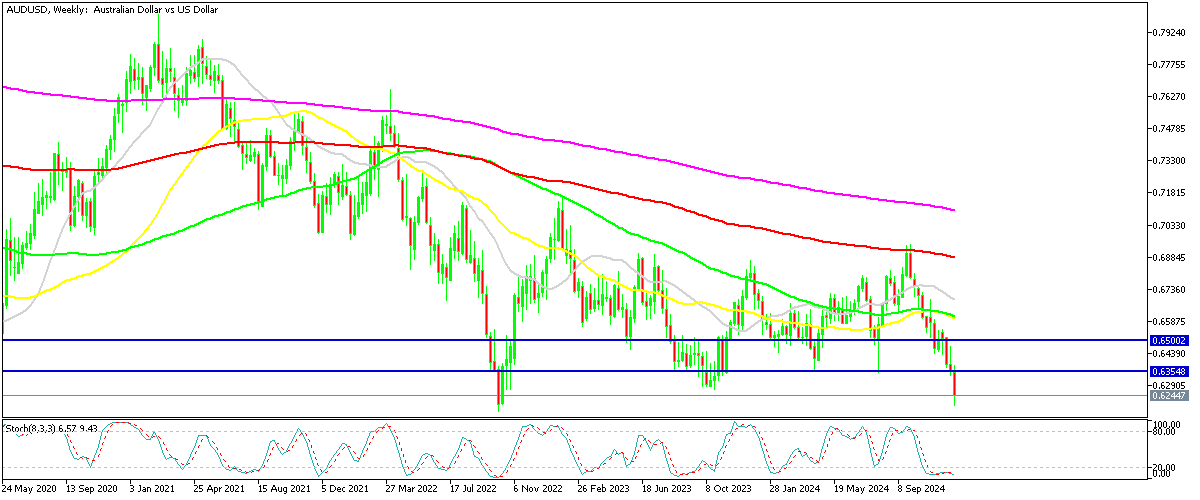

AUDUSD to Head for 0.60 Once the 0.62 Level is Broken

The decline in AUDUSD extended to nearly 10 cents after the FED rate cut, but stopped at 0.62, however sellers will probably break that support level soon, sending the price toward 0.60.

The AUD/USD pair has been in a prolonged downtrend since early 2021, characterized by consistent lower highs. After reversing below 0.70 in late September, the pair has fallen sharply, losing 9.5 cents. The drop paused at the critical support zone around 0.62, but the recent break below 0.6270, a two-year low, underscores significant bearish momentum. This breach adds to the downside pressure and raises the likelihood of further declines, particularly as global monetary policy developments weigh on the pair.

Federal Reserve’s Hawkish Tone Adds to AUD/USD Pressure

Deutsche Bank highlighted a notable shift in the Federal Reserve’s messaging during its latest FOMC meeting. While the federal funds rate was reduced by 25 basis points to 4.25%-4.50%, the Fed adopted a more hawkish tone than expected.

- Inflation Outlook: The Fed revised its inflation forecast, projecting a return to the 2% target by 2027 and raising the 2025 median forecast to 2.5%. This was described as a “dramatic” adjustment, reflecting lingering price pressures.

- Forward Guidance: The language shifted to emphasize “the extent and timing” of potential adjustments, moving away from explicit signals of further cuts. This suggests that January’s expected pause could extend well into 2025.

- Labor Market: Fed Chair Powell described the labor market as stable but noted that current job growth rates are insufficient to maintain steady unemployment levels.

The Fed’s hawkish stance supports expectations that the federal funds rate will remain above 4% through next year, with no further cuts anticipated.

Australian Economy Faces Headwinds

Australia’s domestic economic data has shown some recent strength, but the broader outlook remains bearish. The Reserve Bank of Australia (RBA) has signaled a dovish shift, leaving interest rates unchanged in its last meeting.

- RBA Guidance: The RBA expressed increased confidence in its projections for falling inflation, fueling market expectations of a February rate cut, now seen as having a 70% probability.

- Sustainability of Growth: While some indicators suggest resilience, the overall trend points to weakening momentum in the coming months, further weighing on the Australian dollar

Technical Outlook for AUD/USD

The combination of the Federal Reserve’s hawkish policy, weaker Australian fundamentals, and the RBA’s dovish tone suggests the AUD/USD pair will remain under pressure. The breach of key support at 0.6270 opens the door for further declines, with the 0.62 level being a critical point to monitor. Without significant changes in monetary or economic conditions, the bearish trend is likely to persist in the near term.