Hedera (HBAR) Climbs Over 37% to $0.1187 After ETF Filing: Strong Market Momentum

Hedera (HBAR) sees a 37.67% surge after Canary Capital files for an HBAR ETF with the SEC. Strong market momentum and technical indicators s

Hedera (HBAR) has seen a remarkable price surge of 37.67%, reaching $0.1187, after Canary Capital filed for a Hedera Spot ETF with the U.S. Securities and Exchange Commission (SEC).

The filing has ignited increased optimism surrounding HBAR, signaling a positive outlook for the future of the cryptocurrency.

This price movement reflects growing investor interest, with HBAR’s market capitalization rising to $4.47 billion and trading volume surging by 32.93%, reaching $1.23 billion. The filing has positioned HBAR as a leading player in the market, with increased exposure and potential for long-term growth.

The ETF aims to provide direct exposure to HBAR without the use of derivatives or other financial instruments, offering investors pure exposure to the cryptocurrency’s performance.

Canary Capital’s HBAR ETF Filing Sparks Optimism

Canary Capital’s filing for an HBAR Spot ETF with the SEC represents a significant move for the cryptocurrency market. This proposed fund intends to directly hold HBAR tokens, ensuring that investors gain direct exposure to the token’s price movements.

The filing has spurred expectations that the U.S. administration may be more inclined to approve such funds in the current market climate, contributing to the rise in HBAR’s value.

The filing outlines the ETF’s purpose to increase the value of HBAR as the native token of the Hedera network. With this announcement, speculations about HBAR’s future growth have intensified, further attracting the attention of investors eager to participate in the Hedera ecosystem’s expansion.

Strong Market Momentum and Technical Outlook

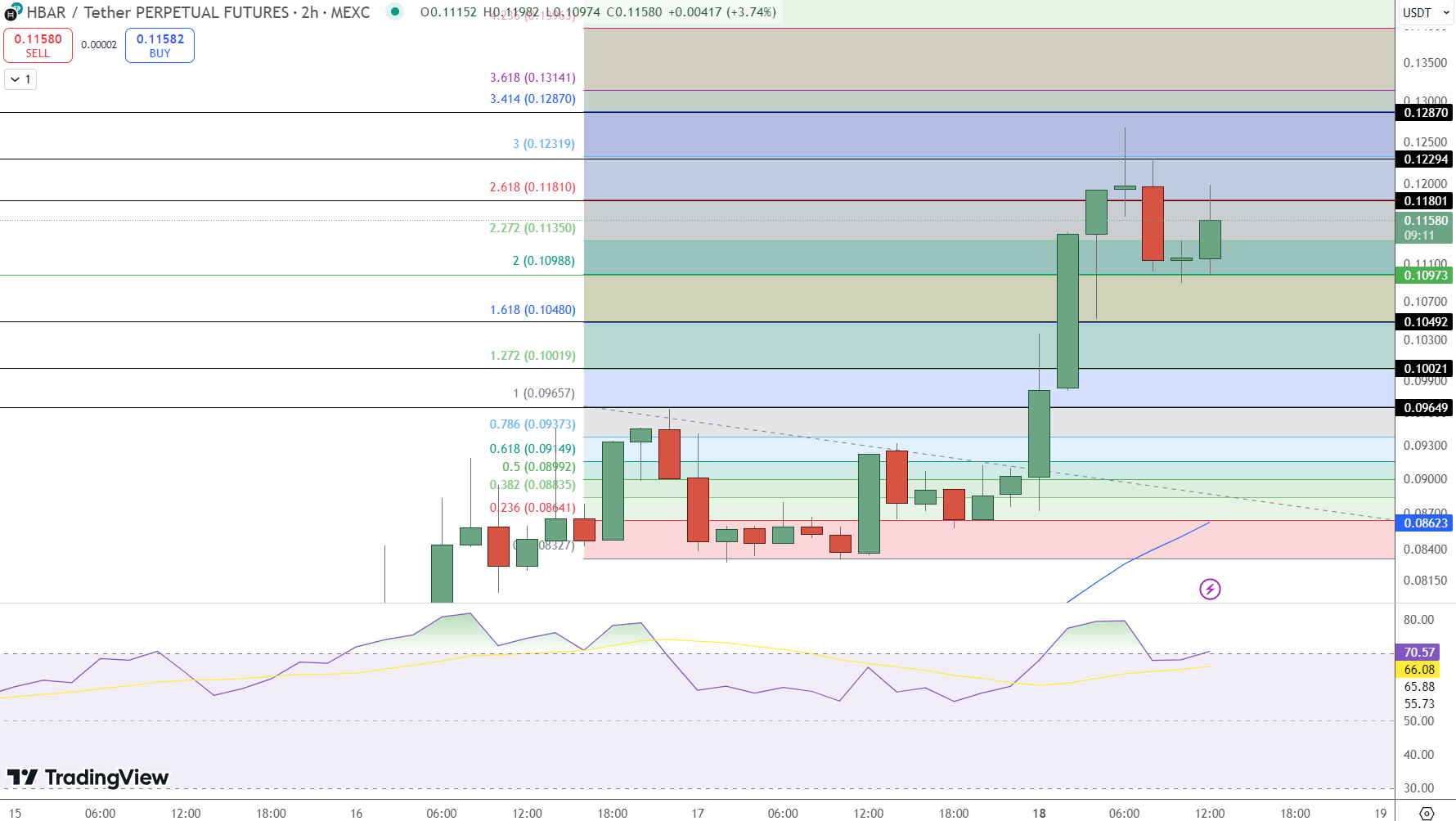

The surge in HBAR’s price is supported by strong market momentum and technical indicators. The cryptocurrency’s trading volume-to-market capitalization ratio has reached 26.09%, suggesting heightened trading interest. On the price chart, HBAR has demonstrated steady upward movement, rising from approximately $0.086 to $0.1187.

Technical indicators also reflect a bullish trend. The Moving Average Convergence Divergence (MACD) shows a bullish crossover, and the Relative Strength Index (RSI) currently stands at 87.81, placing HBAR in overbought territory. Despite the overbought conditions, the RSI’s trend above 50 suggests that bullish sentiment remains dominant in the market.

My prediction for the crypto market 2025:

✅️ Brian Brooks confirmed as SEC chair

✅️ Hedera ETF

✅️ SpaceX and Amazon named Hedera General Council members

✅️ Thousands of cryptos die as 90% of market liquidity pours into $HBAR $XRP and $BTC

✅️ $50 XRP

✅️ $15 HBAR

✅️…— Joe Blinko (@JoeyBlinko) November 18, 2024

Analysts have expressed optimism about HBAR’s future. Crypto analyst Maverick predicts that the asset could reach a year-to-date high of $0.1813, representing an 182% increase from its current price. This growth potential is attributed to increased trading volumes and the optimism surrounding the ETF filing.

Key Technical Levels and Outlook

- Resistance Levels: Immediate resistance at $0.12294, with further targets at $0.12870 and $0.13141.

- Support Levels: Key support at $0.10973; a break below targets $0.10492 and $0.10021.

- Technical Indicators: RSI at 70.57 signals overbought conditions; 50-day EMA at $0.09649 supports uptrend continuation.

Looking ahead, the key focus for HBAR is whether it can maintain momentum above $0.11800 and push through resistance levels near $0.12294. Failure to sustain levels above $0.10973 could lead to short-term corrections, but the overall market sentiment remains bullish.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account