Staying Short on NZD/USD As China Services Fall in Contraction

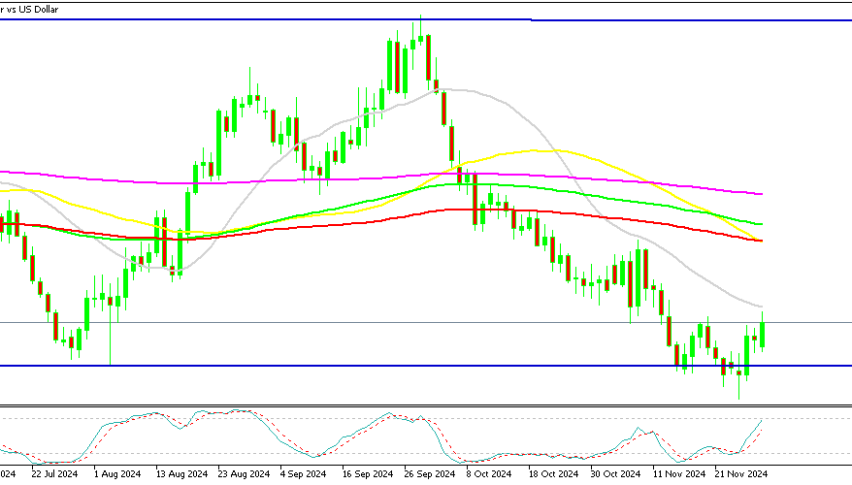

NZD/USD reversed more than 1 cent higher last week after the break of support at 0.5850, but buyers seem exhausted above 0.59, so we're...

NZD/USD reversed more than 1 cent higher last week after the break of support at 0.5850, but buyers seem exhausted above 0.59, so we’re staying short on this pair, considering that the economy in China remains weak, as Services PMI showed over the weekend.

The NZD/USD pair experienced a brief surge above 0.59 following yesterday’s 50 basis point rate cut by the Reserve Bank of New Zealand (RBNZ). However, the upward momentum stalled, and the pair remains locked in a broader bearish trend. Earlier this week, NZD/USD broke below the 0.5850 support level, triggering a rapid decline that tested the 0.58 level. This move set the stage for a potential retest of the 2022 low at 0.5740.

RBNZ 50 bps Rate Cut Couldn’t Stop the Retrace

The RBNZ’s decision to cut rates by 50 basis point was accompanied by Governor Adrian Orr’s comments, which suggested further rate reductions might be on the horizon. This dovish outlook, combined with weak economic data, continues to weigh heavily on the New Zealand dollar. While profit-taking on the USD and month-end flows related to Thanksgiving temporarily pushed the pair above 0.59, the rally appears limited.

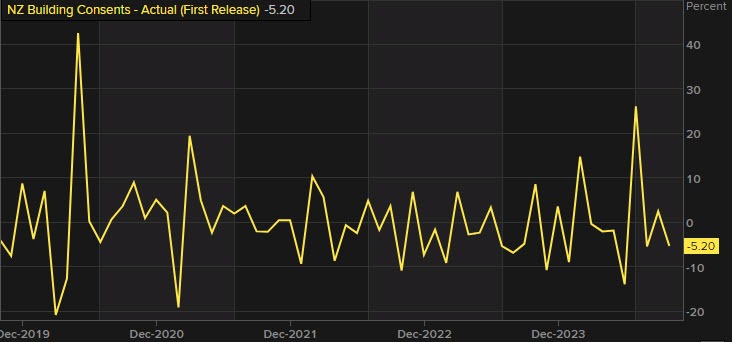

The NZD/USD pair has re-entered its familiar five-cent range, fluctuating between a low of 0.5740 and an upper boundary near 0.6370. Despite the recent bounce, the bearish trend dominates, with the 20 SMA poised to act as resistance, likely rejecting further advances. NZD buyers appear fatigued, suggesting limited upside potential in the near term, while Building Consent declinebymorethan 5% in New Zealand.

October 2024 New Zealand Building Consents![Building consents]()

Headline Figures

- October building consents: -5.2% (seasonally adjusted).

- Previous month revised to +2.4% (from +2.6%).

Key Facts and Trends

- Monthly Trends:

- New dwellings consented decreased by 5.2% in October, following a 2.4% increase in September.

- Annual Totals:

- 33,467 new dwellings consented in the year to October 2024, a 16% decline compared to the year to October 2023.

- Non-residential building consents: Total value at $9.3 billion, reflecting a 3.5% year-on-year decrease.

- Dwellings Per Capita:

- 6.3 new dwellings per 1,000 residents in the year ended October 2024, down from 7.6 per 1,000 in October 2023.

Observations

The data indicates a sustained slowdown in building activity, with residential construction showing significant year-on-year declines both in absolute numbers and relative to population growth. Non-residential activity also weakened, reflecting broader economic pressures in the sector.

On top of that, the Chinese services PMI report released over the weekend, showed that the activity stagnated last month, as the weekend data showed, which is bearish for the AUD and the NZD.

China Official Services and Manufacturing PMI Report for November

Manufacturing PMI:

- Rose to 50.3, exceeding expectations of 50.2 and improving from 50.1 in October.

- Marks the second consecutive month of expansion, signaling some recovery in the industrial sector.

- Gains may reflect seasonal demand improvements and earlier government measures taking effect.

Non-Manufacturing PMI:

- Fell slightly to 50.0 from 50.2 in October, hitting the threshold for stagnation.

- Suggests a cooling in services and construction activity, possibly tied to slowing consumer confidence and weaker real estate performance.

Composite PMI:

- Improved marginally to 50.8, indicating modest overall growth in the economy.

- Reflects strength in manufacturing, offset by stagnation in non-manufacturing sectors.

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account