Stock Market Turmoil as Tariff Confusion Persists

When Donald Trump announced a pause on tariffs for Canada and Mexico, the stock market responded by climbing, but China imposed new tariffs on the US.

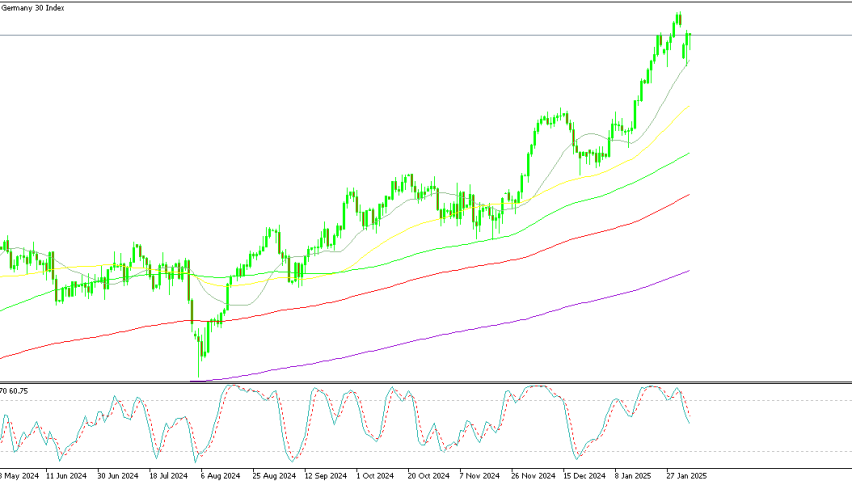

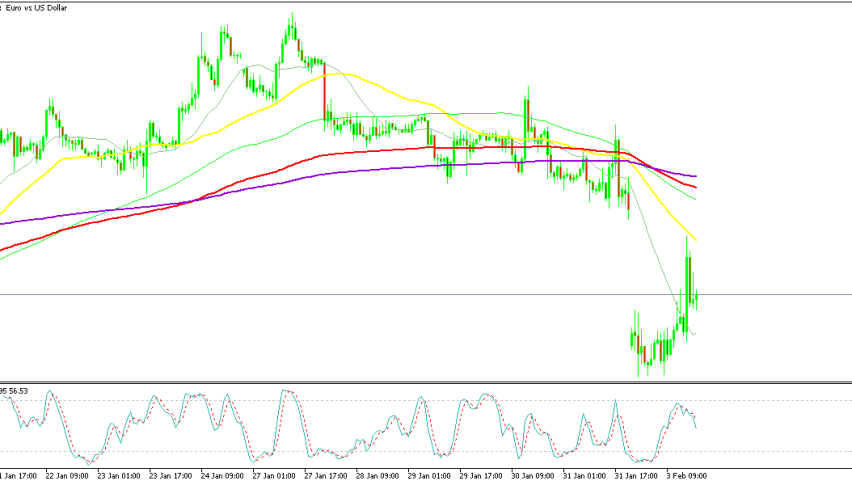

The stock market is down today after the United States and China imposed tariffs on one another. Even US president Donald Trump holding off on 25% tariffs on Canadian and Mexican goods was not enough to keep the markets from dipping.

Of course, there are far more goods imported from China to the US than those imported from Mexico and Canada. When the US issued its 10% tariff on Chinese goods, the Chinese government responded with tariffs of 10% on agricultural machinery and crude oil and 15% on liquefied natural gas and coal from the United States.

The stock market dropped as a result of this trade war, which is likely to continue until China accedes to the US government’s demands. Trump said the tariffs are designed to spur these governments to stop the flow of illegal immigrants into the US as well as drug and gun trades, with specific emphasis on fentanyl black market imports.

The Dow Jones dropped by 0.28% on Monday evening, followed by the Nasdaq Composite, which fell 1.20%. The S&P 500 likewise fell, losing 0.76%. Investors expect the trade war with China to continue for some time.

Tariffs Stopped for Mexico and Canada

Trump was going to impose traffic on Canada and Mexico but came to an agreement on Monday that put a 30-day delay on those tariffs. Canadian Prime Minister Justin Trudeau promised to implement measures to limit the flow of illegal immigrants, guns, and illegal drugs into the US by securing its border better.

Mexico agreed to similar steps, with President Claudia Sheinbaum saying she would put stronger security at the Mexican/American border to prevent illegal imports from passing through.

Trump’s strong stance on border control is now directly affecting the stock market and will likely continue to do so. There is concern among investors that once the 30-day reprieve has come to an end, tariffs will be instituted against goods from both Mexico and Canada and Chinese that tariffs may continue as a trade ware develops.

With no interest rate cut in sight and tariffs causing the price of goods to increase, the stock market could be in for a rough February.