AUDUSD Tumbles After Weak Australian Q3 GDP

AUDUSD has been bearish since October, but it has been consolidating around the 0.65 level after breaking it, awaiting the Q3 GDP report from Australia, which showed a slowdown.

Despite hawkish comments from RBA Governor Michele Bullock and better-than-expected retail sales data released on Monday, the AUD/USD pair has remained in a consolidation phase near the 0.65 level since mid-November. However, the pair continues to show a pattern of lower highs. Technical indicators, such as moving averages on the H4 chart, are providing resistance, maintaining downward pressure on the currency pair.

This technical setup implies that any resurgence of USD buying interest could trigger additional bearish momentum. Besides that, today’s GDP report was soft, which underscores ongoing economic challenges, particularly weak household consumption, while government expenditure remains the backbone of recent growth.

AUD/USD Chart – The Highs Keep Getting Lower

Governor Bullock reiterated recently that rate cuts are not on the horizon, underscoring the Reserve Bank of Australia’s (RBA) cautious approach to monetary policy. October’s retail sales figures increased by 0.6%, surpassing the anticipated 0.4% gain. This reflects stronger-than-expected consumer spending and suggests resilience in domestic demand.

However, the Australian dollar has struggled to capitalize on these supportive factors, as the US dollar’s persistent strength over the past two months continues to weigh on the AUD. This dynamic underscores the dominant role of external factors, particularly the robust USD, in shaping the AUD/USD ’s trajectory, limiting the impact of positive domestic developments.

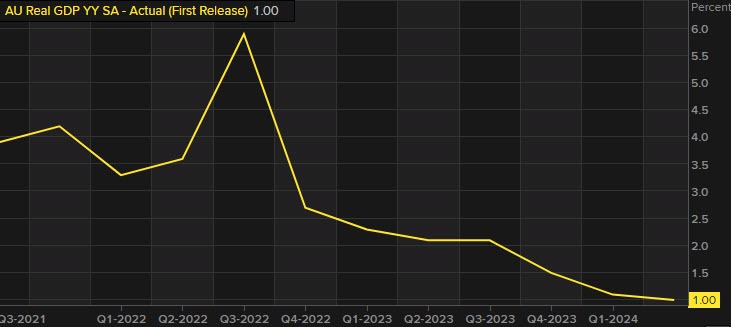

Australian GDP Report for Q3![Australia GDP]()

- Q3 GDP Growth: Australia’s GDP grew by 0.3% in Q3, falling short of the 0.4% estimate, but slightly improving from Q2’s 0.2% growth.

- Year-on-Year Growth: Real GDP YoY (seasonally adjusted) came in at 0.8%, below the 1.1% forecast and down from the prior quarter’s 1.0%.

- Final Consumption: Increased by 0.4%, compared to 0.3% in the previous quarter.

- Gross Fixed Capital Expenditures: Showed a strong rebound, rising by 1.5% after a contraction of -0.1% in Q2.

- GDP Chain Price Index: Declined by -0.2%, an improvement over the larger drop of -0.9% in the previous quarter.

Household Spending Contribution:

- Household spending, which makes up half of GDP, stagnated during the quarter, contributing 0% to growth.

- Government spending stepped in as a key driver, contributing 0.6% to GDP growth, offsetting weak private sector contributions.

The AUDUSD has moved lower on the news with the price testing the low of a swing area of 0.6440. Moving below should see more downside momentum with the low prices from last week and three weeks ago at 0.6430 and 0.64 as the next downside targets.