Forex Signals Brief November 12: Attention on UK Employment and FED Speakers Today

Despite a quieter session yesterday due to a partial U.S. market holiday, the dollar is holding onto its post-election gains as the new week begins. Today’s key events include the release of UK employment data and several speeches from Federal Reserve officials, adding potential catalysts to market movements. The dollar strengthened against major currencies like the yen, euro, and pound, continuing its upward momentum from last Friday.

While commodities currencies initially held steady, they also dipped during the U.S. session. In equity markets, U.S. futures opened lower but managed to push higher, with the S&P 500 closing above the 6,000-point mark yet again. European indices, which had initially risen, ended the day in negative territory after a late retreat.

Gold prices fell nearly 3% to around $2,610, hinting at a potential deeper pullback. However, there was some recovery by the close of the U.S. session, offering a bit of support as traders assess the next moves in this sector. The S&P 500, meanwhile, will attempt to sustain its gains and potentially break through the 6,000-point barrier in today’s trading.

Today’s Market Expectations

The UK unemployment rate is expected to edge up slightly from 4.0% to 4.1%. Average earnings, excluding bonuses, are predicted to slow to 4.7% from 4.9%, while earnings including bonuses may rise to 3.9% from 3.8%. With two more Consumer Price Index (CPI) reports due before the Bank of England’s (BoE) final decision of the year, inflation data will likely remain a key market focus. A weak employment report could raise the probability of a December rate cut by 25 basis points, although the chance of this occurring is currently low at around 20%.

The ZEW Economic Sentiment indicator from Germany and the Eurozone will be released a bit later on, which is expected to stagnate this month and show little change. This indicator has been weakening all year, but it improved in October, however in November the economic sentiment is not expected to improve further. Later in the US session, we have a number of FED members holding speeches, such as the FOMC Member Waller, FOMC Member Barkin and FOMC Member Kashkari who will close the day.

Yesterday the volatility was low, however there was enough price action for us to pull many forex trades. We opened eight trading signals in total, with six of them closing by the end of the day. We remained short on GOLD and long on USD/JPY which proved to be a good trading strategy since the USD kept pushing higher, and ended up with four winning forex signals and two losing ones.

Gold Bounces After the Decline Stops at the 50 SMA

Gold has seen significant gains over the past two years, rising by more than 50% from its November 2022 low of $1,600. This upward trend accelerated throughout 2024, frequently reaching new highs. However, in recent weeks, gold has experienced a pullback, with prices retreating nearly $180 from its highs to hit $2,610 yesterday. A doji candlestick on the weekly chart indicates a potential bearish reversal. After the recent U.S. election, gold attempted a brief recovery but couldn’t sustain a move above $2,700, reinforcing its current downtrend. Breaking below the 50-day simple moving average (SMAs), which was a key support level, marks a significant technical development, however we’re watching the price action at $2.600.

XAU/USD – Daily Chart

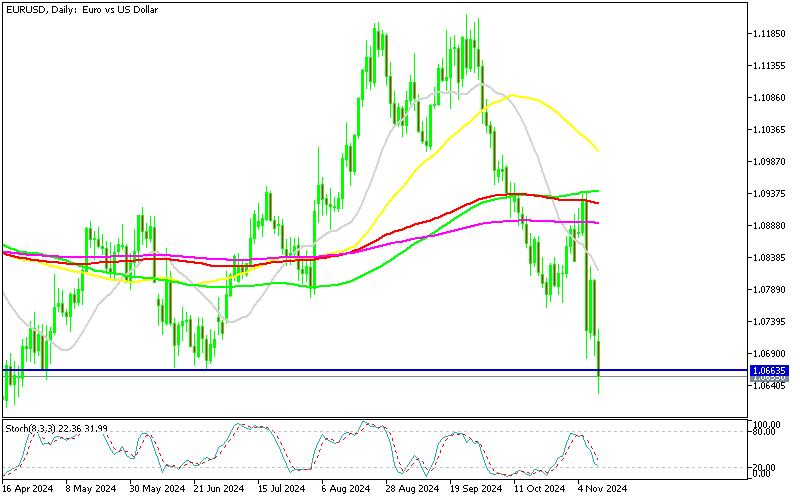

EUR/USD Breaks Below the 1st Support

Earlier this year, the Euro (EUR) gained approximately 6 cents, but the EUR/USD has since turned downward. Multiple attempts in September to hold above the 1.12 level failed, signaling weak buyer support. In October, renewed USD strength accelerated the decline. The recent Republican victory in the U.S. presidential election added further momentum to the Euro’s downward trend, pushing the EUR/USD down about 6 cents from its recent peak. The inability to hold above 1.10 has confirmed the pair’s bearish trend, with the break below $1.0660, the June low, strengthening the bearish stance. The EUR/USD is now nearing its April 2024 low of $1.06.

EUR/USD – Daily Chart

Cryptocurrency Update

Bitcoin Heading for 100K

Bitcoin has shown remarkable volatility this year, with a strong upward trend overall. After a summer pullback, Bitcoin rebounded from its April-September decline (falling from over $70,000 to just above $50,000), hitting a new high of $74,000 last Wednesday after the election. With continued strong buying momentum, Bitcoin climbed past $80,000 over the weekend and reached $88,500 yesterday, edging closer to the significant $100,000 milestone.

BTC/USD – Daily chart

Ethereum Pushes Above $3,000

Ethereum is drawing significant buying interest as it trades above $2,700, successfully surpassing its 100-day Simple Moving Average (SMA). Even after a brief dip below $2,500, it quickly regained support above the 50-day SMA, reinforcing its bullish trend. Ethereum surged past $3,000 over the weekend following the U.S. election results, and as market momentum held, it reached $3,380 yesterday, continuing its upward movement.

ETH/USD – Daily chart