CHF to USD Rate Falls to 0.88 on the Swiss GDP Report for Q2

CHF to USD rate continues to show volatility, with USD/CHF slipping below 0.88 after failing to reach o.90 last week.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Over the past two months, the USD/CHF exchange rate has staged a significant recovery, climbing nearly 5.5 cents from below 0.84 in early September. This upward momentum has been fueled by the Eurozone’s economic struggles, highlighted by a contraction in the Services PMI this month.

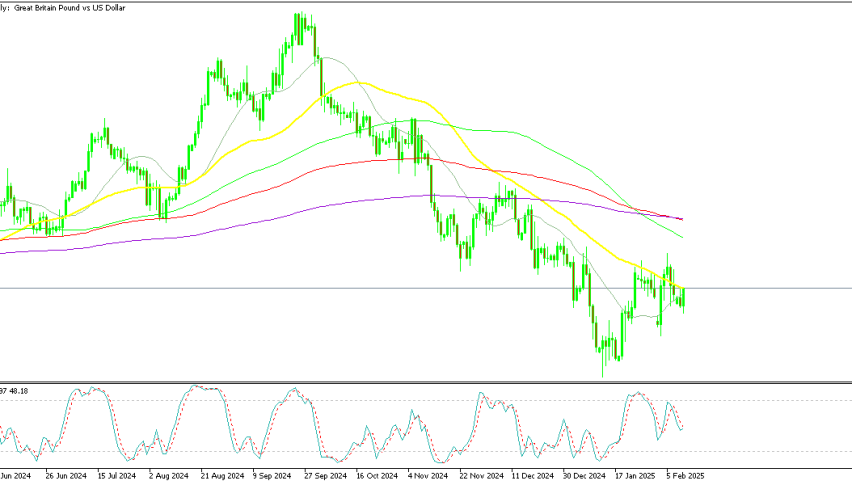

USD/CHF Chart Weekly – Rejected by the 100 SMA

Such weakness raises concerns about a potential Eurozone recession, which could negatively impact the Swiss economy and prompt the European Central Bank (ECB) to accelerate interest rate cuts. In contrast, the expansion of U.S. services activity has strengthened the USD/CHF , pushing it to its highest levels since July. However, the rally met resistance at the 100-week SMA (green), rejecting the pair and signaling a potential pause in its ascent.

Swiss Franc’s Outlook Amid Eurozone and Domestic Pressures

The Eurozone’s political and economic instability continues to cast a shadow over the Swiss economy, adding to the pressure on the Swiss franc. Market speculation has grown regarding the Swiss National Bank’s (SNB) inclination to lower interest rates further into negative territory if necessary. SNB President Schlegel reinforced this sentiment last week, stating the bank remains open to such measures if economic conditions require them. While the franc briefly dipped earlier in the week, it managed to recover, reflecting resilience despite broader challenges.

The USD/CHF pair has slipped slightly below 0.88 amid a broader retreat in the U.S. dollar, though the market continues to price in a 72% probability of a 25-basis-point rate cut in December. On the Swiss side, expectations of 70 basis points of easing by the end of 2025 add further complexity to the currency’s outlook. With mixed economic signals and potential monetary policy shifts, the CHF remains under close watch as markets assess the next moves by central banks.

Switzerland GDP Report for Q3 by SECO – 29 November 2024

- Quarterly GDP Growth:

- Q3 GDP grew by 0.4% q/q, matching expectations.

- Prior Q2 GDP was revised slightly lower from +0.7% to +0.6%.

Swiss Economic Context and Challenges

The Swiss economy managed moderate expansion in Q3 despite mounting global and regional challenges. However, the outlook for the final quarter of the year appears less optimistic due to several factors:

- Euro Area Slowdown:

- As Switzerland’s largest trading partner, the eurozone’s sluggish performance is likely to weigh heavily on Swiss economic activity.

- Contractions in European manufacturing and services sectors could spill over into Swiss exports and production.

- Domestic Resilience Tested:

- While Switzerland has shown resilience in past downturns, the cumulative pressure from weaker trade and tightening financial conditions is starting to emerge.

- Sectors tied to global demand, such as manufacturing and tourism, are particularly exposed.

Although Switzerland continues to perform better than many of its European counterparts, its close economic ties to the eurozone mean it is not immune to regional headwinds. The final quarter of 2024 may bring subdued growth or stagnation if external conditions fail to improve, especially as high inflation and geopolitical uncertainties persist globally.