GBPUSD 1 Cent Lower As Buyers Fail, UK BRC

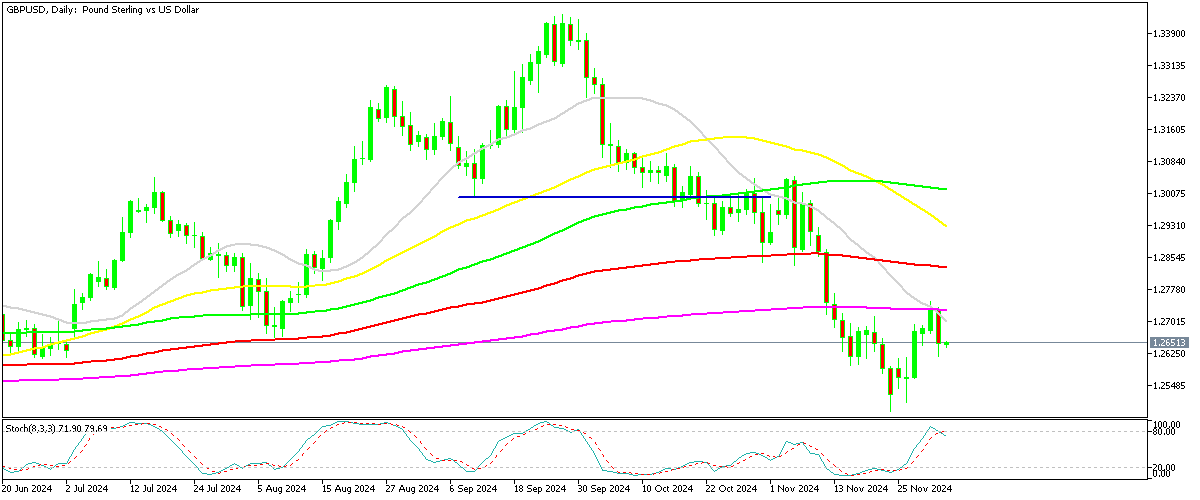

GBPUSD reversed lower yesterday falling around 1 cent lower after failing at the 200 daily SMA, with the chart setup pointing to further declines in the coming days, as USD buyers return after the Thanksgiving holiday.

Over the past two months, GBP/USD experienced a significant decline of nearly 9.5 cents, briefly dipping below the 1.25 mark. This drop coincided with the strengthening of the USD, fueled by Donald Trump’s election as US president, which ignited the so-called “Trump trade.” This market shift has proven bearish for risk-sensitive currencies like the GBP, while benefiting the USD and equities.

GBP/USD Chart Daily – Buyers Failed at the 200 SMA

However, last week brought a notable reversal as the pair rebounded by 2.5 cents to reach 1.2750. This recovery was aided by limited market activity during the US Thanksgiving holiday, which created a temporary boost for GBP/USD . Despite this rebound, risk sentiment weakened yesterday, pushing the pair back down near 1.26 after buyers failed to sustain the price above the 200-day SMA (purple line).

Although there was a brief breakout above this level, bearish momentum resumed, leading to a drop to 1.2617 with the return of US traders after the holiday break. This movement aligns with market expectations that the Bank of England will continue reducing interest rates amid softening UK inflation. Additionally, the UK BRC Shop Price Index was released, offering an early indicator of official retail sales data expected later this month, which could provide further insights into the economic outlook and influence GBP/USD direction.

UK BRC Retail Sales Monitor for November

- November Sales Decline: Retail sales, as reported by the British Retail Consortium (BRC), fell by 3.4% year-over-year, marking a sharp decline compared to expectations of a modest 0.7% growth.

- October Sales Comparison: In contrast, October’s y/y retail sales had shown slight growth at 0.3%, highlighting a significant worsening in November.

- Factors Behind the Drop:

- Reduced consumer spending amid higher living costs, with inflationary pressures weighing on household budgets.

- Early holiday discounts may have failed to attract the same level of consumer activity seen in previous years.

- Persistent weakness in discretionary spending categories, such as apparel and electronics.

GBP/USD Live Chart

Sidebar rates

Add 3442

Related Posts

Add 3440

XM

Best Forex Brokers