The CAD Falls 1 Cent As Predicted As Soft CPI Suggests More BOC Rate Cuts

USD/CAD has surged 1 cent higher, climbing above 1.23 today, after another soft CPI inflation reading from Canada.

USD/CAD has surged 1 cent higher, climbing above 1.23 today, after another soft CPI inflation reading from Canada, which keeps the pressure on for the Bank of Canada to continue cutting interest rates.

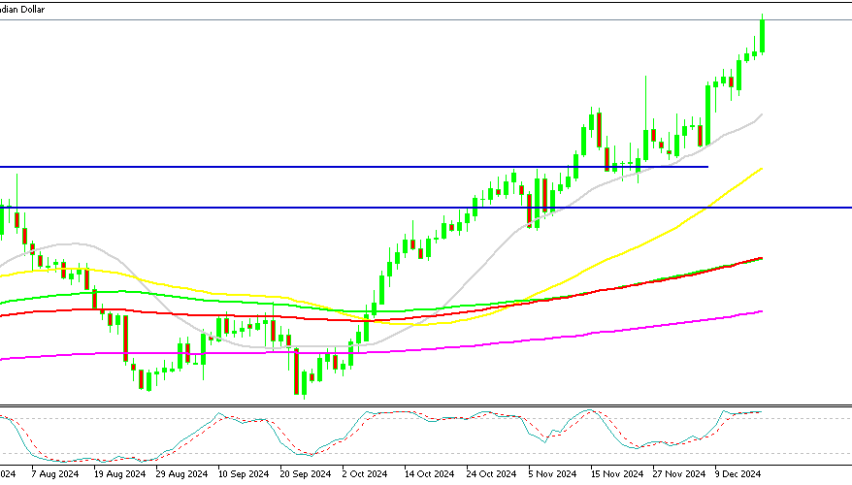

USD/CAD has climbed nearly 10 cents since late September, breaking above 1.43 today as Canadian inflation came in weaker than anticipated. The 20-day Simple Moving Average (SMA) on the daily chart continues to act as a solid technical support, helping to lift the pair’s lows. This support is bolstered by the Bank of Canada’s dovish stance, marked by two consecutive 50 basis point rate cuts, with expectations now leaning toward another cut following today’s soft CPI inflation data.

Yesterday, USD/CAD surged to 1.4270 but lost momentum, dipping below last week’s high of 1.4240 and finding support near 1.4220 before bouncing back. Today, renewed buying pressure and moderate inflation data have propelled the pair back above 1.43, with buyers firmly in control.

Canada CPI Inflation Report for November

Headline and Core Inflation:

- CPI MoM: 0.0% (vs. 0.1% expected, prior 0.4%).

- Core CPI MoM: 0.1% (vs. 0.4% prior).

- CPI YoY: 1.9% (vs. 2.0% expected, prior 2.0%).

Key CPI Measures:

- CPI Median: 2.6% (vs. 2.4% expected, prior revised to 2.6%).

- CPI Trim: 2.7% (vs. 2.5% expected, prior revised to 2.7%).

- CPI Common: 2.0% (vs. 2.2% prior).

- BOC Core YoY: 1.6% (vs. 1.7% prior).

- BOC Core MoM: -0.1% (vs. 0.4% prior).

Black Friday Impact

- Household Operations, Furnishings, and Equipment: Declined 0.9% MoM.

- Key Drivers:

- Cellular services: -6.1%.

- Furniture: -2.1%.

- Key Drivers:

- Clothing and Footwear: Declined 0.8% MoM.

- Key Drivers:

- Women’s clothing: -0.8%.

- Children’s clothing: -4.9% (largest monthly drop for November).

- Key Drivers:

Shelter Costs:

- Shelter Component: Increased 4.6% YoY (slower than October’s 4.8%).

- Rent Prices: Accelerated to +7.7% YoY (from +7.3% in October).

- Regional Increases:

- Ontario: +7.4%.

- Manitoba: +7.9%.

- Nova Scotia: +6.4%.

- Regional Increases:

- Mortgage Interest Costs: Rose +13.2% YoY (slower than October’s +14.7%).

- Main Contributors: Rent and mortgage interest were key drivers of the 12-month CPI increase.

- Rent Prices: Accelerated to +7.7% YoY (from +7.3% in October).

Gasoline Prices:

- Gasoline Prices YoY: Fell -0.5% (smaller decline than October’s -4.0%).

- Base-Year Effect: Prices fell 3.5% MoM in November 2023, influencing the YoY comparison.

The year-over-year CPI came in at 1.9%, slightly below the expected 2.0%. CIBC highlighted notable deflation in specific categories, including clothing (-3.8% YoY) and furniture (-2.2% YoY). They noted that the decline in apparel prices is “particularly unusual,” potentially reflecting weak Canadian consumer spending.

This aligns with expectations for Canadian retail sales data due later this week. Steeper-than-usual discounts on items such as furniture and clothing point to ongoing softness in domestic demand, reinforcing the likelihood of further interest rate cuts from the Bank of Canada in the New Year. The Bank of Canada faces added complexity in the coming months. A temporary two-month VAT holiday on various items, which started this week, is expected to sharply lower CPI figures before causing a significant rebound in February when the measure expires.

Meanwhile, declining oil prices and weaker equities—both typical drivers of Canadian dollar weakness—have supported USD/CAD , which jumped up to 1.4323. The pair surpassed 1.4300 for the first time since March 2020. On the long-term monthly chart, key resistance levels, including the 2015 and pandemic highs near 1.4680, are drawing closer.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account