Gold Consolidates Above the $2.600 Support, Awaiting Further Global Developments

Gold tumbled $100 lower yesterday after peace talk in the Middle East, but it has been consolidating today, awaiting more news as both sides seem unconvinced and agitated, as the recent price action has shown.

Gold’s recent price movements highlight the influence of global geopolitical tensions, particularly the ongoing Middle East crisis and the conflict between Russia and Ukraine. Escalating violence, including intensified Russian military actions following Ukraine’s missile strikes, has driven increased demand for safe-haven assets. Last week, this pushed gold prices up by $200 to a peak of $2,790 before retreating by $235.

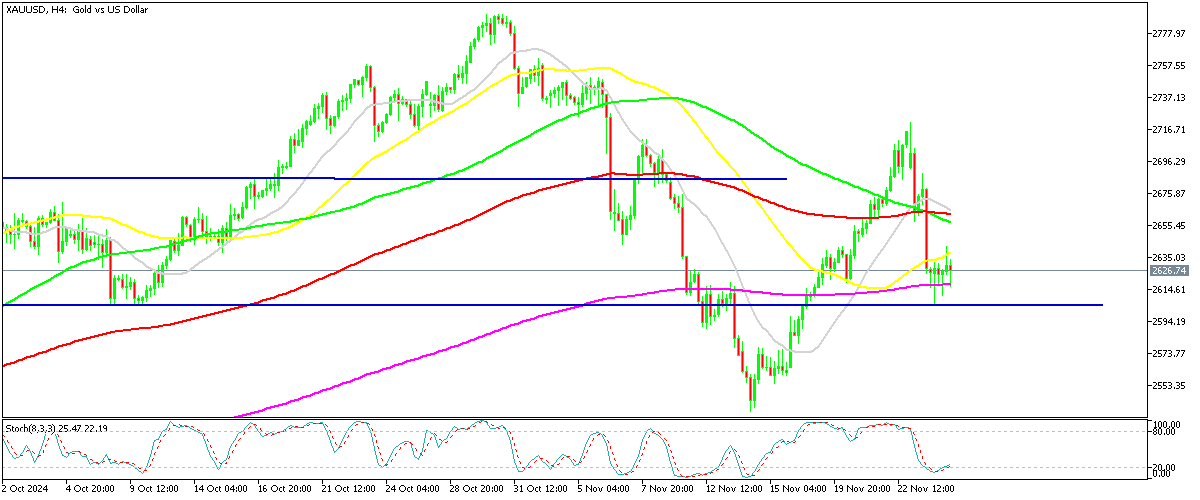

Gold Chart H4 – The 200 SMA Acting As Support

Yesterday, gold opened $25 lower and extended its losses, dropping over $100 after news of a truce between Israel and Lebanon. The ceasefire, brokered with mediation efforts from leaders like Biden and Macron, temporarily eased market fears and weakened gold’s appeal as a hedge.

However, uncertainty remains high. Donald Trump’s recent social media post about potential tariffs on imports from Canada, China, and Mexico, combined with strong US economic data, has led to some stabilization in gold prices, holding above the $2,600 level. While traders digest the lack of clarity surrounding Trump’s trade policies, they remain cautious, viewing gold as a hedge against volatility. Geopolitical risks and unexpected developments may continue to keep the metal in focus for investors navigating these turbulent times. Today’s consumer confidence confirmed that the US consumer is on an improving trend.

US November 2024 Consumer Confidence (Conference Board):

- Consumer confidence index: 111.7 (vs. 111.3 expected).

- Previous figure: 108.7, revised to 109.6.

- Sub-Indices:

- Present Situation Index: Increased to 140.9 (from 138.0 prior).

- Expectations Index: Rose to 92.3 (from 89.1 prior).

- Inflation Expectations:

- 12-month inflation expectations decreased to 4.9% (from 5.3% last month).

“In November, consumer confidence climbed to the top of the narrow range it has occupied over the past two years, according to Dana Peterson, Chief Economist at The Conference Board. The increase was largely fueled by more positive views of current conditions, particularly regarding the labor market. Optimism about future job prospects also surged, reaching its highest level in nearly three years compared to October.

However, this optimism did not extend uniformly across other areas. Expectations for future income saw a slight decline, and predictions about business conditions in the months ahead remained steady, showing no significant change.”