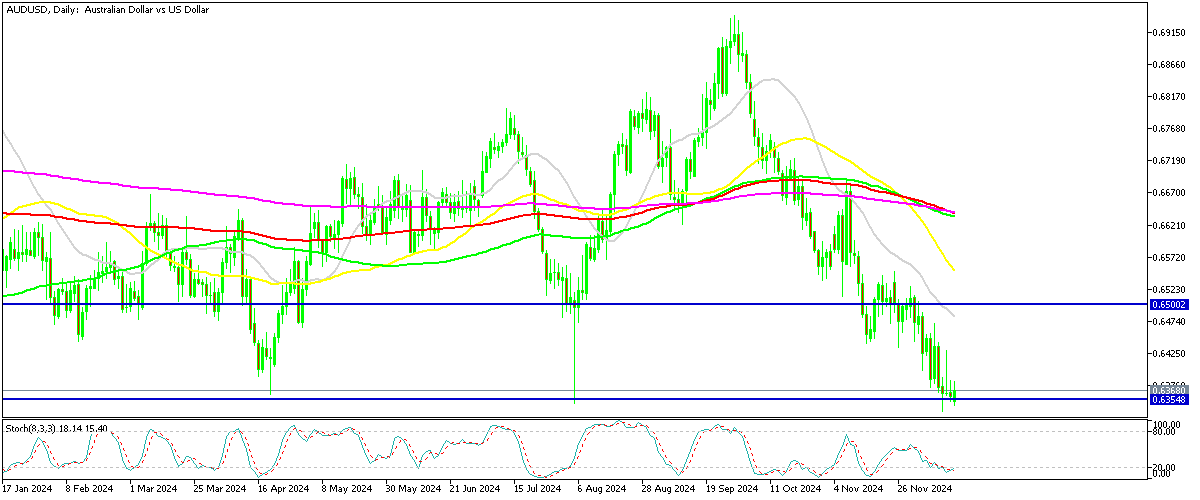

2024 Low Still Holds in AUDUSD at 0.6350 Ahead of the FOMC

AUDUSD has shed 6 cents since early October, however the support zone around 0.6350 which is the low for this year is still holding and yesterday we saw a small bounce, which doesn’t seem convincing nonetheless.

AUD/USD ended last week around 0.6360, struggling near one-year lows after failing to reclaim the 0.65 level earlier in the week. The pair experienced heightened volatility, driven primarily by the Reserve Bank of Australia’s dovish stance. Despite leaving interest rates unchanged, the RBA signaled increasing confidence in its projections of falling inflation, amplifying market expectations of a potential February rate cut, now seen as a 65% likelihood.

AUD/USD Chart Daily – The Support Unlikely to Hold

This policy tilt, combined with disappointing third-quarter GDP data from Australia, intensified selling pressure on the Australian dollar. Although the price dipped below the key 0.6350 support level to a low of 0.6336, sellers were unable to maintain the break, leading to a slight rebound by the end of the week.

Chinese Economic Conditions Having A Negative Impact on the Aussie

External factors, particularly the economic conditions in China, added to the AUD’s weakness. China’s retail sales report missed expectations, showing a slowdown from the previous month, highlighting consumer struggles. Meanwhile, the PBOC’s latest stimulus measures failed to boost market sentiment, as they were more focused on supporting businesses rather than addressing the challenges faced by domestic consumers.

The broader outlook for the Australian dollar remains uncertain, with its direction heavily influenced by a combination of domestic economic resilience and external pressures from China’s sluggish recovery. While strong employment data in Australia offers some support, persistent concerns about global growth, particularly related to China, continue to weigh on the currency.

Australian Westpac Consumer Sentiment for November for December 2024

- Consumer Sentiment Index MoM dropped to 92.8 points.

- November Consumer Sentiment Index was 5.3%.

- YoY Consumer Sentiment Index increased by 13%.

ANZ-Roy Morgan Consumer Confidence for the Week

- Consumer Confidence fell to 83.9 points, marking a 9-week low.

- Declined 1.6 points from the previous week’s 85.5 points.

- ANZ Commentary:

- Despite the RBA signaling comfort with the inflation outlook post-December meeting, confidence declined.

- Drop driven primarily by a 7.9-point decrease in the “time to buy a major household item” metric.