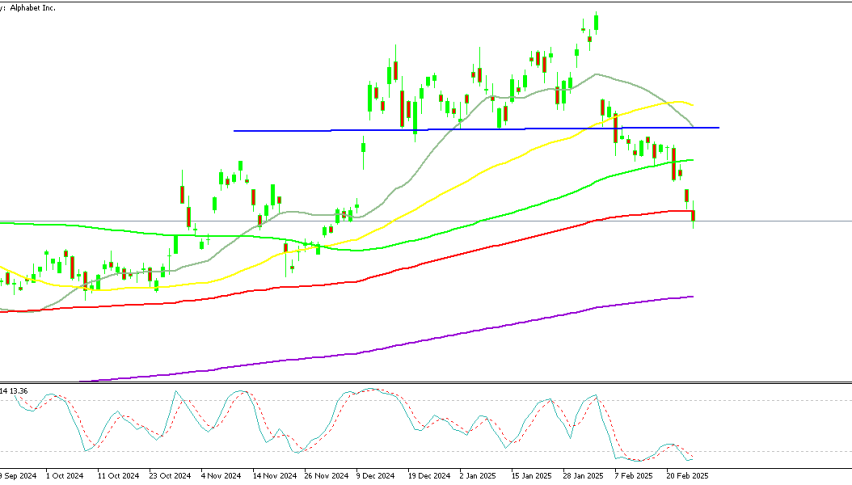

Is Google Stock Good to Buy After 7% Decline, With Support Below $190?

Google stock opened lower overnight after the disappointing earnings report, but the decline stalled today after finding support below $190.

The Google stock has been trading in a range since early December, with support below $190 and resistance around $200 after some decent gains since August. This week though, buyers showed resilience, pushing the stock price above the resistance, however during the night, Google shares plunged as sellers dumped the stock in the after-hours trading, following the release of financial tables and the miss in expectations.

Google Chart Daily – The 50 SMA Reinforced the Support Zone

Now, considering that the area below $190 has been holding as support on several occasions in the last two months, this retreat looks like a good opportunity to buy Google shares. This goes in line with the improvement in risk sentiment in financial markets this week, as the tariff war doesn’t seem to be too bad. But, today the Google stock showed no signs of life, while most companies made decent gains, as the competition weighs on Google stock and the revenue, as shown in the financial report. So, we will see how the stock opens tomorrow and if the price shows no further bearish signs, while the US-China trade war doesn’t escalate further, then we will consider buying Google stocks.

Alphabet Financial Performance Fails to Impress

Investors reacted negatively to weaker-than-expected sales figures and a substantial increase in planned capital expenditures for the year. Despite initially rising 2.5% to close at $207.71 per share on Tuesday, Alphabet’s stock tumbled nearly 8% in after-hours trading as the company reported underwhelming revenue figures and outlined $75 billion in capital spending for 2024.

Alphabet, the parent company of Google, posted fourth-quarter revenue of $96.5 billion, marking a 12% increase from the previous year. However, this fell short of market expectations, which had projected revenue of $96.7 billion. On the earnings front, Alphabet delivered a stronger-than-expected profit, with earnings per share (EPS) rising 31% to $2.15, surpassing the consensus estimate of $2.07 and improving from $1.64 in the same quarter last year.

Despite the solid earnings growth, the market’s reaction suggested that investors were more concerned about the revenue miss and the company’s aggressive spending plans. With $75 billion earmarked for capital expenditures, questions remain about Alphabet’s strategy and its ability to sustain long-term profitability. The sharp drop in after-hours trading highlights the cautious sentiment among investors as they digest the latest financial results and outlook for the company.