RBA and Australian Employment Couldn’t Help AUD/USD

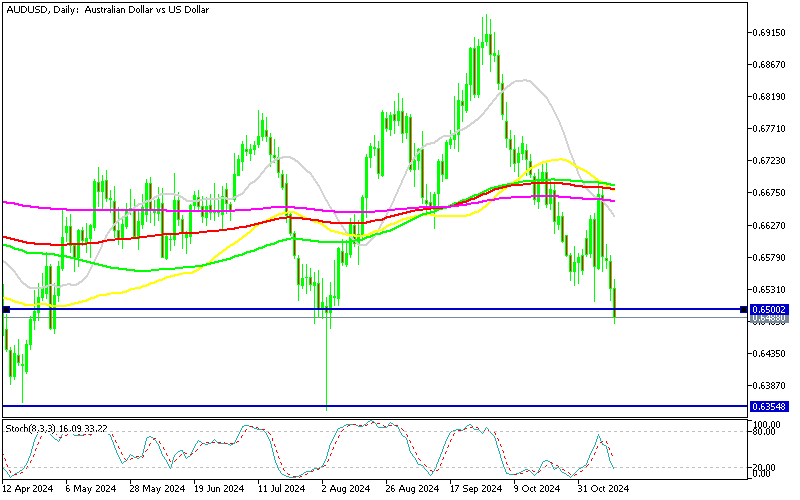

AUD/USD has been testing the 0.65 support several times, and yesterday it finally broke below after stronger US inflation numbers.

AUD/USD has been testing the 0.65 support several times, and yesterday it finally broke below after stronger US inflation numbers, while today’s employment report from Australia and comments from the RBA Gov Bullock couldn’t help the Aussie much.

In October, the AUD/USD exchange rate declined by 4 cents, with sellers maintaining control as the pair’s downtrend was supported by both economic conditions and technical signals. Last week’s 2-cent rise on hopes of Chinese economic stimulus quickly faded, pulling the pair back to its key support level around 0.65 for AUD sellers.

AUD/USD Chart Daily – The Decline Has Been Steep

This bounce from the 0.65 level last Thursday was short-lived as daily chart moving averages resisted the recovery, sending the pair back down and hinting at a possible breach below this critical level. Yesterday, the Aussie dollar faced additional downward pressure from two sources: the Australian Wage Price Index, which again came in below expectations, weakening the AUD, and the US CPI report, which showed inflation rising in October, lending strength to the USD. The employment data leaned slightly on the weak side last night, further weighing on the Aussie.

The October employment report showed a modest increase in employment but missed expectations, with fewer jobs added than anticipated. Although the unemployment rate held steady at 4.1%, a slight dip in the participation rate signals a minor softening in labor market engagement. In contrast, the underemployment rate improved, and monthly hours worked saw an increase, suggesting that those employed are working more hours, potentially offsetting some of the weaker job growth. This report reflects a generally stable labor market but with signs of cooling momentum compared to recent months.

Employment Report Australian Bureau of Statistics, for October 2024

- Employment Change: +15.9k jobs added

- Expected: +25.0k

- Prior: +64.1k

- Unemployment Rate: 4.1%

- Expected: 4.1%

- Prior: 4.1%

- Participation Rate: 67.1%

- Expected: 67.2%

- Prior: 67.2%

- Full-Time Employment: +9.7k

- Prior: +51.6k

- Employment-to-Population Ratio: Remained steady at 64.4%

- Underemployment Rate: Decreased to 6.2%

- Monthly Hours Worked: Increased to 1,972 million

RBA Governor Bullock Comments

- Global Bond Markets: Generally stable, though they reflect growing government debt levels.

- Monetary Policy Stance: Current policy is considered restrictive enough; the RBA intends to maintain this stance until there’s clear confidence in inflation control.

- Inflation Drivers: Recent inflation was driven by both supply-side and demand-side factors.

- Inflation Target: The RBA’s goal is to reduce inflation, but not to return prices to pre-COVID levels, as that would entail deflation, which is not desirable.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account