Chainlink’s Major Partnerships and Technical Indicators Signal Potential LINK Rally

Live LINK/USD Chart

Leading decentralized oracle network Chainlink (LINK) has been making notable progress in early 2025; its native token shows great increasing momentum among new alliances and technology innovations. Right now, LINK/USD is trading around $18, an over 21% decline over the past 24 hours.

Chainlink’s Major Partnership Boosts Institutional Adoption

Usual, a large stablecoin issuer with more than $1.2 billion in assets, has now embraced Chainlink’s infrastructure for their USD0 and USD0++ stablecoins. Using several Chainlink services—Price Feeds, Cross-Chain Interoperability Protocol (CCIP), and Proof of Reserve—this integration improves the security and openness of Usual’s ecosystem.

Particularly in the fast developing tokenized real-world assets (RWA) market, the cooperation shows Chainlink’s increasing impact in the institutional finance industry. Cofounder of Usual, Adli Takkal Bataille, underlined the need of this integration for hastening the acceptance of their stablecoins and allowing safe cross-chain markets.

Innovation in DeFi Yield Tracking

With the release of its DeFi Yield Index (CDY), a fresh instrument meant to aggregate and standardize market-wide DeFi lending rates, Chainlink has further improved its market position. Driven by blockchain indexing technology of Space and Time, this invention seeks to increase capital efficiency and give conventional financial institutions better access to DeFi yield possibilities.

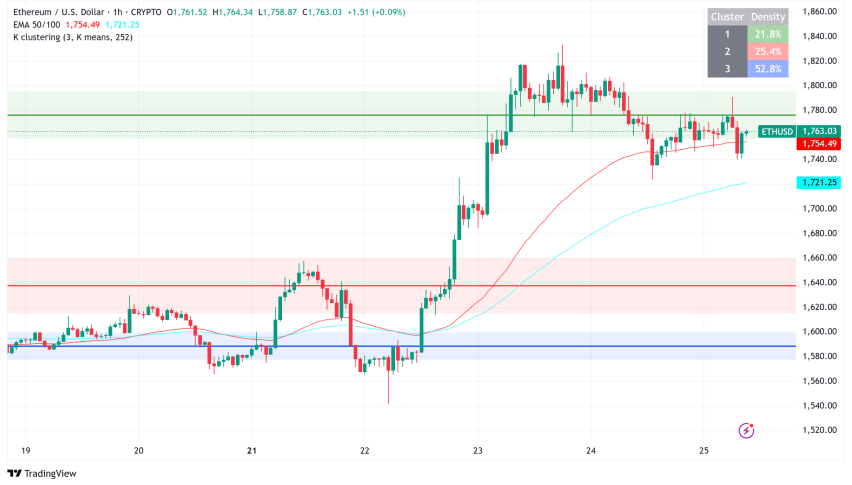

LINK/USD Technical Analysis

The market sentiment for LINK continues to show potential, though with key technical levels to watch:

Support Levels

- Critical support zones established at $16 and $15

- Current price action suggests these levels are crucial for maintaining bullish momentum

- Any breach below $15 could indicate a shift in market structure

Resistance Zones

- Immediate resistance at $20, representing a key psychological level

- Major resistance barrier at $25, which if broken could trigger significant upward movement

- Breaking above $25 could open the path toward the $34-$36 range

Moving Averages

- Currently trading below both the 50 EMA ($21.60) and 100 EMA ($22.75)

- Price needs to reclaim these levels to confirm bullish momentum

- The gap between current price and EMAs suggests potential for mean reversion

LINK Whale Activity

Large investors continue accumulating LINK in the $17-$21 range. This accumulation pattern, combined with retail investor interest, could provide strong support for prices. Historical data suggests whale accumulation often precedes significant price movements

Chainlink Price Prediction

According to CoinCodex and various market analysts, LINK could see significant growth in the coming months:

- Short-term target: $32 (February 2025)

- Mid-term projection: $41 (March 2025)

- Extended forecast: $48 (May 2025)

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account