Traders Profit in USD/CAD As It Spikes on Canada Tariff Fears

USD/CAD surged near a five-year high as newly elected U.S. President Trump moved closer to imposing a 25% tariff on imports from Canada

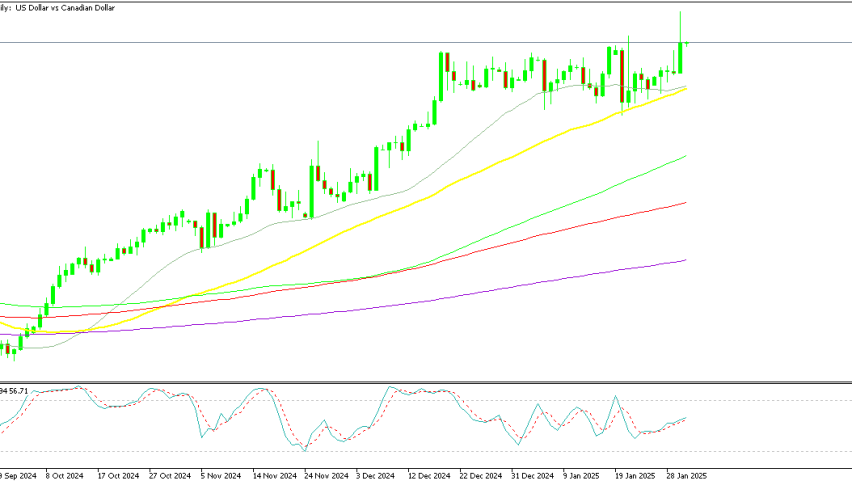

Live USD/CAD Chart

USD/CAD surged near a five-year high as newly elected U.S. President Donald Trump moved closer to imposing a 25% tariff on imports from Canada and Mexico.

The White House administration also signaled plans for a 10% tariff on Chinese goods, according to later comments, fulfilling a key campaign promise. While Trump had initially set these tariffs as a “Day 1” priority, their delay provided temporary relief. However, he has now suggested they will take effect on February 1, with a decision on oil imports still pending. Trump indicated he would determine whether to include oil based on pricing fairness, despite the primary goal of tariffs being to curb illegal immigration and fentanyl smuggling.

Market Reaction: USD/CAD Hits Multi-Year Highs

A brief market panic followed initial reports of Trump signing tariff-related executive orders, sparking a sharp reaction in USD/CAD. When it became clear that he was reiterating threats rather than enacting immediate measures, some of the move faded—though not entirely. The volatility highlighted ongoing market unease surrounding tariffs, with further swings occurring after Trump commented on potential China tariffs.

Meanwhile, the Bank of Canada (BOC) raised rates by 25 basis points as expected, reinforcing a cautious approach to monetary easing. Initially, USD/CAD fell by one cent, but a late-session rally saw a two-cent spike, pushing the pair to 1.4596—its highest level since 2020. The move briefly tested 1.4667, approaching the 2016 high of 1.4690. The BOC’s decision signaled a measured approach to rate adjustments rather than an aggressive cutting cycle, reinforcing a steady outlook for Canadian monetary policy.

Outlook: Uncertainty Over Tariffs and Rate Policy

Traders remain on edge as tariff uncertainty continues to drive market swings. USD/CAD’s rally underscores how sensitive markets are to trade policies, particularly as Trump’s rhetoric continues to influence sentiment. While the Bank of Canada’s rate hike initially pressured the pair lower, the tariff-related surge suggests external factors are dominating currency moves. Looking ahead, investors will be closely watching for further clarity on tariff implementation and any shifts in central bank policy that could shape USD/CAD’s trajectory.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account