Forex Signals Brief January 10: Strong NFP Would Accelerate USD Uptrend

Today NFP jobs are expected to fall to 160K, so anything above 200K would be taken as positive and increase the odds of a less dovish FED, which would send the USD higher.

Yesterday’s major events unfolded early, leaving markets relatively quiet. Australian trade data for November 2024 highlighted stronger performance, with imports rising by 1.7% (up from 0.1%) and exports increasing by 4.8% m/m (up from 3.6%). Retail sales grew by 0.8% m/m, exceeding the prior 0.6% but falling short of the 1.0% forecast. Annual retail sales rose by 3.0%. These updates came during muted trade, as US markets were closed for the Carter funeral.

China’s December 2024 inflation data signaled ongoing economic struggles. PPI fell back into negative territory at -0.1% m/m from +0.1%, while CPI narrowly avoided deflation at +0.1% y/y, down from the prior +0.2%. Annual PPI remained deeply negative at -2.3%, reflecting persistent weakness.

With US stock markets closed, only limited data was available, including lower-than-expected Challenger layoffs. Federal Reserve commentary emphasized a cautious approach to monetary policy. Fed’s Harker noted the normalization of job creation and stronger labor market conditions, suggesting the Fed could hold steady while relying on incoming data for future rate decisions. Collins echoed the need for patience and gradual rate reductions, aligning with the Fed’s December projections. Similarly, KC Fed President Jeff Schmid stressed a measured approach to further rate cuts, while Bowman advocated for a practical stance on financial regulation under the incoming administration.

Today’s Market Expectations

The Canadian employment report is expected to show a gain of 25.0K jobs in December, down from November’s 50.5K, with the unemployment rate ticking up to 6.9% from 6.8%. While the previous report’s headline figure appeared strong, underlying details painted a less favorable picture. CIBC highlighted the highest unemployment rate since 2016, public sector job gains dominating the growth, and private sector employment lagging behind labor force expansion. The rise in unemployment since early 2023 has primarily been driven by difficulties in finding jobs rather than layoffs, a pattern typical during recessions. Future rate adjustments will now depend on incoming data, signaling the peak of its dovish stance. Markets still expect at least two more 25-basis-point cuts this year the Bank of Canada, with a 71% chance of another cut this month.

In the US, the Fed forecasts an average unemployment rate of 4.3% this year and appears willing to tolerate slight overshoots if inflation remains uncooperative. December’s Non-Farm Payrolls (NFP) report is projected to show 160K new jobs, down from 227K in November, with the unemployment rate steady at 4.2%. Average hourly earnings are expected to grow by 0.3% m/m (compared to 0.4% previously) and 4.0% y/y, consistent with prior figures. Meanwhile, the upcoming CPI report is likely to hold more weight for market sentiment than the NFP data.

Yesterday it was quiet apart from a strong bearish move in the GBP in early European trading, with the USD continuing to grind higher against commodity dollars, although with not much pace. We remained long on the USD which proved to be a good strategy on Wednesday, but yesterday’s trades remained mostly open.

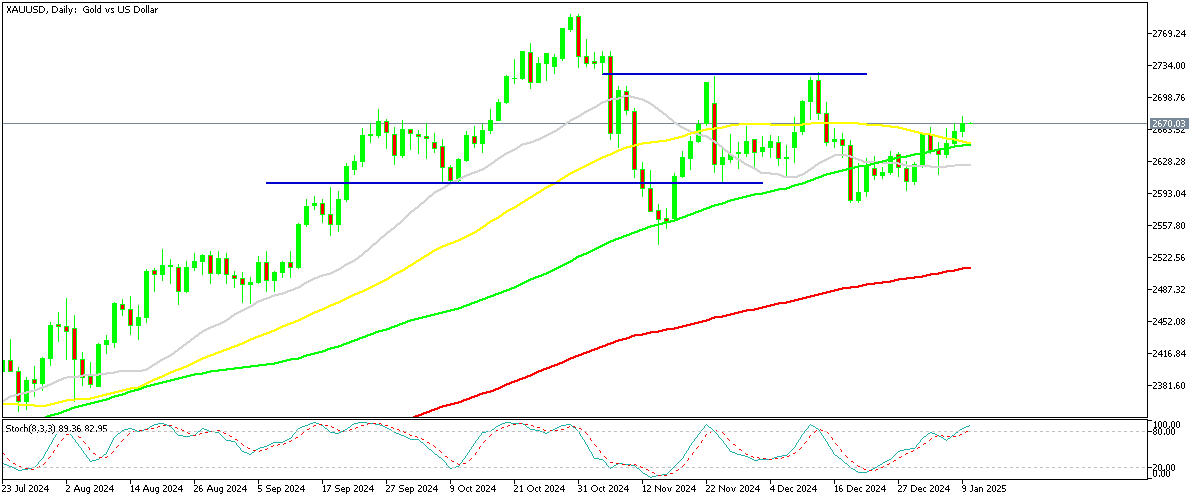

Gold Consolidates Above the 50 Daily SMA

Gold saw a sharp $100 drop in December after failing to surpass the key resistance level of $2,725. While the 50-day Simple Moving Average (SMA) acted as resistance late last week, buyers returned as the price dipped below the 100-day SMA. Although there was a partial recovery, the price struggled to move beyond the 50-day SMA. However, on Wednesday, buyers managed to push gold above this level, and by yesterday, the price had stabilized above it.

XAU/USD – Daily Chart

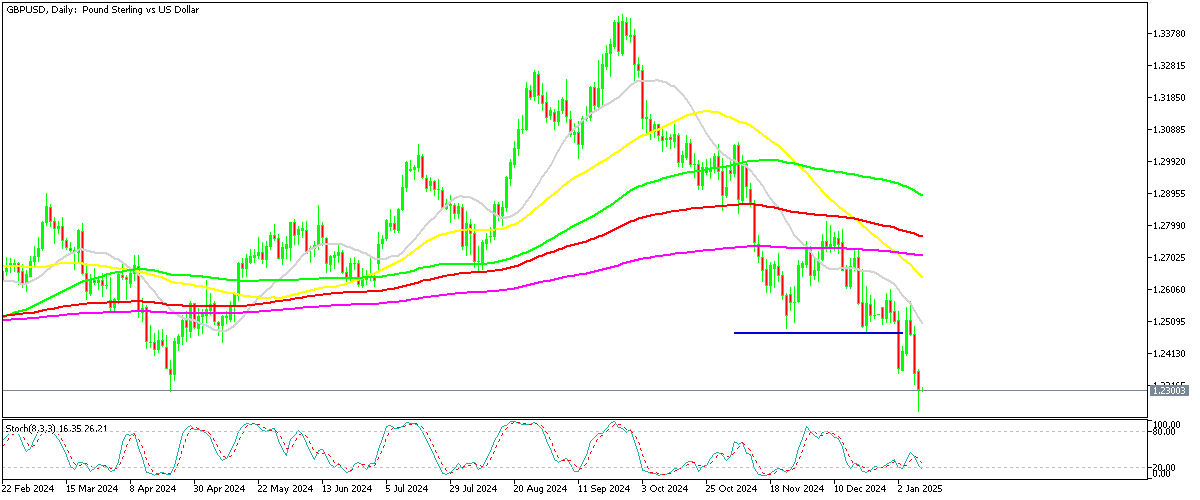

GBP/USD Breaks Below 2024 Low

GBP/USD turned bearish in October, sending this forex pair below all moving averages on the daily chart and losing more than 12 cents in total. Yesterday the British Pound resumed the decline and fell more than 1 cent, declining below 1.23 which was the 2024 low, where it closed the day.

GBP/USD – Daily Chart

Cryptocurrency Update

Bitcoin Falls to the Support Zone Above $90K

In the cryptocurrency market, Bitcoin displayed significant volatility. Early in the week, it approached $108,000 before tumbling after a 25 basis point rate cut. Prices plunged to the low $90,000s and dipped below $100,000. Bitcoin rebounded off the 50-day SMA to reach $95,000, but resistance near the 20-day SMA forced it back down to settle at $90,000. Efforts to reclaim $100,000 were short-lived as the price retreated below this level once again. The current support zone appears to be holding, presenting a potential opportunity to go long on Bitcoin.

BTC/USD – Daily chart

Ethereum Approaches the $4,000 Level Again

Ethereum’s price movements were even more dramatic. It climbed from $3,000 to nearly $4,000 midweek before stalling and dropping below $3,500. Over the last two weeks, Ethereum regained some ground and found solid support around the 50-day SMA. However, bearish sentiment resurfaced, pulling the price below $3,500 again. By yesterday, Ethereum extended its decline further to $3,200.

ETH/USD – Weekly Chart