New Record High in USD/CAD Might Not Last, If Canada Tariffs Reverse

Yesterday USD/CAD opened with a 2 cent gap higher after the US trader tariffs, but there's a chance of tariff reversal, which should reverse

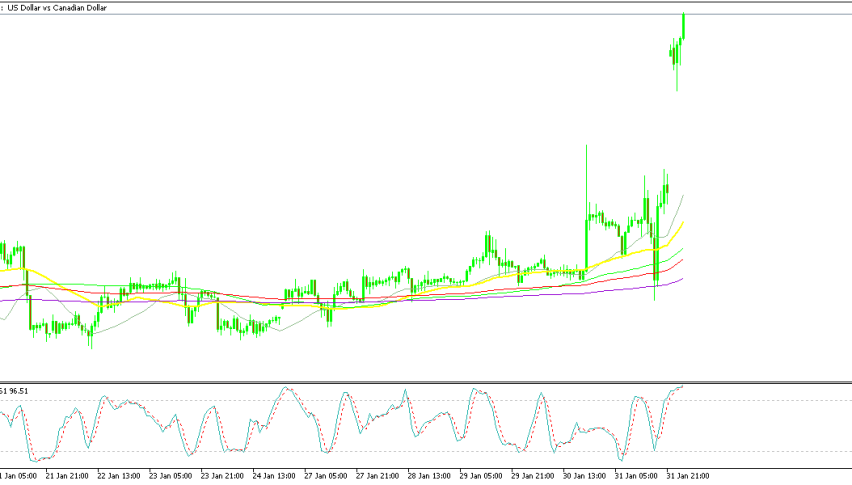

Live USD/CAD Chart

Yesterday USD/CAD opened with a 2 cent gap higher after the US trader tariffs, but there’s a chance of tariff reversal, which should reverse this pair lower.

Last Thursday, as newly elected U.S. President Donald Trump advanced plans for a 25% tariff on imports from Canada and Mexico, the USD/CAD pair surged to a five-year high. Over the weekend, Trump officially signed the trade tariffs into law, triggering a strong market reaction. By Monday night, USD/CAD had opened 200 pips higher and reached a record high of 1.4750.

Despite the sharp currency moves, CAD buyers are holding onto hope that the tariffs could be lifted if Canada agrees to U.S. demands—though the likelihood of that happening remains low. Trump’s administration has signaled some room for negotiation, particularly in Canada’s case, where the tariffs could be removed if significant steps are taken to address the health crisis.

Key Points on New trade Tariff Measures

- Canada Tariffs: A 25% tariff will apply to all Canadian imports, except for energy products, which will face a lower 10% tariff.

- Mexico Tariffs: All Mexican imports will be subjected to a 25% tariff with no exemptions.

- Retaliation Clause: The policy includes provisions for further actions, likely escalating tariffs if trading partners retaliate.

- China Tariffs: An additional 10% tariff will be imposed on all Chinese exports to the US, adding to the existing tariff structure.

- Legal Basis: The tariffs are being implemented under the International Emergency Economic Powers Act (IEEPA).

- China and Fentanyl: The move is partly in response to China’s refusal to cooperate on measures aimed at restricting fentanyl shipments.

- Canada’s Role in Fentanyl Trade: Increasing evidence suggests that Canada is playing a growing role in the transshipment of fentanyl.

- De Minimis Waiver Revoked: The tariff plan includes the removal of the de minimis waiver for Canadian imports, further tightening trade restrictions.

Canada Retaliation

The White House confirmed over the weekend that the new tariffs will apply to China, Canada, and Mexico. However, the retaliation clause adds complexity, as Canada has vowed to announce countermeasures—if not impose immediate retaliatory tariffs.

Later today, Canada’s Prime Minister is expected to issue a formal response after meeting with Mexico’s President, who has yet to comment publicly on the situation. This meeting will be crucial in determining how the two nations will coordinate their response to the U.S. tariffs.

Room for Negotiation Before Implementation

While the situation remains tense, there are still indications that negotiations are possible. The delayed implementation of the tariffs—set to take full effect on Tuesday—suggests that there is a small window for last-minute discussions. Goldman Sachs recently released an analysis predicting that tariffs on Canada and Mexico may only be temporary, further reinforcing the possibility of a resolution.

Trump himself has acknowledged that the tariffs could create “temporary discomfort” but remains firm in his stance, showing little concern about potential fallout. He is scheduled to speak with Canadian Prime Minister Justin Trudeau on Monday, though he has low expectations for that conversation. Trump also mentioned he would engage with Mexico, but details on that discussion remain unclear.

Key Points on Trump’s Executive Order and Tariffs

- Effective Date: The executive order imposing tariffs on Canada, Mexico, and China will take effect on February 4.

- Canada Tariff Exemption: Goods that were already in transit or loaded onto vessels before February 4 will not be subject to the new tariffs.

- Potential Removal: The new tariffs on Canada could be lifted if the country takes sufficient measures to help address the ongoing health crisis.

Meanwhile, the European Union is also bracing for potential tariff measures, as Trump appears prepared to expand his trade policy beyond North America and China. With trade tensions intensifying, global markets will be closely monitoring developments in the coming days.

BMO Revises Interest Rate Outlook Amid Tariff Impact

In response to the economic strain caused by Trump’s 25% tariffs, the Bank of Montreal (BMO) has adjusted its forecast for Canada’s interest rates.

BMO now anticipates that the Bank of Canada (BoC) will lower its policy rate to 1.5% by October, implementing six consecutive 0.25% rate cuts over the coming quarters. This aggressive easing cycle reflects concerns over the tariffs’ impact on economic growth, trade, and inflation in Canada.

The updated forecast underscores expectations that Canada’s central bank will shift toward a more accommodative stance to cushion the economy from the fallout of rising trade barriers. Markets will closely watch the BoC’s upcoming policy statements for any confirmation of this outlook.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account