IBM, Microsoft Stocks Surge on Upbeat Earnings, Meta Stock Dives on Cloud Services Fall

Microsoft stock futures have dived 5% after the market close as Cloud revenue falls, while Meta shares are 5% up and IBM stock 10% up, as earnings beat expectations.

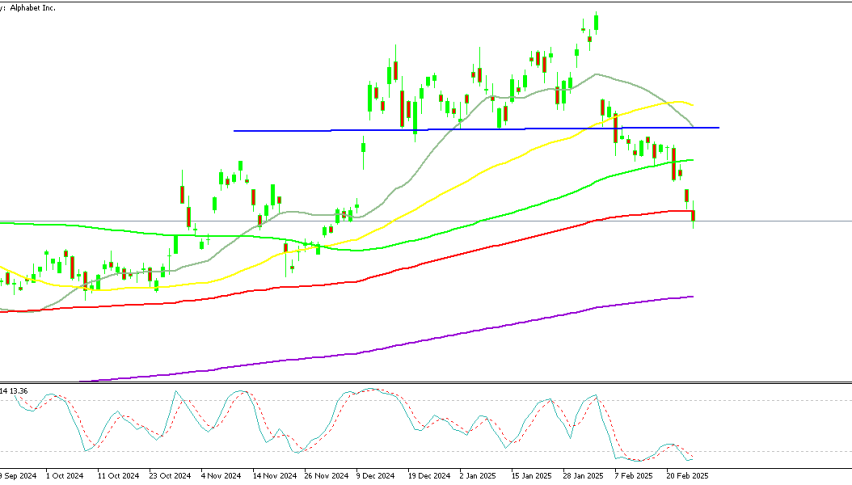

Tech earnings produced mixed market reactions, with Microsoft and Meta surpassing expectations, while IBM posted solid results and saw a significantly stronger stock rally. The divergence in stock movements highlights investor sensitivity to growth trends, particularly in AI and cloud services.

Microsoft reported better-than-expected earnings and revenue, but slower Azure growth and a miss in Intelligent Cloud revenue dampened sentiment, leading to a 4% stock decline. This marks the second consecutive quarter of decelerating cloud growth, raising concerns about enterprise demand and AI-driven revenue expansion. Analysts will likely scrutinize future AI adoption trends and Microsoft’s ability to sustain cloud momentum in an increasingly competitive landscape.

Microsoft (MSFT) Q2 2025 Earnings

- Earnings Per Share (EPS): $3.23 (beat; expected $3.11).

- Revenue: $69.6B (beat; expected $68.78B).

- Azure & Cloud Services Growth: +31% (miss; expected +31.8%, down from 33% last quarter).

Segment Performance:

- Intelligent Cloud: $25.5B (miss; expected $25.74B).

- More Personal Computing: $14.7B (beat; expected $14.13B).

- Productivity & Business Processes: $28.9B (beat; expected $28.85B).

- Total Cloud Revenue: $40.9B.

Stock Performance:

- Microsoft shares dropped -5% to $416, as slower Azure growth and a miss in Intelligent Cloud revenue dampened sentiment.

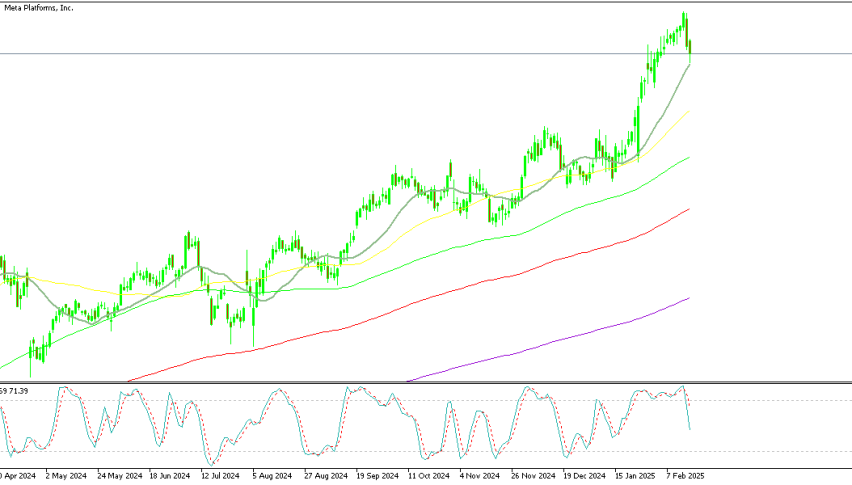

Meta delivered a strong earnings and revenue beat, but its stock reaction was muted, down -0.3%, suggesting that lofty investor expectations were already priced in. The focus now shifts to user growth, advertising revenue trends, and Meta’s continued investments in AI and the metaverse. Investors may also monitor Meta’s cost structure and efficiency improvements, as the company balances growth with profitability.

Meta Platforms (META) Q4 2024 Earnings

- Earnings Per Share (EPS): $8.02 (beat; expected $6.77).

- Revenue: $48.39B (beat; expected $47.03B).

- Stock Reaction: Meta shares surged higher by 5%, on strong earnings and revenue beats, settling 3% up now.

IBM had the most significant stock move, initially surging +11.5% post-earnings, though shares later settled at +10%—still a substantial gain. The strong market response likely reflects investor confidence in IBM’s cloud and enterprise segments, as well as its positioning in AI-driven solutions. Stability in recurring revenue streams and enterprise demand resilience may have reassured investors in an uncertain tech environment.

IBM (International Business Machines Corp) Q4 2024 Earnings

- Earnings Per Share (EPS): $3.92 (beat; expected $3.75).

- Revenue: $17.54B (met expectations).

- Stock Reaction: IBM shares surged +10%, reflecting strong investor confidence following the earnings report.

Sidebar rates

82% of retail CFD accounts lose money.