Solana Maintains Market Dominance as Price Targets New Heights

Solana (SOL) continues to cement its position as a leading blockchain platform, currently trading at $209 with a weekly gain exceeding 6%.

Solana (SOL) continues to cement its position as a leading blockchain platform, currently trading at $209 with a weekly gain exceeding 6%.

Solana Ecosystem Dominance and DeFi Growth

Despite increased competition from other blockchain networks, Solana maintains its position as the most popular blockchain ecosystem in 2024, commanding 38.8% of global crypto investor interest in chain-specific narratives. However, this represents a 10.5 percentage point decrease from Q1, indicating growing competition from other ecosystems.

The platform’s DeFi sector has achieved unprecedented success, with decentralized exchanges (DEXs) recording over $5 billion in daily trading volume for three consecutive days – a first in Solana’s history. During the November 10-16 period, Solana DEXs processed approximately $16 billion in transactions, with Raydium leading the charge at 62% of total volume, followed by Orca at 22.2%.

Institutional Integration and Robinhood Listing

In a significant development for mainstream adoption, Robinhood Markets has announced the addition of Solana to its cryptocurrency offerings for U.S. traders. This integration, alongside other major cryptocurrencies like Cardano and XRP, brings Robinhood’s total available crypto assets to 19, potentially exposing Solana to a broader retail investor base.

Real Economic Value and Application Revenue

According to Syncracy Capital’s recent report, Solana’s real economic value (REV) has surged to 111% of Ethereum’s in October, a dramatic increase from just 1% last year. This growth is primarily driven by transaction fees and MEV tips. Similarly, total application revenue (TAR) has reached 109% of Ethereum’s, highlighting the platform’s growing competitive edge.

DePIN Sector Development

Beyond DeFi, Solana’s Decentralized Physical Infrastructure Networks (DePIN) sector has shown remarkable growth. Notable projects include Hivemapper, which has successfully mapped 28% of global roads, and Helium, operating a 20,000-device network supporting U.S. carriers.

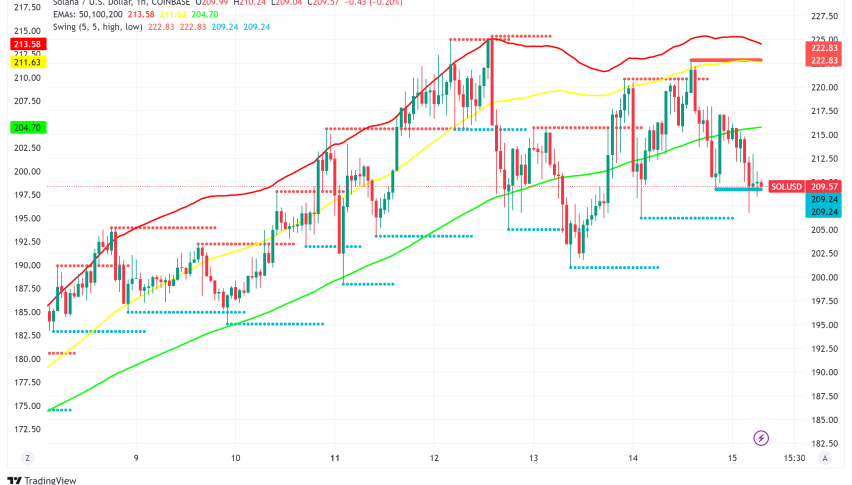

SOL/USD Technical Analysis and Price Action

Recent technical analysis suggests Solana is approaching a critical juncture after breaking its yearly high of $210. The asset is currently consolidating above this key level, with analysts pointing to similarities between Solana’s current chart patterns and Bitcoin’s historical price movements.

The next significant resistance level lies at $240, with the all-time high of $258 serving as a major psychological barrier. Support has formed around the $210 mark, which bulls need to defend to maintain momentum for the next leg up.

Solana’s Market Outlook

As the broader cryptocurrency market reaches new heights, Solana’s ability to maintain its position above $210 will be crucial for continued momentum. With Bitcoin trading at unprecedented levels and the ecosystem showing strong fundamentals, analysts remain optimistic about Solana’s potential to challenge its previous all-time highs.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account