USDJPY Lower After Softer US ADP Jobs and ISM Services

USDJPY surged 2.5 cents higher in recent sessions, but has retreated 1 cent lower as the USD declined after the soft ISM services and ADP employment figures, however it is holding above 150.

After a strong two-month rally that added over 17 cents to its value, the USD/JPY pair has faced increased bearish pressure over the past two weeks. The decline intensified following the declaration of martial law in South Korea, causing the pair to drop sharply below the 150 level, shedding 1.5 cents as investors sought safety. However, the pair managed a recovery, climbing 250 pips higher and briefly reclaiming the 151 level after initially breaching 149.

USD/JPY Chart H1 – The 100 SMA Holding As Support at 150

Subsequently, after a retracement of roughly one cent, USD/JPY dipped back toward the 150 mark. Despite a series of favorable US reports, today’s economic data offered little support. Nonetheless, the 100 SMA (green) has provided strong support around the 150 level, prompting a decision to issue a buy signal on the pair, banking on technical resilience at this key threshold.

US November ISM Services Report: Key Data and Analysis![ISM services d]()

- Headline ISM Services Index:

- Came in at 52.1, significantly below the expected 55.5 and prior month’s 56.0.

- Indicates slower expansion in the services sector and marks the weakest reading since September 2023.

Key Components Breakdown:

- Employment:

- Fell to 51.5 from 53.0, indicating slower job growth in the services sector.

- New Orders:

- Declined to 53.7 from 57.4, reflecting weaker demand growth.

- Prices Paid:

- Edged slightly higher to 58.2 from 58.1, signaling persistent inflationary pressures in input costs.

- Supplier Deliveries:

- Dropped sharply to 49.5 from 56.4, suggesting faster delivery times and easing supply chain pressures.

- Inventories:

- Plunged to 45.9 from 57.2, indicating a significant inventory reduction.

- Backlog of Orders:

- Eased to 47.1 from 47.7, pointing to reduced pressure from unfulfilled demand.

- New Export Orders:

- Declined to 49.6 from 51.7, signaling contraction in international demand.

- Imports:

- Rose to 53.8 from 50.2, suggesting stronger demand for imported goods.

- Inventory Sentiment:

- Increased to 54.6 from 53.0, implying growing confidence among businesses about inventory levels.

The sharper-than-expected decline in the ISM Services Index reflects a cooling in the US services sector, with demand and employment both moderating. The drop in supplier delivery times and inventory levels points to easing supply chain disruptions, but the uptick in prices paid highlights lingering inflationary pressures. The weakness in export orders and backlog of orders further dampens the outlook, raising concerns about external demand and future activity.

The data suggests a mixed picture for the US economy, with growth momentum in services slowing more than anticipated. While easing supply chain pressures are a positive sign, persistent price pressures and weakening demand could weigh on the sector’s outlook. Markets may interpret this as a sign of a broader economic slowdown, which is what sent the USD 50 pips lower across the board, potentially influencing monetary policy expectations. Current Fed cut odds are up to 75% from 70% for a 25 bps rate cut this month.

Comments in the report

- “Federal Reserve interest rate cuts have not had the desired effect on mortgage rates yet. With election results mostly determined, expansion of residential construction is anticipated, but the unknown effect of tariffs clouds the future.” [Construction]

- “All operations are normal at the moment. Nothing local or national that is having any major effect on our operations.” [Educational Services]

- “Higher level of activity is driving the need for additional resources.” [Finance & Insurance]

- “We have concern after the presidential election that tariffs will affect prices for electronics and components in 2025.” [Information]

- “Domestic lead times still seem very long. We are having to go to China for many electrical equipment requirements. Even after tariffs, the price is half, and so are the lead times.” [Management of Companies & Support Services]

- “Election results and the potential tariff changes would impact inventory and lead to higher prices in the hospital supply chain. What we saw during COVID-19 with startup U.S. production is a warning sign again.” [Professional, Scientific & Technical Services]

- “Construction materials are shorted or hard to get due to increased construction projects in the area and (in the) U.S. Sometimes projects are delayed due to this.” [Public Administration]

- “We finished a solid quarter and are planning on a similar holiday period. Not breaking any records, but positive.” [Retail Trade]

- “Still waiting to see how presidential cabinet picks shake out, if they are confirmed and how they will affect our operations going forward. Holding capital projects now until the cabinet is complete and we know how federal funds will be dispersed going forward.” [Transportation & Warehousing]

- “Even though we are reducing our spending and our employment levels, we have a positive outlook for 2025 performance with expected reinvestment of funds.” [Utilities]

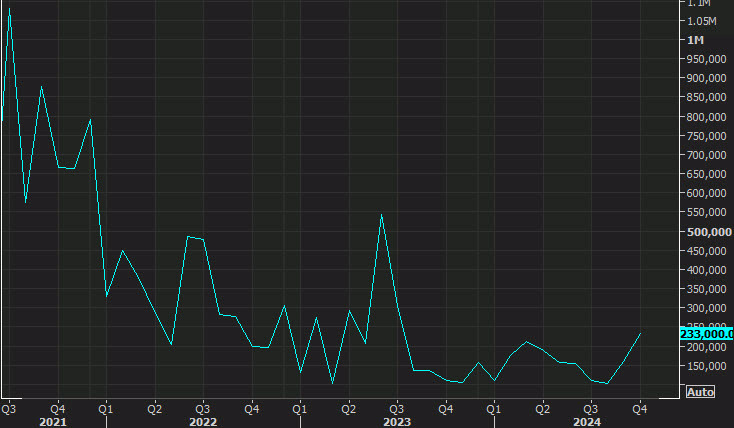

US November ADP Employment Report: Key Highlights and Analysis![ADP employment]()

- Headline Employment:

- Added 146K jobs, slightly below the expected 150K.

- Previous month revised down from +233K to +184K, reflecting a softer labor market trend.

Sector Breakdown:

- Services Sector:

- Gained +140K jobs, a significant drop from +211K in the prior month.

- Continues to be the primary driver of job growth, though at a slower pace.

- Goods-Producing Sector:

- Added a modest +6K jobs, down sharply from +22K previously

- Reflects weaker hiring in manufacturing and construction.

Pay Growth Data:

- Job Stayers:

- Annual pay growth rose to 4.8%, up from 4.6% in the previous month.

- Indicates steady wage inflation for employees remaining in their roles.

- Job Changers:

- Pay gains jumped to 7.2%, from 6.2%, highlighting stronger wage bargaining power for those switching jobs.

“While overall growth for the month was healthy, industry performance was mixed. Manufacturing was the weakest we’ve seen since spring. Financial services and leisure and hospitality were also soft,” said Nela Richardson, chief economist at ADP.

The market hasn’t done much with this, in part because it was in-line and in part because this survey doesn’t have a good track record of predicting non-farm payrolls. The consensus for Friday is +200K following the +12K reading in October.