Forex Signals Brief Feb 4: JOLTS Jobs Don’t Matter When Markets Trade Politics

Today JOLTS jobs will be the main forex release, but markets are more focused on politics and trade tariffs, which are driving markets now.

Live BTC/USD Chart

Today JOLTS jobs will be the main forex release, but markets are more focused on politics and trade tariffs, which are driving markets right now.

The US dollar opened 1.5 cents higher against most major currencies, as markets reacted to new tariffs—25% on Mexico and Canada and 10% on China. However, the dollar weakened during the US session after reports that Mexican President Sheinbaum and Trump agreed to delay tariffs for 30 days. Mexico pledged 10,000 National Guard troops for border security, while Trump promised to curb weapon flows into Mexico. Cryptocurrencies also reversed form the early morning crash as sentiment improved.

Talks with Canada’s Prime Minister Trudeau were initially unproductive, but by day’s end, Canada also secured a 30-day tariff reprieve in exchange for $1.3 billion in border security funding and appointing a Fentanyl czar. Trump confirmed a 10% tariff on China and hinted at targeting the EU next.

Fed officials weighed in, with Susan Collins warning tariffs could fuel inflation and Raphael Bostic noting rising economic uncertainty. Stronger-than-expected US construction spending (+0.5%) and ISM manufacturing (51.2) bolstered optimism. US stocks closed lower but off their lows, with the Dow down 122 points (-0.28%), the S&P 500 losing 45 points (-0.76%), and the Nasdaq falling 236 points (-1.20%). Gold rebounded to $2,814.13 after hitting a record $2,830, while Bitcoin recovered from $91,500 to close above $102,000.

Today’s Market Expectations

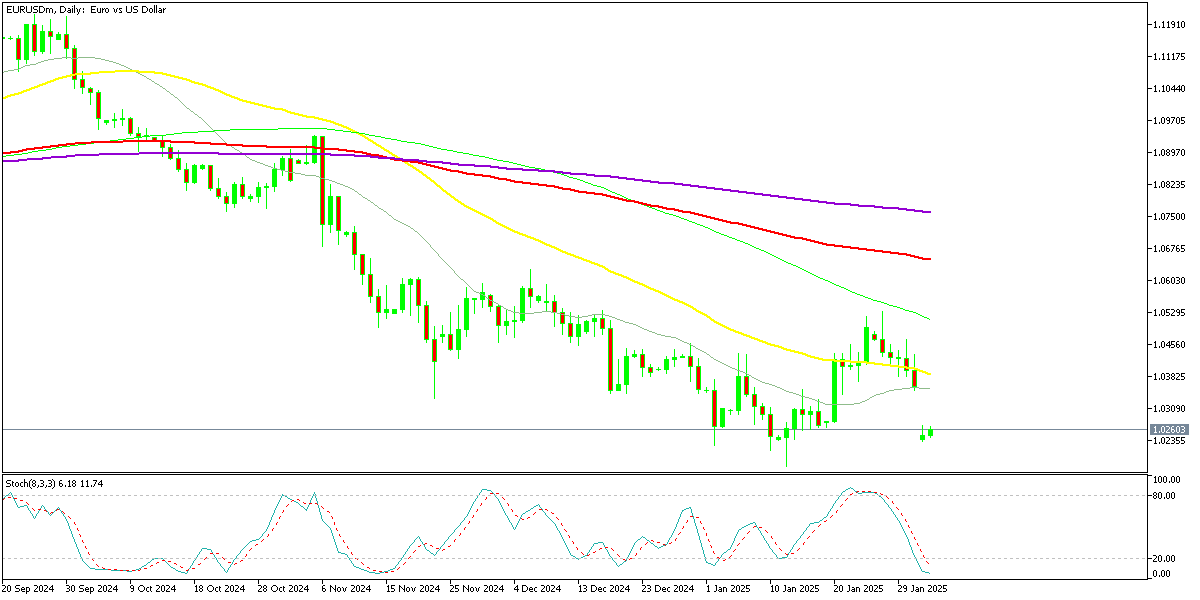

This week has also started in a volatile manner, after the weekend news, which have propelled USD/CAD above 1.47 and EUR/USD down to 1.02 lows. But, we will also have the Eurozone CPI inflation report today, which might send this pair even lower.

Risk assets, including stock markets and commodity-linked currencies, saw a crash in early Asian session, but then the sentiment improved and they saw strong buying momentum, leading to a volatile but ultimately weaker U.S. dollar. Across 26 forex trades, we secured 19 wins and 7 losses, maintaining a predominantly long stance on equities and gold.

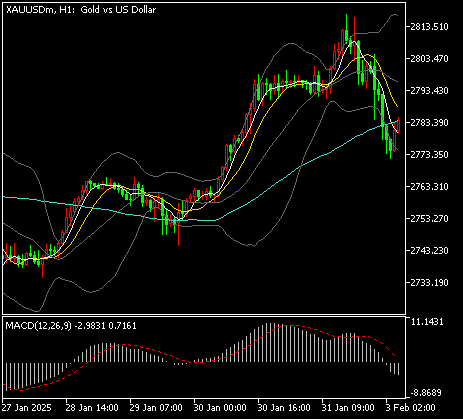

Gold Returns Below $2,800 Again

GOLD continues to show strong bullish momentum, reaching a new all-time high of $2,798.40 today and holding above the previous peak of $2,790. With buyers firmly in control, a push above $2,800 and even toward $3,000 remains a possibility. The ongoing global economic and political uncertainty continues to favor safe-haven assets, further supporting gold’s bullish outlook. The latest US GDP report provided additional fuel for XAU/USD, driving it past the late-October high of $2,790. However, after hitting $2,830, gold experienced some volatility, briefly pulling back to $2,772 before rebounding sharply by nearly $50.

XAU/USD – H4 Chart

EUR/USD Heads to Parity Again

Meanwhile, USD/CAD opened with a two-cent bullish gap following the weekend tariff developments. As the tariffs were suspended, the pair retraced its gains, leading to significant volatility after the Trump-Trudeau call. Initially, USD/CAD surged to a 20-year high of 1.4793 before falling to 1.44. Trump later described the conversation as going “very well,” which, despite lacking a definitive resolution, strengthened the Canadian dollar and triggered a two-cent drop in USD/CAD.

EUR/USD – Daily Chart

Cryptocurrency Update

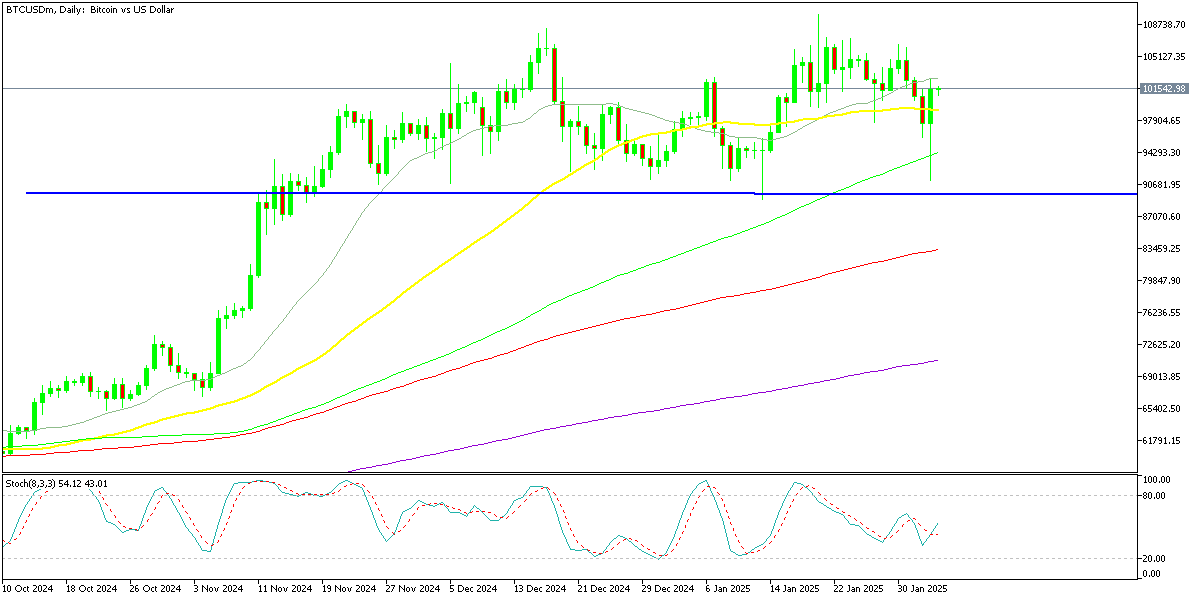

Bitcoin Returns Below $100K

BITCOIN also experienced heightened volatility yesterday following the bearish reversal from late last week which accelerated early in the day and BTC dipped to the low $91,500 as Donald Trump signed the tariffs. However a strong rebound toward $100,000 followed and the price climbed above that major level closing the day with a hammer candlestick, which is a bullish reversing signal.

BTC/USD – Daily chart

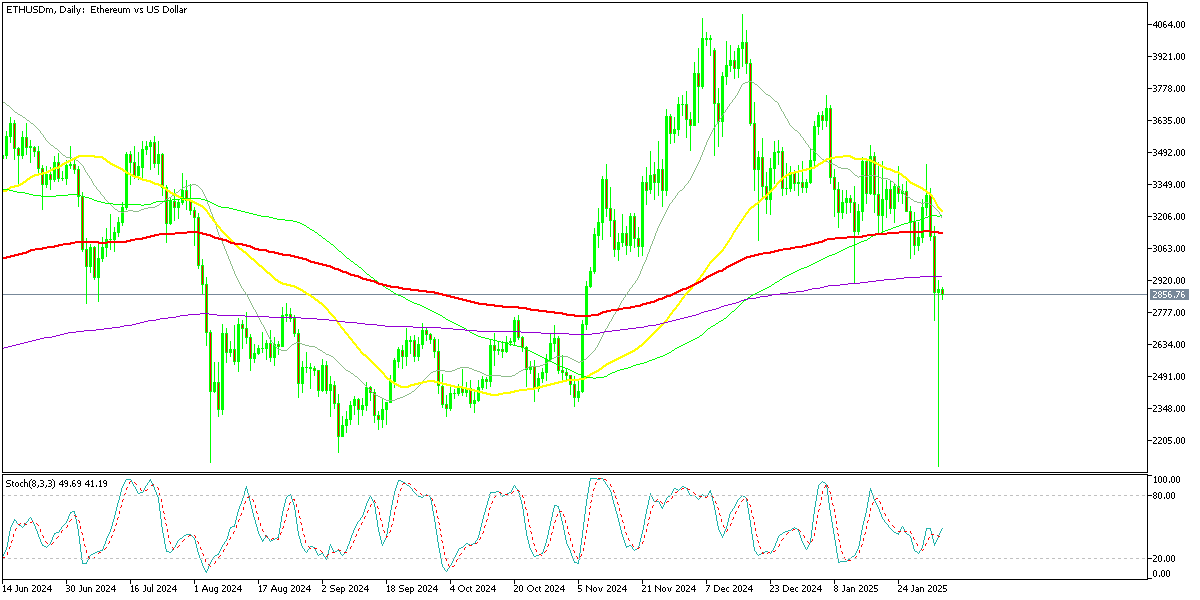

Ethereum Falls Below $3,000

ETHEREUM mirrored Bitcoin’s fluctuations as well yesterday, although the decline was larger and so was the rebound that followed. In the last three days, the declined were getting larger as the selling pressure escalated, and yesterday in the Asian session ETH/USD fell close to $2,000. However the sentiment improved and the decline stalled around the $2,100 area, which is a strong support zone, reversing the price several times. The bounce was also very strong, with the price closing where it opened around the $2,900 level, forming a pin candlestick, which also suggests further bullish momentum.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account