CHF to USD Rate Faces the 200 SMA on the Way to 0.90, As Swiss Inflation Falls

The CHF to USD rate turned volatile again yesterday, bouncing 1 cent higher but stopped at the 200 daily SMA, however, the USD/CHF pair will likely reach 0.90 soon as inflation turns negative in Switzerland.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Over the past two months, USD/CHF has shown a notable recovery, climbing approximately 5.5 cents before pulling back by 1.5 cents from its November peak. Yesterday, the pair found support around the 0.88 level, coinciding with dovish sentiment from the Swiss National Bank (SNB). Weekend remarks by SNB Chairman Martin Schlegel highlighted the prolonged challenges in Switzerland’s industrial sector, with activity remaining significantly weaker than anticipated.

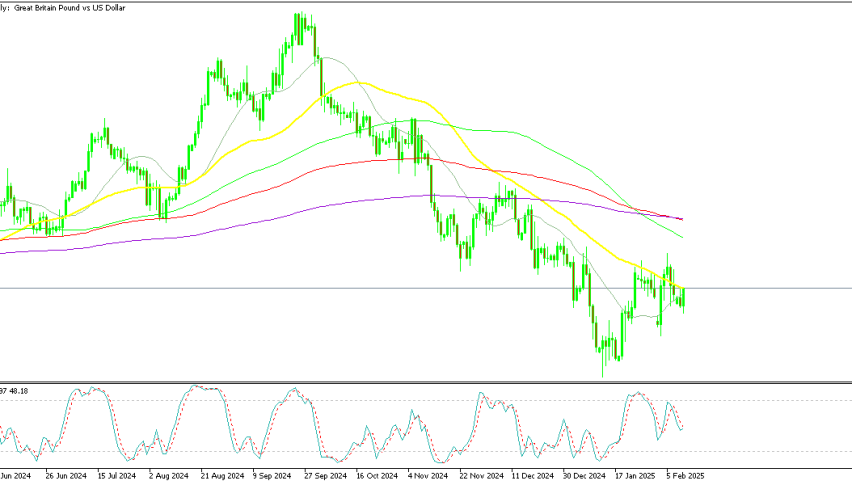

USD/CHF Chart Weekly – The 100 SMA Holds As Support

Adding to this, Swiss inflation remains subdued, as confirmed by November’s negative inflation data released today. This economic backdrop is likely to support further upward movement in the USD/CHF pair. Meanwhile, challenges in the Eurozone have also played a role in driving this trend. A decline in services activity, as reflected in November’s PMI data, underscores the region’s economic struggles. These issues heighten the likelihood of a Eurozone recession, potentially pressuring the European Central Bank (ECB) to implement rapid interest rate cuts, further influencing Swiss economic conditions.

Switzerland CPI Inflation Report for November

- Headline Inflation (CPI):

- November’s Consumer Price Index (CPI) increased by 0.7% year-over-year, slightly below the expected 0.8%.

- This represents an uptick from October’s CPI reading of +0.6%, signaling a modest rise in price pressures.

- Core CPI:

- Core CPI, which excludes volatile items like food and energy, rose by 0.9% year-over-year, up from +0.8% in October.

- The increase in core inflation highlights persistent underlying price pressures despite overall moderate headline inflation.

- Key Observations:

- Inflation remains well below the Swiss National Bank’s (SNB) target range, reinforcing Switzerland’s status as a low-inflation economy.

- The modest inflation growth could reflect subdued consumer demand and strong deflationary forces in certain sectors.

Swiss inflation remains well below the 2% target, but the Swiss National Bank (SNB) is likely to feel compelled to lower interest rates later this month due to the franc’s continued strength, particularly against the euro. While the pressure from rising prices has eased, the SNB remains cautious, aiming to prevent inflation from falling too low and potentially creating additional economic challenges.