BoC Rate Cut and Looming Canada Tariffs to Keep USD/CAD Bullish

USDCAD will be prone to both the FED and the BOC today, but the elephant in the room is the possible tariffs from the US on Canadian goods.

Live USD/CAD Chart

USDCAD will be prone to both the FED and the BOC today, but the elephant in the room is the possible tariffs from the US on Canadian goods, which would send this pair above 1.45.

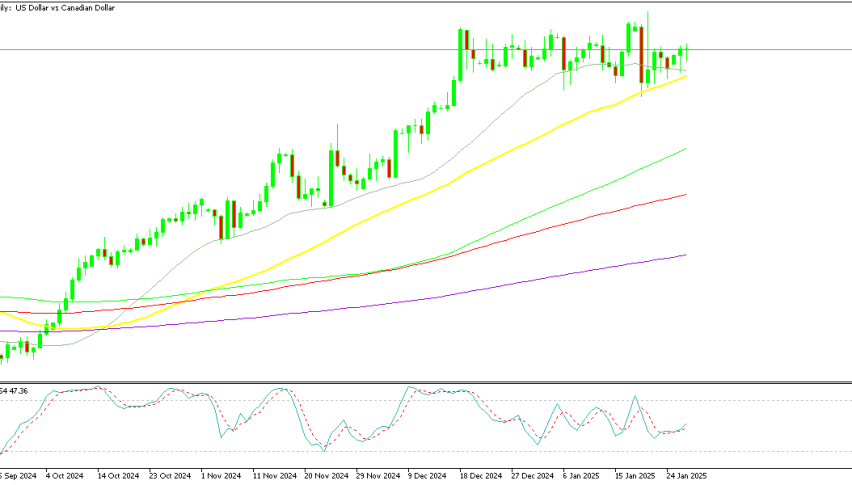

In the early European session on Tuesday, the USD/CAD pair climbed to a one-week high near 1.4420. Despite this upward move, the pair remains within a narrow range, reflecting market indecision ahead of significant central bank meetings later this week. Moving averages are doing a good job on the weekly chart, keeping the price supported, with the 50 SMA (yellow) taking over recently as the price consolidates above 1.40.

USD/CAD Chart Daily – Supported by MAs During Rangebound Trading

Bank of Canada Rate Decision Looms

The Bank of Canada (BoC) is widely expected to cut interest rates by 25 basis points during Wednesday’s meeting, reducing the overnight rate from its current 3.25% to 3.00%. Markets are pricing in a 99% probability of this move. Looking ahead, the March meeting is more uncertain, with only a 44% chance priced in for another reduction to 2.75%. By year-end, 67 basis points of rate cuts are expected in total.

However, the looming implementation of US tariffs in February creates additional unpredictability for the BoC and the Canadian dollar. Bank of Canada Governor Tiff Macklem is expected to emphasize that future rate decisions will depend on the economic impact of tariffs, with the next policy announcement scheduled for March 12.

Trump’s Tariff Stance Pressures Markets

President Trump reiterated his commitment to universal tariffs, proposing higher initial rates than the gradual increase from 2.5% reportedly supported by Treasury Secretary Scott Bressen. Trump specifically mentioned plans to impose new taxes on steel and copper imports and reiterated his intent to implement a 25% tariff on Canadian imports starting February 1st.

This announcement has weighed heavily on the Canadian dollar, as markets remain skeptical about the full implementation of these tariffs but acknowledge the significant risk. Trump’s hardline trade policies have added to global uncertainty, further pressuring the Canadian currency.

Broader Market Sell-Off and Risk Aversion

A surge in risk aversion halted the Canadian dollar’s gains yesterday. The NASDAQ dropped 3.07%, wiping $1.0 trillion from AI company valuations. Nvidia alone lost $590 billion in a historic one-day collapse, exceeding its own market capitalization. This equity market turmoil increased demand for safe-haven US dollars, with the Japanese yen showing the weakest performance among major currencies.

Trump’s rhetoric amplified the risk-off sentiment, leading to broader USD strength. The combination of equity market losses, tariff threats, and political uncertainty leaves little room for optimism, particularly for the Canadian dollar.

Outlook for the Canadian Dollar

While the market remains doubtful about the full implementation of Trump’s proposed tariffs on Canada and Mexico, the uncertainty is enough to weigh on sentiment. The Bank of Canada, for its part, is in no position to gamble on political outcomes. Moving forward, the central bank is likely to maintain a cautious tone, signaling that future policy adjustments will hinge on incoming economic data and the evolving trade environment.

With risks mounting from both trade policies and broader market instability, the Canadian dollar faces an uphill battle in the weeks ahead.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account