Lido DAO (LDO): +39% Surge Amid DeFi Momentum and SEC Compliance Challenges

Lido DAO (LDO) token surged as the top gainer as it experienced a +39% jump within the past few days. This rise adds to its strong...

Lido DAO (LDO) token surged as the top gainer as it experienced a +39% jump within the past few days.

This rise adds to its strong weekly performance, with the token climbing from $1.079 to $$1.59 over the last six days. Lido DAO has shown promise, and this could be a good time to jump in and invest.

The consistent gains are due to growing investor interest and positive momentum in the decentralized finance (DeFi) space. During the last month, the price of LDO has risen by 0.65% which added a massive average of $0.01 to its present worth.

One reason for the rise of Lido DAO in the DeFi space is that Trump’s administration might push decentralized finance (DeFi) from a niche sector to the mainstream. Crypto advocates are anticipating favourable policy shifts that could benefit the industry.

Moreover, as Bitcoin’s price rises, it tends to drive activity across the broader DeFi sector. Bitcoin staking, particularly as the price nears $100,000, could attract more investors in the crypto sector.

Legal Battle Over Lido DAO’s Compliance with SEC Regulations Raises Concerns for DeFi Investors

Meanwhile, Andrew Samuels, an investor who bought 132 Lido (LDO) tokens in May 2023 and then sold them for a loss a few weeks later, filed a class action lawsuit against Lido in December of last year for violating US securities regulations.

He claimed that despite issuing securities tokens, the DAO failed to register with the Securities and Exchange Commission (SEC), which Chhabria’s ruling does not contest.

The controversy developed when Samuels also sued several venture capital firms, including a16z, Dragonfly (NASDAQ: DFLI), Robot Ventures, and Paradigm. He argued that as members of the Lido DAO general partnership, they were culpable for its misbehaviour.

The investment firms tried to dismiss the litigation and alleged that their investment did not establish a partnership under California law and, hence, cannot be held accountable for the putative partnership’s conduct.

Venture Capital Firms Face Accountability for Lido DAO’s Actions

Judge Vince Chhabria of the United States District Court for the Northern District of California ordered that institutional investors in Lido DAO could be held liable for the conduct of the decentralized governing body that powers the liquid staking protocol on the Ethereum blockchain.

Investors in DeFi—and crypto dudes who appreciate the insulation from accountability given by DAOs—reacted quickly and worriedly to Judge Chhabria’s verdict. They feared that they might be held culpable for the acts of decentralized initiatives in which they were taking part.

Despite that participants in DAOs claim that they are networks of developers and contributors who cannot be held accountable for how their projects are used.

Legal Implications for Investors in Decentralized Finance (DeFi)

However, Chhabria proceeded the prosecution against Lido DAO and the investors.This case raises various new and critical considerations concerning people to protect themselves from responsibility in the cryptocurrency realm, Chhabria stated in an order on Monday.

Nonetheless, with Trump winning the presidency and the Republicans controlling both houses of Congress, lawmakers will likely give crypto firms and projects other friendlier avenues for registration with regulators.

Lido DAO (LDO/USD) Technical Analysis

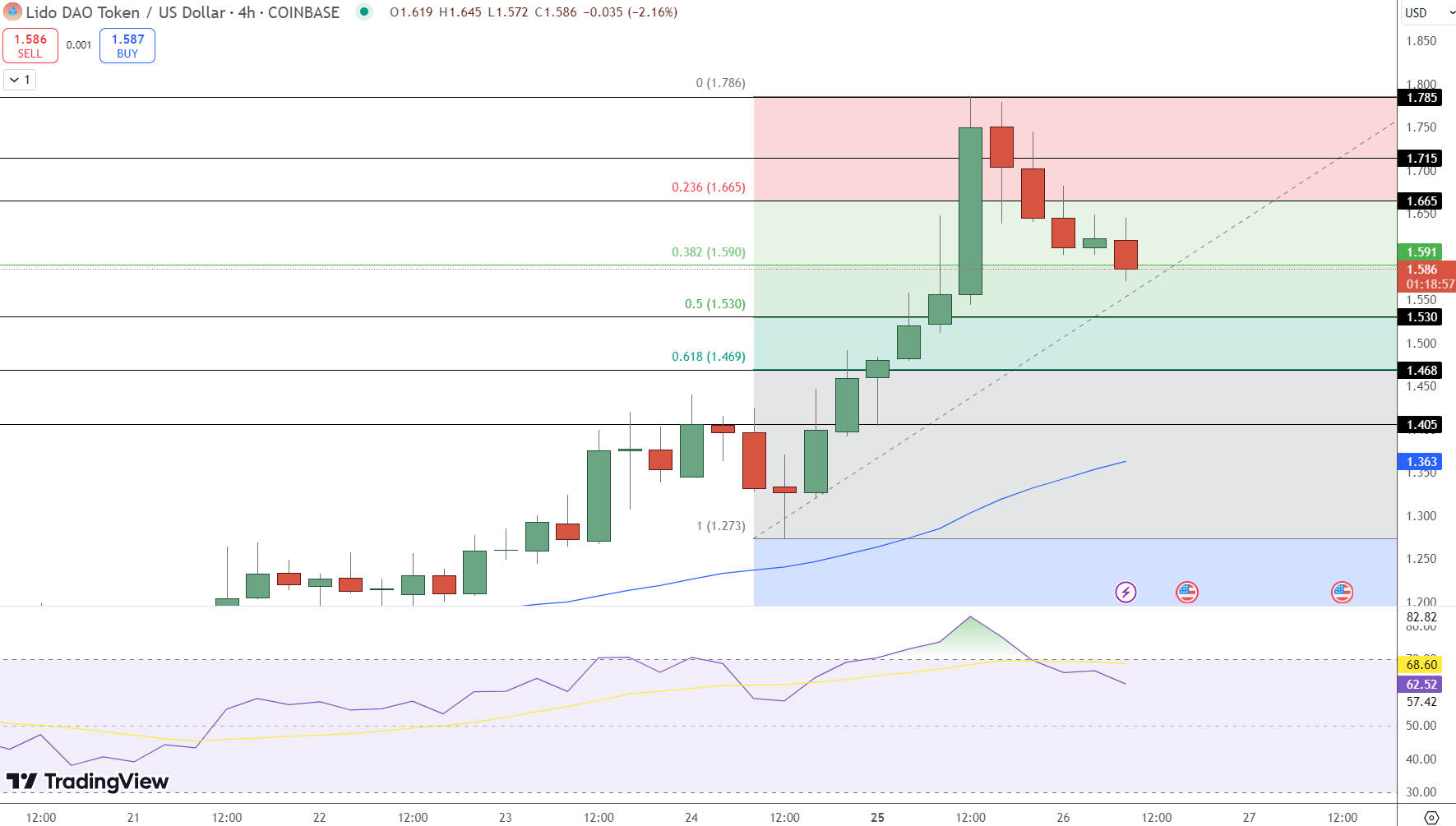

Lido DAO (LDO/USD) is trading at $1.586, down 2.16% for the session, after retreating from the key resistance at $1.715. The price is consolidating near the 38.2% Fibonacci retracement level at $1.590, suggesting potential for either a continuation or reversal. Immediate support lies at the 50% retracement level of $1.530, with deeper support at $1.468. On the upside, resistance is noted at $1.665 and $1.715.

The RSI at 62.52 indicates that bullish momentum is slowing but remains above neutral territory. Meanwhile, the 50-day EMA at $1.363 provides long-term support, keeping the broader trend intact. A break above $1.665 could revive the bullish momentum, while a drop below $1.530 risks further declines.

Key Points:

- Support Levels: $1.530, $1.468, $1.405.

- Resistance Levels: $1.665, $1.715, $1.785.

- Outlook: Consolidation above $1.530 suggests potential recovery or further correction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account