CAD to USD Rate Falls Below 1.41 After the 2 Cent Jump on Canada Tariffs

USDCAD jumped 2 cents last night after Trump's post on 25% tariffs on Canada, but has given back half the gains as markets digest the news.

USDCAD jumped 2 cents higher last night after Trump’s post on 25% tariffs on Canada, but has given back half the gains as markets digest the news.

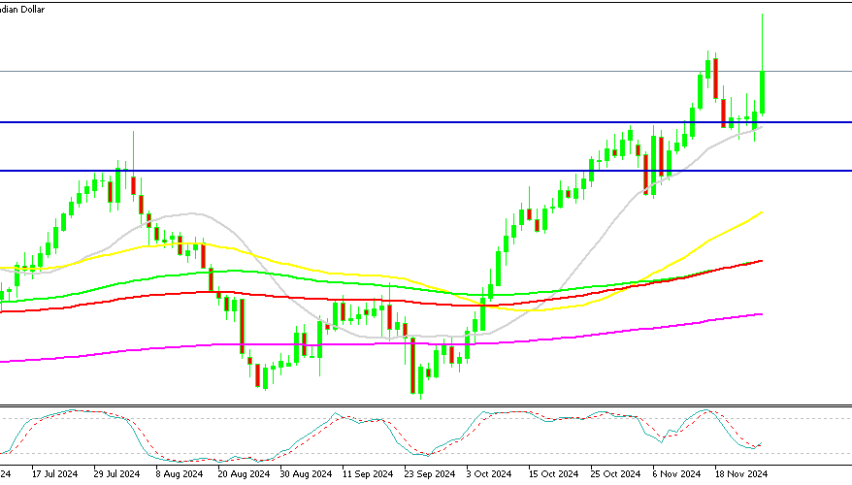

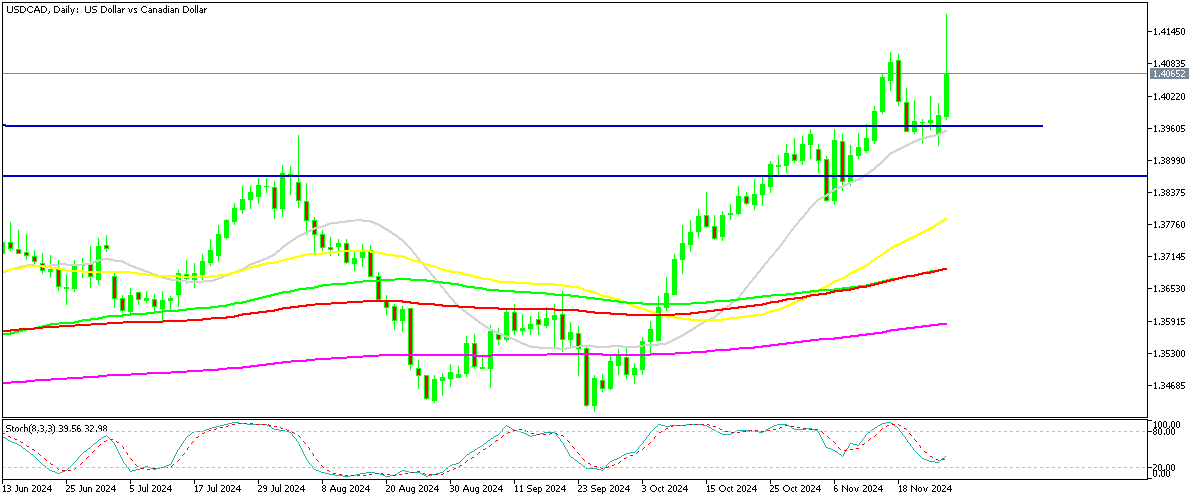

USD/CAD has been very bullish since the last week of September, surging around 7 cents and moving above 1.40 earlier this month, after getting another boost following Donald Trump’s victory in the US. The 20 SMA (gray) has been acting as support during pullbacks, pushing the lows higher and today we saw a surge to 1.4177 during the Asian session.

Tariff Proposals and Economic Implications

Trump revealed plans to impose a 25% tariff on goods from Canada and Mexico and a 10% tariff on Chinese imports on his first day in office. This approach reflects a softer tone compared to the 60% tariffs initially suggested during his campaign. The announcement caused a brief stir in currency markets, with the Canadian dollar and Mexican peso weakening. However, Canada and Mexico are expected to adopt minor measures to secure exemptions from the tariffs, which could provide relief for the next four years.

Donald Trump’s Post

“I will sign all necessary documents to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States, and its ridiculous Open Borders. This Tariff will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!”

USD/CAD Volatility and Market Recovery

Following the tariff news, USD/CAD surged to a four-year high of 1.4177 before retracing, dropping below 1.41 as the market adjusted. Despite the initial reaction, broader sentiment began to improve, with stock markets recovering and US indices turning positive.

Looking Ahead

While Trump’s tariff threats caused momentary disruptions, they appear to lack long-term credibility, reducing their impact on markets. As investors focus on geopolitical developments and Federal Reserve policy expectations, US equities and currency markets are regaining stability, signaling a more measured response to the ongoing uncertainty.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account