Bank of England (BoE) Cuts Rate to 4.75%, GBP/USD Surges as Bullish Momentum Builds

The Bank of England (BoE) made a significant shift in its monetary policy on Thursday, lowering its benchmark interest rate from 5.0% to 4.75% as expected by economists.

This cut signals a move away from the BoE’s previous cycle of aggressive rate hikes, which were implemented to counteract rising inflation. Now, with inflationary pressures beginning to ease, the BoE is shifting its focus toward supporting economic growth amidst signs of a slowdown.

🚨 #BreakingNews: The Bank of England #BOE has cut its policy rate by 25 bps to 4.75% in the November meeting, as expected!

📈 #GBPUSD responds positively, up to near 1.2934 pic.twitter.com/2Jp1lgUYXQ

— UTrada (@utrada_global) November 7, 2024

MPC Vote Reveals Strong Consensus for Rate Cut

The BoE’s Monetary Policy Committee (MPC) voted 8-1 in favor of the 25-basis-point rate cut. While eight members supported the reduction, one member preferred holding the rate at 5.0%, highlighting a minority caution within the committee. This decision underscores the BoE’s cautious approach as it seeks to balance inflation control with the need to bolster economic stability in a softening economy.

Key Highlights of the BoE Decision:

- Official Bank Rate: Reduced from 5.0% to 4.75%, matching economist predictions.

- MPC Vote Split: 8-1 in favor of the cut; one member advocated for no change.

- Objective: Support economic stability as inflation moderates and growth slows.

🌥 Happy Tuesday, dear traders! Let’s discuss the most exciting news for the beginning of the week:

🇬🇧 The Bank of England is expected to cut the rate by 0.25% to 4.75% at the November 7 meeting, according to analysts surveyed by RTRS. GBPUSD declines to 1.2965.

🛩 Boeing… pic.twitter.com/pdUsBu2nAm

— Scott F. Reddy (@kkssenergy) October 29, 2024

Inflation Cooling as Economic Strain Becomes Apparent

In its latest Monetary Policy Report, the BoE pointed to several indicators of economic strain, including a slowdown in consumer spending, a softer labor market, and declining business investment. Although inflation remains above the BoE’s 2% target, recent data shows it is gradually cooling, allowing the central bank to ease its previously stringent stance. The BoE emphasized that it will closely monitor inflation trends and hinted that any future rate cuts would be contingent on continued economic data.

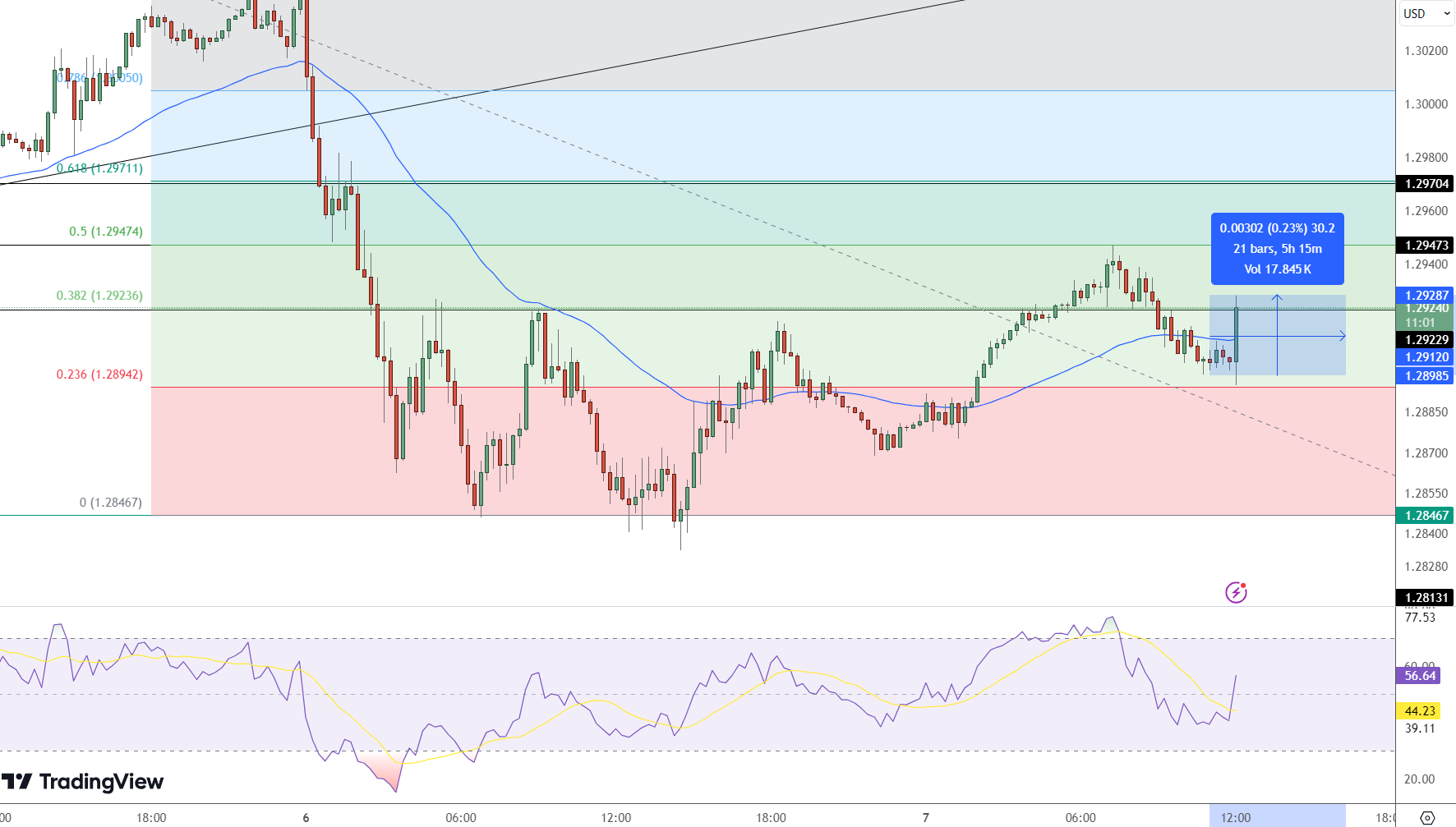

Market Response: GBP/USD Turns Bullish

Following the BoE’s rate cut, the pound strengthened against the U.S. dollar, with GBP/USD gaining bullish momentum. Investors welcomed the move as a proactive step to support growth while managing inflation concerns. The rate cut aligns the BoE with other central banks, like the Federal Reserve, which have also adopted a cautious stance. Currency traders are now closely watching the BoE’s next steps, as GBP/USD reflects optimism about this strategic shift.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |