USDCHF Ready to Go Up After Finding Support at 0.88, As SBN’s Schlegel Confirms Weak EZ Manufacturing

USDCHF retreated 1.5 cents lower off November highs, but has formed a support zone around 0.88, while SNB is feeling dovish, as Schlegel’s remarks suggested over the weekend, which should help this pair resume the uptrend.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

After dipping below 0.84 in September, the USD/CHF pair has staged a robust recovery over the past two months, climbing by approximately 5.5 cents. This upward trend has been fueled largely by the Eurozone’s economic struggles, as evidenced by a November decline in services activity reflected in the PMI data. These challenges have heightened concerns about a potential Eurozone recession, which could negatively impact the Swiss economy and prompt the European Central Bank (ECB) to implement rapid rate cuts.

Adding to the bullish outlook, Swiss National Bank (SNB) Chairman Martin Schlegel recently acknowledged that the manufacturing sector has been mired in a prolonged recession, with activity significantly weaker than anticipated. This recognition, combined with a potential end to the recent USD pullback, could provide further upward momentum for USD/CHF .

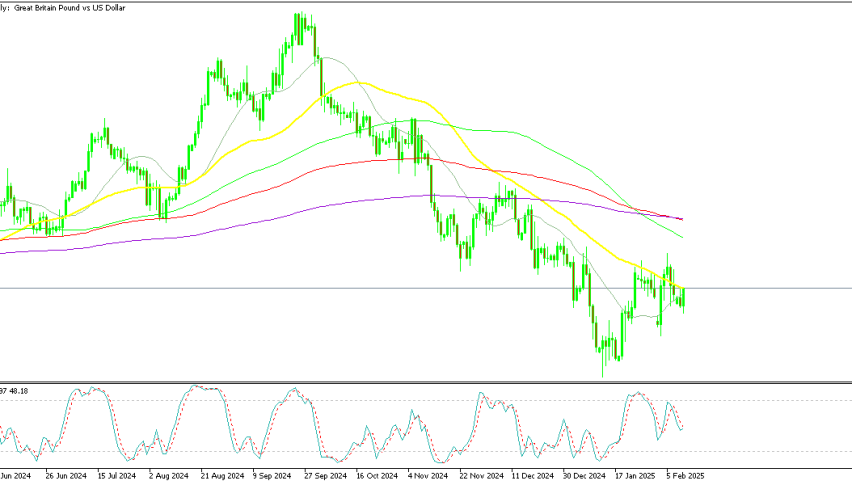

USD/CHF Chart Weekly – The 100 SMA Holds As Support

In November, USD/CHF reached a high of 0.8957 before retreating by 1.5 cents last week. However, the decline halted at the 100-day SMA (red) on the daily chart, which has consistently held as a support level. With the stochastic indicator showing oversold conditions, the retracement appears to be complete, setting the stage for a likely resumption of the bullish momentum.

Swiss National Bank (SNB) Chairman Martin Schlegel’s Remarks

Key Comments

- Swiss Industrial Sector Impact:

- Decline in demand is attributed to challenges in Germany’s industrial sector.

- Schlegel noted, “When Germany has a cold, Switzerland gets the flu,” highlighting the strong economic interdependence.

- Lower demand from Germany, Switzerland’s largest trading partner, is significantly affecting Swiss manufacturers.

- Upcoming SNB Rate Decision:

- Scheduled for less than two weeks from now at an event hosted by Germany’s Bundesbank.

Monetary Policy Overview

- Rate Cuts in 2024:

- The SNB has reduced its benchmark rate three times in 2024, currently at 1.0%.

- Market predictions for the next decision:

- 72% probability of a 25 bps rate cut.

- 28% probability of a 50 bps rate cut.

Inflation Trends

- Inflation has remained below the SNB’s target range of 0-2% for nearly 18 months.

- October annual inflation:

- Dropped to 0.6%, marking the lowest level in nearly three years.

The SNB faces mounting pressure to maintain accommodative monetary policy due to declining demand in key industries and subdued inflation. Economic ties to Germany further amplify the impact of external headwinds on Switzerland’s industrial sector.