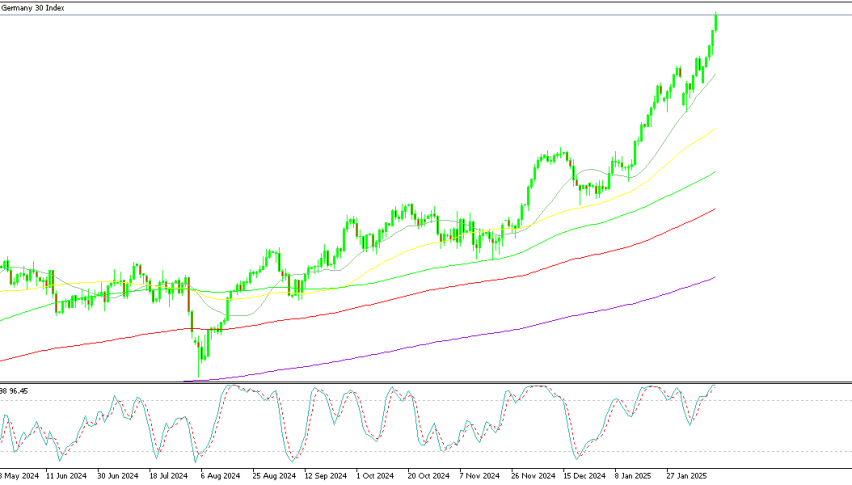

Trump Tariff Post Weighs on European Open

Major European indices open lower after Trump posted on social media a threat of more tariffs.

- Trump promises extra tariffs

- Major global indices fall

- FOMC minutes later on today

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

The DAX traded down 0.55% this morning, while the CAC and FTSE are both down 0.40%. In Asia the NIKKEI225 lost over 2% at one point.

The stock market is still assimilating Trump’s latest threat towards China, Mexico, and Canada. The president elect posted on his social media platform that in his first day at the white house he would impose higher tariffs.

The post stated 25% extra tariffs on goods from Mexico and Canada and an additional 10% on goods from China. One consideration some analysts are making is that the new threat is a sharp decline from the original 60% tariff’s touted during Trump’s campaign.

A lot depends on what actually happens after Trump takes office. Trump mentioned that he wants Mexico and Canada to do better on border control. There might be a political compromise that keeps those tariffs off the table.

For now, the market is contemplating just how much damage a tariff war would create to the global economy. The USA is Germany’s largest trading partner, since the decline from China for imports.

The DAX could be particularly affected by US tariffs that could also inflict the EU, as mentioned at the time by Trump.

FOMC Minutes

Later on today, we get the release of the FOMC meeting minutes. The market is expecting to see evidence that the Fed is committed to lowering rates at sufficient pace to keep the economy expanding.

Recent data for October inflation showed the YoY rate creeped back up to 2.6% from 2.4%. Whereas the PCE index, the Fed’s favorite inflation metric, has been steady for the past 3 months at 2.7%.

Data and the risk of Trump tariffs may cause the Fed to place monetary policy on hold. At least to see if inflation finally continues to fall and have a better understanding of how far Trump’s threats might go.

ECB Disconnect

On the other hand, the ECB is facing a completely different situation. EU inflation is declining, and forecasts are for the decline to continue. We also have a faltering economy, with Germany in contraction of the past 5 quarters.

The market used to consider the Fed monetary policy as leading that of the ECB. But we have seen this year how that correlation broke given the Eurozone’s situation.

I believe that even without a cut from the Fed in December the ECB is likely to continue its path in January to loosen monetary policy as it attempts to stimulate the economy.