Stability Returns to Stock Market, but Inflation Fears Loom

On Wednesday, the US stock markets stayed mostly flat, returning to a level of normalcy not seen since elections, but investors are starting to worry about inflation again.

The Nasdaq Composite fell just 0.11% as trading closed off on Wednesday. The S&P 500 stayed completely flat, though, with no change from the previous day. The Dow Jones Industrial Average gained 0.32%, rounding out a mixed but mostly neutral stock market report for the day.

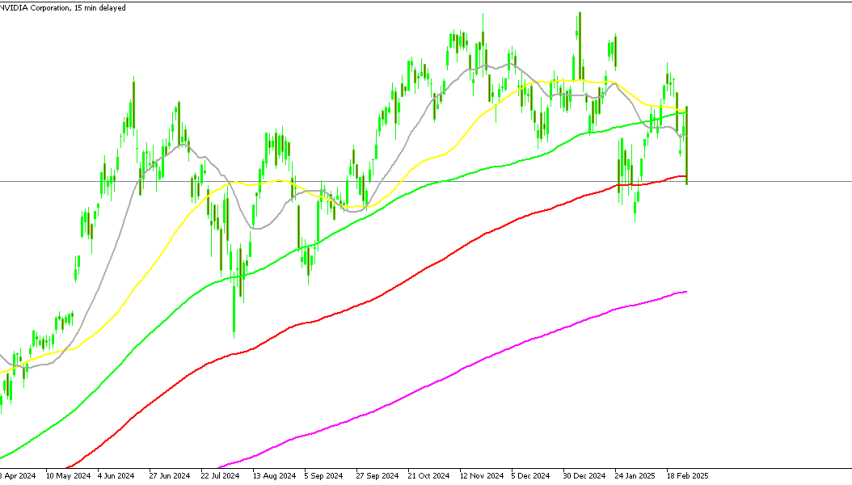

These numbers, along with the statistics from earlier this week, indicate that the stock market is stabilizing for now. The investor fears that the bearish trend would erase all of the stock market earnings has proven unfounded. After the US election, the stock market shot up for a few days and then plummeted afterwards. It looks like the bear trend had finished, and we could start to see the market climb again soon.

Retailers Bring in Earnings Reports

This has been the week for retail quarterly reports, as Wal-Mart, Target, Dollar Tree, and Lowe’s all issued their earnings statements. Wal-Mart (WMT) stock is up as a result of a decent quarter, but the Dollar Tree (DLTR) has not been so fortunate. A 2.61% drop in stock price for Wednesday has left Dollar Tree at its lowest point for the year. We cannot even recommend buying the dip right now, as this is no temporary decline.

Lowe’s (LOW) is slightly up right now but has dropped significantly in recent days. This may be a good time to jump in, as the stock is at one of its high points for 2024.

Target (TGT) dropped significantly and will have a tough time recovering from yesterday’s 21% price drop. Before the drop, Target was trending at about the same level it started the year, but this sharp drop has pushed it far below that level.

Inflation Fears Rising

Today will see a treasury auction take place, and that could indicate where inflation is headed under Donald Trump’s administration. Even though the market temporarily boomed when Trump was announced as President, the golden haze has faded, and investors and analysts have to look at the facts.

Once Trump is sworn in, he is likely to institute a long list of changes that will affect the US economy in unpredictable ways. He has spoken about some of those and has started to make changes already in choosing his cabinet members. With Elon Musk set to control how the US government spends its money and RFK Jr. over the Department of Health, we could see some major shakeups occur.

Some of the cabinet members have never really been politicians, and others are expected to make major changes. How this will affect the stock markets remains to be seen, but investors feel validated in worrying about inflation. If cabinet members and the administration as a whole prioritize personal vendettas and social causes above economic stability, then the markets could suffer dramatically.

Sidebar rates

82% of retail CFD accounts lose money.