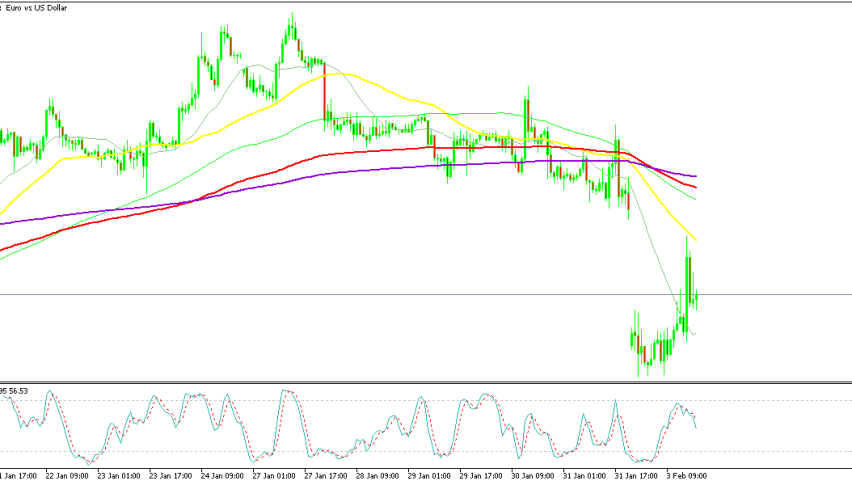

Euro Heads to Parity After Failed Bounce, Dax Keeps Making Record Highs Despite Trade Worries

Last night EUR/USD opened 1.5 cents lower on US tariffs, while the gap in Dax was lower and it already started reversing higher.

Live EUR/USD Chart

Last night EUR/USD opened 1.5 cents lower on US tariffs, while the gap in Dax was lower and it already started reversing higher, showing resilience.

EUR/USD reversed lower in late October above 1.11 and it turned quite bearish in Q4 of 2024, falling below 1.02 by early January. However, we saw a retrace higher above 1.05 in the third week of last month, which sent the price above 1.05. However, buyers couldn’t keep the price up there and last week this forex pair reversed lower, slipping below 1.04 where it closed the week. Last night, we saw a major bearish gap, which sent the price 1.5 cents lower, to 1.02 lows after the weekend announcement of US tariffs on Canada, Mexico and China.

DAX 40 Chart – Nothing Can Stop the Bullish March

Last week, the U.S. Federal Reserve avoided sounding dovish and maintained its monetary policy at 4.25% to 4.50%. The euro has been impacted by the U.S. dollar’s strength due to this cautious attitude. While the Dax jumped to a new record high at 21,811 points and other European stock markets rose as well, the ECB issued another dovish rate drop, which is negative for the Euro. Last night the DAX 40 index did open lower, but less so than most major stock indices and it quickly started to recover toward all-time highs, which points to more buying momentum in DAX . Earlier today we had the CPI inflation report from the Eurozone.

Eurozone CPI Inflation Report – January 2025

Released by Eurostat – February 3, 2025

- Headline CPI (YoY): +2.5% (vs. +2.4% expected, prior: +2.4%)

- Core CPI (YoY): +2.7% (vs. +2.6% expected, prior: +2.7%)

Key Takeaways:

- Inflation came in slightly higher than expected, with headline CPI rising to 2.5% from 2.4% in December.

- Core CPI, which excludes volatile items like food and energy, remained steady at 2.7%, surpassing forecasts.

- The higher-than-expected inflation print could influence ECB policy discussions, as the central bank navigates its approach to rate adjustments.

- Markets will now turn their focus to upcoming ECB statements and guidance, as well as February inflation trends.

The Eurozone’s January inflation report indicates a slightly stronger-than-expected price increase, with headline CPI rising to 2.5% and core CPI holding steady at 2.7%. These figures suggest that while inflationary pressures are easing from their peak levels, they remain sticky, particularly in core components, which exclude volatile food and energy prices. The European Central Bank (ECB) will likely take note of this data as it weighs future monetary policy decisions.

While the ECB has been gradually shifting towards a more dovish stance, expecting inflation to continue its downward trend, persistent core inflation could complicate the timeline for potential rate cuts. A steady core CPI at 2.7% reinforces the argument that underlying inflationary forces remain strong, potentially delaying aggressive easing measures. From a market perspective, bond yields and the euro could react to this report, as traders reassess expectations for ECB rate cuts in 2025. Investors will now focus on upcoming inflation prints and economic data to gauge whether the ECB will maintain its cautious approach or accelerate policy adjustments. The next key event will be ECB policymakers’ responses to the data, which could offer more clarity on the future interest rate path.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account