Wall Street Giants Bet Big on Blockchain: Asset Tokenization Market Set to Explode

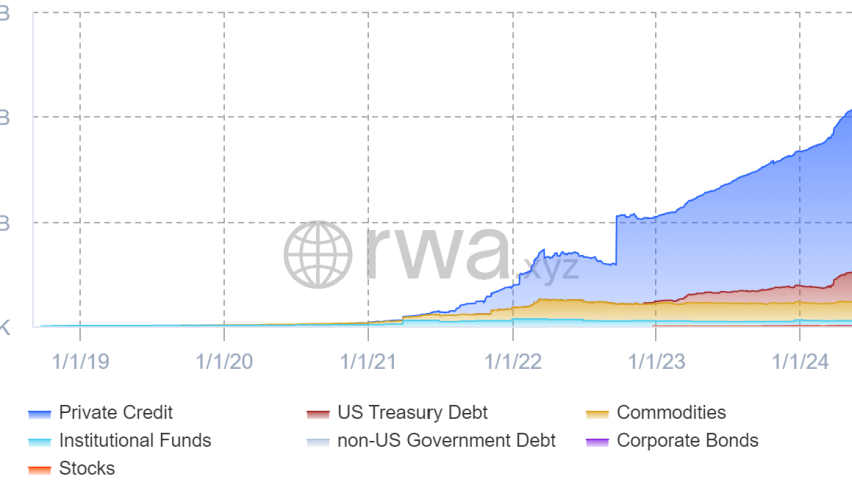

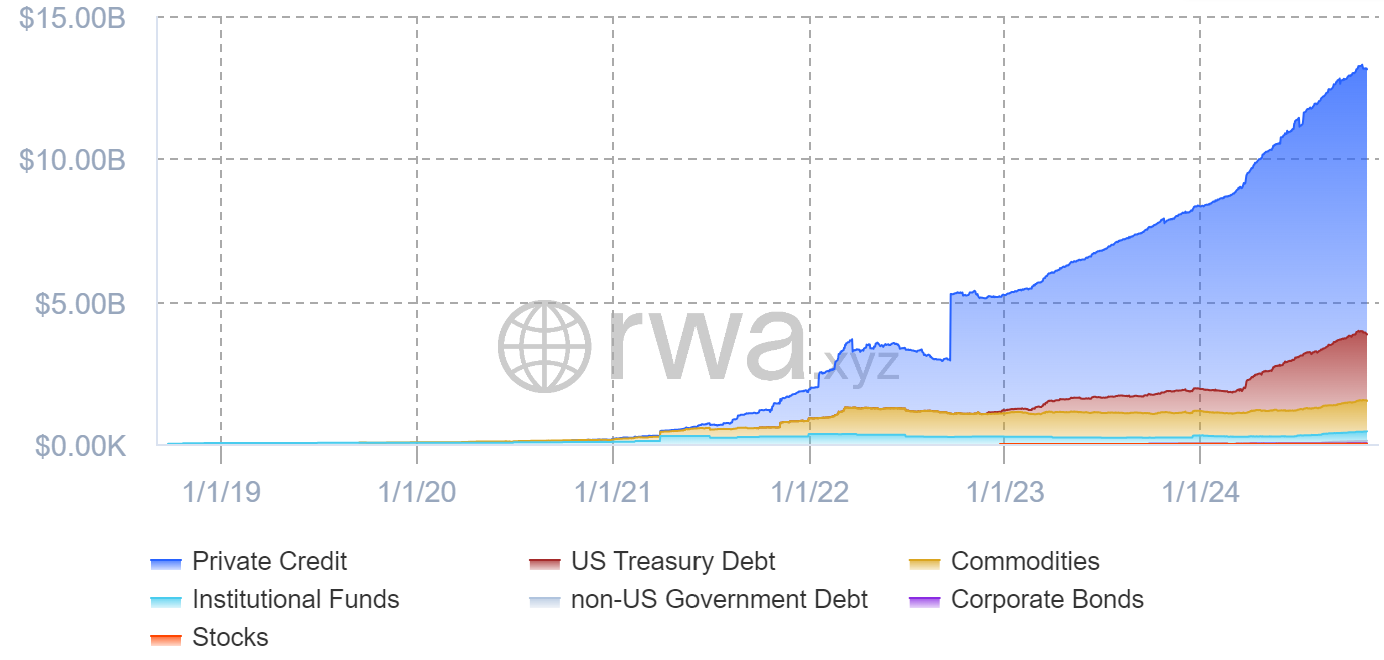

Major financial institutions are racing to stake their claim in what could become a $30 trillion market by 2030: the tokenization of RWAs

Major financial institutions are racing to stake their claim in what could become a $30 trillion market by 2030: the tokenization of real-world assets (RWAs). As BlackRock commits over $1 billion to tokenized treasuries and plans to scale to $10 billion by year-end, the traditional finance sector appears to be fully embracing blockchain technology.

“A market will naturally tend to pricing inefficiencies,” says Michael Bucella, co-founder and managing partner of Web3 investment firm Neoclassic Capital. “To TradFi, that is mispriced credit facilities or exposure to underpriced volume. To crypto-native, that is low-volume, secure assets.”

The surge in institutional interest comes as research firm Tren Finance projects a staggering 50x growth in the RWA tokenization sector by 2030. Boston Consulting Group’s analysis suggests an even more ambitious outlook, forecasting a total addressable market of up to $16 trillion – more than 2,030 times the current market cap of $7.88 billion.

Beyond the Hype: Why Wall Street is Buying In

The appeal of tokenization extends far beyond simple digitization. Dan Spuller, senior director of industry affairs at the Blockchain Association, explains that RWA tokenization is transforming traditionally illiquid assets into accessible investment opportunities.

“Traditionally illiquid assets like real estate, commodities and private debt can now be fractionalized, making them accessible to a broader range of investors while diversifying risk,” Spuller tells Cointelegraph. “Blockchain tech further enhances this by offering both transparency and security, with clear records of ownership and transaction history.”

Asia Leading the Charge

The Monetary Authority of Singapore (MAS) has positioned itself at the forefront of this financial revolution, unveiling an ambitious plan to promote asset tokenization in financial services. Through Project Guardian, MAS has engaged over 40 institutions across multiple jurisdictions, including giants like Citi, HSBC, and Standard Chartered.

Bucella points to emerging opportunities in Asian markets: “There are troves of IP value in Japan and Korea, and the financialization of those assets is a key focus for corporations and regulators alike. I think this is the breakout RWA, or onchain finance sector in the coming years.”

Growing Pains: The Road to $30 Trillion

Despite the optimistic outlook, the sector faces significant hurdles. The lack of unified verification standards has created a fragmented landscape, increasing the risk of fraud and inefficiencies. Custody solutions present another challenge, as managing both digital tokens and physical assets adds layers of complexity and cost.

“Verifying tokenized assets brings challenges in authenticity, ownership validation and regulatory compliance,” Spuller acknowledges. He suggests that standardized token issuance and custody processes could “boost investor confidence and streamline regulatory approval.”

Market Response and Future Outlook

The DeFi and RWA sectors are already showing strong market performance, with recent data showing double-digit gains alongside Bitcoin’s rally. Notable performers include Chainlink (LINK), up over 4% to $12.3, and Aave (AAVE), posting a 16% increase to $186.92.

Chainlink’s co-founder, Sergey Nazarov, recently projected at TOKEN2049 that RWAs may soon surpass cryptocurrencies in market value, signaling a potential shift in the digital asset landscape.

What’s Next?

As traditional financial giants continue to pour resources into tokenization initiatives, the market appears poised for substantial growth. The success of early movers like BlackRock and the regulatory framework being developed in Singapore could set the stage for widespread adoption.

“Yes, the growth is inevitable,” Bucella asserts, pointing to particularly promising developments in intellectual property tokenization. With major institutions betting billions on the sector’s success and regulatory frameworks evolving to support innovation, the tokenization of real-world assets may indeed represent the next frontier in financial markets.

The question now isn’t if traditional assets will move onchain, but rather how quickly the infrastructure and regulations can evolve to support this transformation. As Wall Street and Silicon Valley converge on this opportunity, the race to capture a share of the potential $30 trillion market is just beginning.

Read more: BNB Chain Launches Game-Changing Platform for Real-World Asset (RWA) Tokenization

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account