BlackRock’s Bitcoin spot ETF posted it largest trading activity

BlackRock's Bitcoin exchange-traded fund (ETF) saw record trading following Donald Trump's victory in the US presidential election.

BlackRock’s Bitcoin exchange-traded fund (ETF) saw record trading following Donald Trump’s victory in the US presidential election.

Bloomberg ETF analyst Eric Balchunas revealed that the iShares Bitcoin Trust (IBIT) saw its “biggest volume day ever,” with daily trading volume exceeding $4.11 billion on Nov. 6.

‘For comparison, stocks like Visa, Netflix, and Berkshire saw less volume today than that. It had its second-best day since launch and was up 10% as well,” he continued.

BlackRock’s significant foray into the Bitcoin market is a turning point in the crypto space. Other institutions wishing to diversify their portfolios can benefit from this endorsement from one of the most reputable figures in traditional finance. Analysts observe that the overall sentiment of the market is strongly bullish.

BlackRock’s record-breaking investment volumes may see a larger institutional adoption trend, indicating a possible bull market for Bitcoin.

According to a follow-up post from Balchunas, ETFs also had one of their best days since “the crazy early days” in January, with most funds performing at twice their average volume.

IBIT’s record trading day coincided with a flurry of bullish signals for the cryptocurrency with Bitcoin’s new all-time high of $76,500 on November 7,

rump, a pro-crypto triggered the bullish run in the crypto space

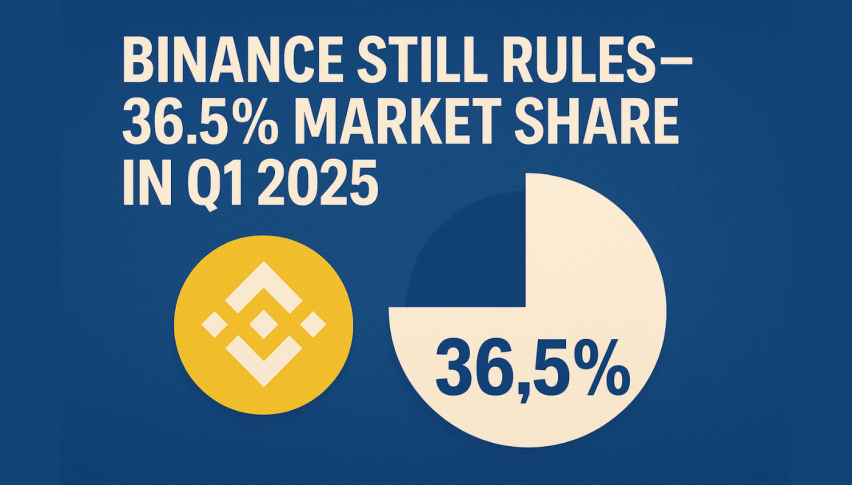

Bitcoin had since slightly retraced to $76K at publication according to Binance data.

Trump’s promised broad pro-crypto policies could benefit assets other than Bitcoin. Asset managers have rushed to file regulatory documents to list exchange-traded funds (ETFs) that hold altcoins, such as Litecoin, XRP, and Solana, as early as 2024.

Additionally, issuers are awaiting approval for some planned crypto index exchange-traded funds (ETFs) that are intended to hold a variety of token baskets. Oct. 25 In the US presidential election, Balchunas referred to the filings for crypto index ETFs as “call options on a Trump victory.”.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account