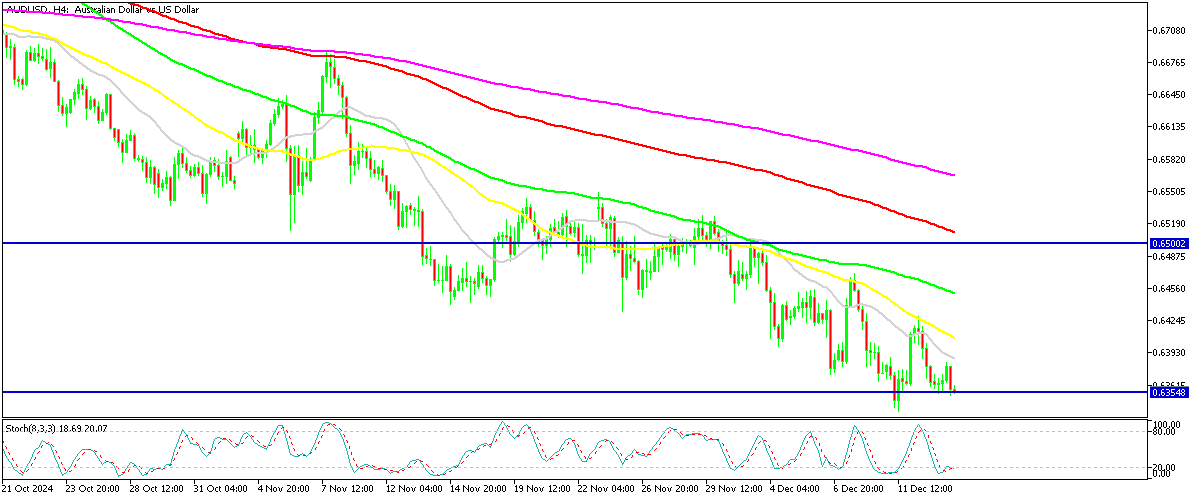

AUDUSD Closes at Support on China Stimulus Disappointment

AUDUSD slipped below 0.6350 which has been the low for this year, but bounced back up, however, sellers returned and the price to the support, which suggests that we will see a break next week as markets feel disappointed by China’s promises again.

RBA’s Dovish Stance and AUD/USD Pressure

The Reserve Bank of Australia (RBA) maintained interest rates at its latest meeting but signaled a dovish outlook, encouraging sellers to push the Australian dollar (AUD/USD) lower. Following Australia’s unemployment data, the currency briefly dropped below the 2024 support level of 0.6350, hitting 0.6336 before rebounding nearly 1 cent.

Australian Labor Market Resilience

November’s labor market data highlighted robust employment growth, with a notable rise in full-time jobs driving the unemployment rate down to a historically low 3.9%, significantly better than expected.

- Key Trends:

- Transition from part-time to full-time roles, indicated by a drop in part-time jobs.

- A marginal decline in the participation rate.

Despite these positives, broader market sentiment remains fragile, especially as global growth proxies react to uncertainty in China.

China’s Economic Impact

The Australian dollar faced renewed selling pressure on Friday as disappointment over China’s lack of a significant stimulus weighed on markets.

- Market Expectations:

- Investors hoped for targeted consumer support and real estate aid but were met with delays.

- China’s major indices and related proxies dropped 2%, reflecting market frustration.

- Stimulus Outlook:

- Rate cuts are anticipated in China, which could provide limited support.

- However, uncertainty continues to affect global growth projections.

Broader Implications for the AUD

The AUD initially tried to recover from yearly lows early in the week, but the combination of the RBA’s dovish stance and China’s lack of decisive action erased these gains. The currency remains precariously near its 2024 low.

Global Growth and Commodities Outlook

China has officially set a target for growth near 5% in 2024, but risks such as a potential US trade war could hinder this goal.

- Commodity Prices:

- Further declines in commodity prices could follow, putting additional pressure on economies reliant on exports.

- Policy Implications:

- Falling commodity prices may create opportunities for central banks to adopt more accommodative monetary policies.

The Australian dollar’s trajectory remains tied to the interplay between domestic economic resilience and external pressures from China. While robust employment offers a silver lining, market uncertainty around global growth, particularly China’s economic path, continues to weigh heavily. A challenging year lies ahead for the AUD and global growth.