EURUSD Faces Support As European Services Activity Remains Slow

EURUSD has been gaining these last two weeks, but that was due to the USD retreat because the Euro economy remains in difficulty. Manufacturing remains in recession while services activity is expanding very slowly, as today’s PMI reports for October showed, while technically this pair is finding resistance above.

Throughout October, the EUR/USD pair faced downward pressure due to continued USD buying, falling by 4.5 cents after failing to maintain levels above 1.12. The pair saw a slight recovery last week, rising above 1.09 following weaker-than-expected U.S. employment data, especially from the Non-Farm Payrolls (NFP) report.

A 50-pip bullish gap opened Monday morning as U.S. election poll shifts influenced the market. On the weekly chart, the pair found support at the 100 SMA (green) level, which has previously served as a key reversal point this year. However, sustained dollar strength and potential weak European data could hinder any immediate upward moves.

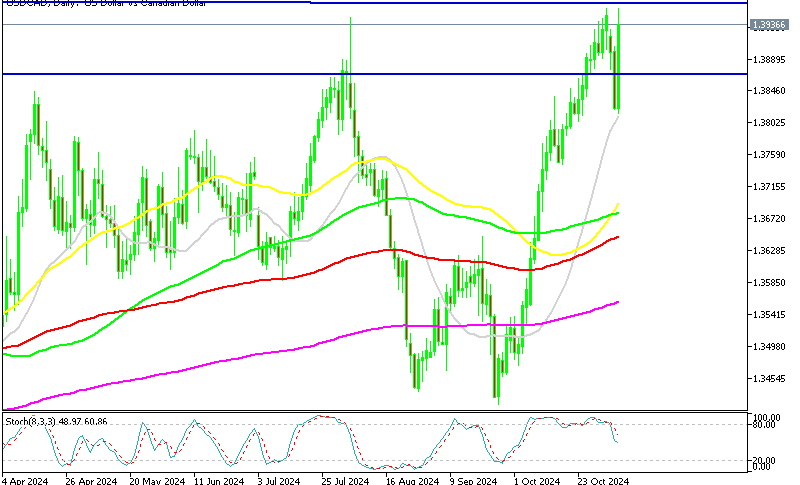

EUR/USD Chart Weekly – MAs Remain as Resistance

The EUR/USD recently rebounded from a major swing level around 1.0761 as buyers stepped in, setting risk below this level to position for a move back toward the 1.10 range. Euro sellers, on the other hand, are likely watching for a decisive break below this level to increase bearish bets into the 1.06 range.

Factors to Watch

With U.S. election results anticipated soon, market participants are cautious, as the outcome could drive the next major directional shift for the USD and EUR/USD pair. Alongside political uncertainty, traders are closely monitoring economic indicators from the U.S. and Europe, which could contribute to heightened market volatility. Notable upcoming events include today’s release of the European Services PMI report for October.

European Services PMI For October by HCOB – 6 November 2024

- Final services PMI: 51.6 (up from 51.2 preliminary, prior 51.4)

- Final Composite PMI: 50.0 (up from 49.7 preliminary, prior 49.6)

Germany October PMI

- Final Services PMI: 51.6 (expected 51.4, prior 50.6)

- Final Composite PMI: 48.6 (expected 48.4, prior 47.5)

- Key Findings:

- Germany Services PMI at 51.6 (Sep: 50.6), a 3-month high

- Germany Composite Output Index at 48.6 (Sep: 47.5), a 3-month high

- New business declines for the second consecutive month, with continued job losses

Germany and France, two key economies in the eurozone, are weighing on overall performance as the region begins Q4 in a state of stagnation. Weakening demand conditions are a central factor, but there’s also a notable decline in employment indicators, marking the steepest drop since December 2020—a trend the ECB will need to monitor closely.

HCOB comments that the current economic climate in the euro area doesn’t typically align with growth and stability. Yet, the services sector has continued to grow steadily this year, offering some resilience. This moderate growth in services has been instrumental in keeping the eurozone out of recession. As inflation eases and wages improve, private consumption is providing sustained demand for services, fueling optimism that the sector will continue to expand. Consequently, there’s also an expectation that new business demand, which has significantly declined over the past two months, will see a rebound.

France October PMI

- Final Services PMI: 49.2 (up from 48.3 preliminary, prior 49.6)

- Final Composite PMI: 48.1 (up from 47.3 preliminary, prior 48.6)