USDCAD Heads Down to 1.40 As Oil Jumps $2 Higher

USDCAD broke above 1.40 last week, surging to 1.4105, but today we’re seeing a strong bearish reversal as the price heads to 1.40 as Oil price jump $2 higher.

Since late September, the USD/CAD pair has gained nearly 7 cents, reflecting a robust uptrend despite a slowdown in November as the pair entered a consolidation phase. The trend resumed following the U.S. presidential election, driven by what has been dubbed the “Trump trade.” Strong U.S. CPI and PPI inflation data last week, coupled with remarks from Fed Chair Jerome Powell emphasizing caution on rate cuts, helped push the pair beyond the key resistance zone of 1.3950-1.3960.

USD/CAD Trends Up, but the Momentum Is Down

Oil Market Dynamics

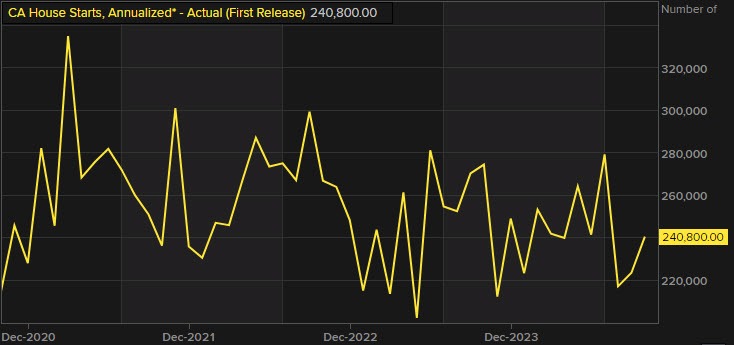

Today’s movement in the USD/CAD has been influenced by several factors. Canadian housing starts data demonstrated stability, lending some support to the CAD. Meanwhile, a mild pullback in the U.S. dollar added to the downward pressure on the pair. However, the primary driver has been the $2 surge in crude oil prices, fueled by the suspension of production at Norway’s Johan Sverdrup oilfield and lingering geopolitical risks in the Middle East. The rise in oil prices, a significant factor for the Canadian economy, has strengthened the CAD and added to the bearish momentum in USD/CAD.

Crude oil prices remain within a consolidation range, with WTI Oil below $70, currently testing the upper boundary. Should prices fail to break higher, particularly if production at the Sverdrup oilfield resumes, oil could retreat, weakening the CAD and potentially allowing the USD/CAD pair to regain its bullish momentum.

Canadian Inflation and Bank of Canada Outlook

Tomorrow’s Canadian CPI data is expected to play a crucial role in shaping the pair’s short-term trajectory. Higher-than-anticipated inflation figures could bolster the CAD by increasing the likelihood of a 25-basis-point rate hike at the Bank of Canada’s next meeting. Conversely, lower-than-expected CPI would likely strengthen expectations for a 50-basis-point rate cut. While this might weigh on the CAD, the impact is unlikely to result in significant weakness in the immediate term.

The USD/CAD pair is likely to find key support at the 1.41 level. A stabilization in the USD’s retreat could trigger a continuation of the broader bullish trend.

The Canada Housing Starts for October 2024![CAD]()

October Housing Starts (Annualized):

- Reported at 240.8K, slightly exceeding the market estimate of 240.0K.

- Marked an improvement from the prior month’s revised figure of 223.4K (initially reported as 223.8K).