eur-usd

EURUSD Breaks Support, Approaching 1.06 As EU Economic Sentiment Remains Weak

Skerdian Meta•Tuesday, November 12, 2024•2 min read

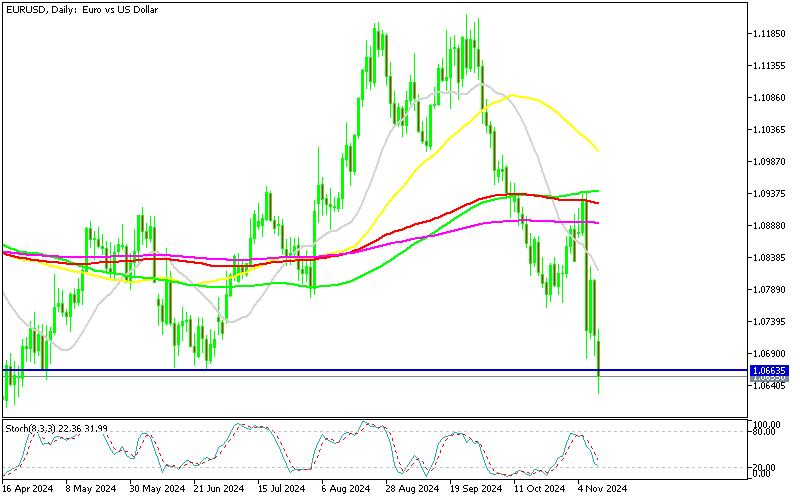

Sellers have been in control in EURUSD as the Eurozone economy remains weak, turning the ECB dovish and weighing on this pair. Moving averages have turned into resistance on the daily chart for this pair and after the Republican red sweep in US elections last week, the decline has picked up pace further, breaking below the first support yesterday.

EUR/USD Chart Daily – MAs Have Turned Into Resistance

Earlier this year, the Euro (EUR) rose by about 6 cents, but momentum has since shifted, with the EUR/USD exchange rate now trending downward. After several failed attempts to hold above 1.12 in September, it became clear that buyers couldn’t sustain those gains. As USD buying resumed in October, the EUR began to decline significantly. This downward move was further accelerated by the Republican presidential victory in the U.S. last week, pushing the EUR/USD pair down around 6 cents from its recent peak.

Technical and Economic Pressures

The EUR/USD’s struggle to stay above 1.10 confirmed its bearish trend, with the break below the $1.0660 support level (June’s low) reinforcing the position of Euro sellers. The current decline is now approaching the April 2024 low of $1.06. This technical weakness is compounded by recent weak economic data from the eurozone, especially in Q4, as major economies like Germany and France showed signs of stagnation. These economic headwinds have added further pressure to the Euro, deepening its downward trajectory.

German and Eurozone ZEW Economic Sentiment for November

Germany ZEW Economic Sentiment for November

- Current Conditions: -91.4 points (below the expected -85.9 and previous -86.9)

- Economic Sentiment: 7.4 points (below the expected 13.0 and previous 13.1)

Eurozone ZEW Economic Sentiment for November

- Economic Sentiment: 12.5 points (lower than the expected 20.5 and previous 20.1)

Investor pessimism is highlighted by the ZEW numbers, which show deteriorating economic circumstances and sentiment in Germany and the larger Eurozone. The notably low current circumstances number for Germany indicates continued difficulties, while the Eurozone’s and Germany’s lower-than-expected sentiment readings point to increasing economic uncertainty.

EUR/USD Live Chart

EUR/USD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

8 hours ago

Save

Save

9 hours ago

Save

Save

12 hours ago

Save

Save