a high of $718.50 today. The stock remains well above its breakout point at $700, which now acts as a crucial support level. As long as the price stays above this threshold, the bullish bias remains strong. However, if sellers gain traction and the price falls below $705 with momentum, it could trigger profit-taking, with further downside targets near $700 and possibly $680.

This rally underscores the strength of momentum-driven trends, particularly in high-growth stocks facing strong buying pressure. Traders should continue to ride the trend, adjusting their strategy only if key technical levels, such as the breakout point, start showing signs of reversal. Even if a correction occurs, it could be short-lived, presenting an opportunity for investors to reload long positions before the next leg higher.

Trump-Meta Settlement Boosts Sentiment

Adding fuel to the rally, Meta surged 15% last week, climbing from $620 to over $700 after reports surfaced that Donald Trump reached a settlement with the company. The lawsuit stemmed from Meta banning Trump’s account following the 2020 Capitol protest. The resolution of this legal battle significantly improved market sentiment, driving the stock higher.

The settlement follows Mark Zuckerberg’s recent outreach to Donald Trump, who was re-elected in 2024. In an effort to rebuild ties, Zuckerberg contributed $1 million to Trump’s inauguration. Additionally, Meta relaxed content moderation policies across Facebook, Instagram, and Threads, while also ending collaborations with external fact-checking organizations.

With both technical and political factors aligning in Meta’s favor, the stock’s bullish momentum appears well-supported for now.