Forex Signals Brief November 19: Canada Inflation to Jump by 3 Points

Yesterday the calendar was light, while today the CPI inflation from Canada is the focus, which should show a 3 point jump in October.

Yesterday the economic calendar was light, while today the CPI inflation from Canada is the focus, which is expected to show a 3 point jump in October, however we’ll see if it will help the CAD further after the climb yesterday.

Over the past week, the U.S. dollar showed strong buying momentum, but today saw a corrective move lower, influenced by technical factors and intraday shifts in yields from positive to negative. The Australian dollar made the most significant gains, with AUD/USD rising by 0.70% as the U.S. dollar weakened. In contrast, the U.S. dollar recorded a modest increase of 0.18% against the Japanese yen, reflecting relative stability in that pair.

Economic data offered some positive news with the NAHB Housing Market Index for November coming in at 46, surpassing the expected 43. This marked the highest level since April, up from the previous month’s reading of 43. However, despite this improvement, a reading below 50 continues to indicate weakness in the housing market.

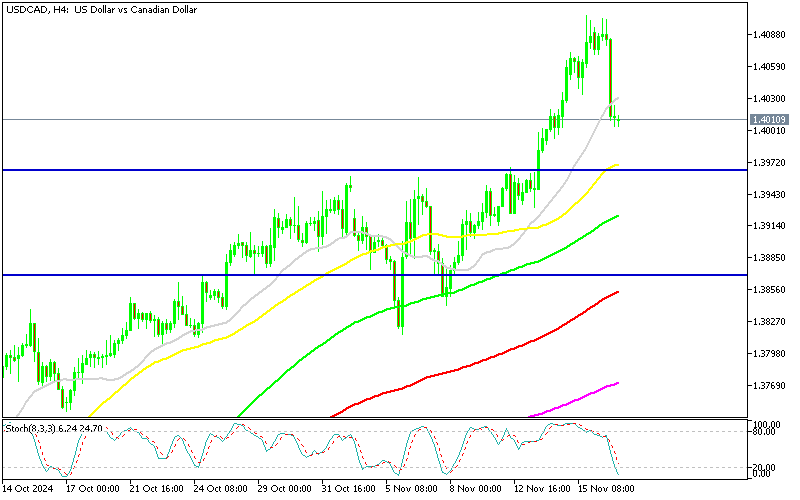

The USD/CAD pair moved lower, reaching 1.40, as the Canadian dollar gained strength from rising oil prices. Oil saw a significant increase of $2 yesterday, further supporting the Canadian dollar and adding selling pressure to the U.S. dollar.

Today’s Market Expectations

The day started with the RBA meeting minutes released early this morning.

The month-over-month Canadian CPI stands at 0.3%, recovering from the previous -0.4%, while the year-over-year CPI is projected to rise to 1.9%, up from 1.6%. Core inflation metrics also point to modest increases, with the Median CPI Y/Y expected at 2.4% (up from 2.3%) and the Trimmed Mean CPI Y/Y steady at 2.4%. These underlying inflation figures will attract attention, as the Bank of Canada (BoC) continues to prioritize economic growth amidst subdued activity and inflation stabilizing within the target range in recent months. Should inflation fall below expectations, the market may increase its pricing of a 50 basis point rate cut in December, currently estimated at a 35% probability.

Last week we remained long on the USD as the Trump trade continued and the USD kept making gains. That proved to be a good trading strategy and we ended with an 80%-20% win/loss ratio, after opening 35 trades and ending the week with 28 winning forex signals and 7 losing ones.

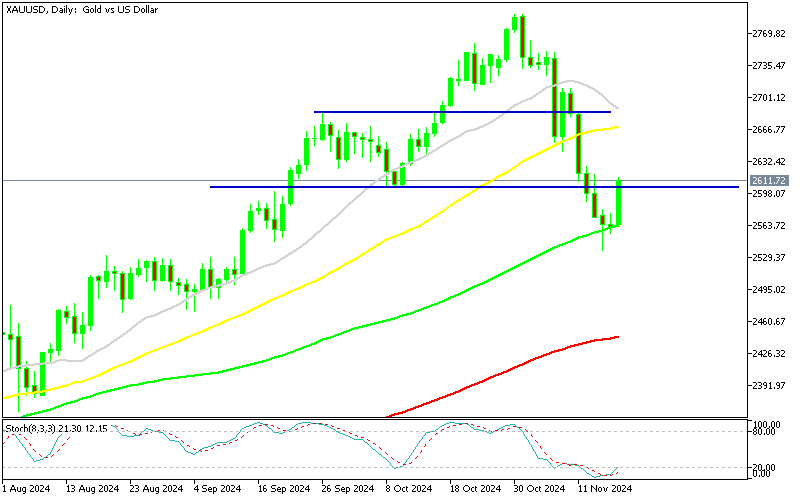

Gold Bounces Off the 100 Daily SMA

Gold has also shown signs of recovery following a significant decline from $2,790 in late October to a two-month low last Thursday. Despite testing the 100-day SMA at $2,550, gold failed to close below this critical level and has since rebounded above $2,600. The bullish momentum today is building on a reversal signal hinted by Friday’s doji candlestick. This could mark the end of gold’s corrective phase, with the precious metal regaining its upward trajectory.

XAU/USD – Daily Chart

USD/CAD Falls to 1.41

Despite some consolidation in November, the USD/CAD pair has risen by about 7 cents since late September. The “Trump trade” provided renewed momentum post-election, pushing the pair above the pivotal 1.3950-1.3960 resistance zone last week. This was supported by robust U.S. inflation data (CPI and PPI) and Fed Chair Jerome Powell’s cautious comments on rate cuts. The USD/CAD pair is likely to find critical support at the 1.41 level. Any stabilization in the USD’s decline could reignite the broader bullish trend, signaling further upside potential for the pair.

USD/CAD – H4 Chart

Cryptocurrency Update

Bitcoin Retreats Below $90K Again

Bitcoin and Ethereum have exhibited significant volatility in recent months. Bitcoin’s dramatic summer decline saw it drop from over $70,000 to just above $50,000. However, post-election optimism fueled a sharp recovery, with Bitcoin climbing to $93,500 on Wednesday and nearing the $100,000 mark. Following a slight dip below $90,000, Bitcoin rebounded above this key level yesterday as market risk sentiment improved.

BTC/USD – Daily chart

Ethereum Retreats but Holds Above $3,000

Ethereum showed resilience after falling below $2,500. The cryptocurrency regained its upward momentum, reaching $3,450 and surpassing its 50-day simple moving average before experiencing a minor pullback. Both assets reflect a resurgence in investor confidence, though they remain susceptible to market corrections.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account